By: Gerald Sparrow President & Founder, Sparrow Capital Management, Inc.

What is a bull market, and more importantly, who determines if we are in one?

Technically speaking, a bull market is defined as a 20% gain in a stock market index, such as the Standard & Poor’s 500, from a closing low.

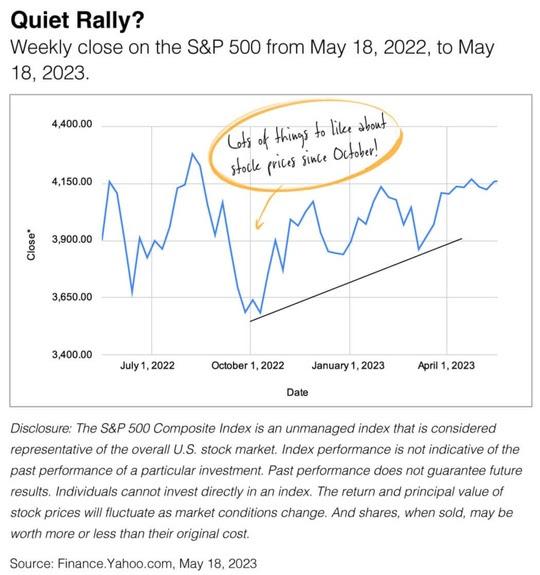

So are we in one? Technically, no. The S&P 500 hit a low of 3,583 on October 10, 2022. So a 20% gain would put the S&P 500 at right about 4,300. As you can see from the accompanying chart, the S&P 500 is still below that level.

The accompanying chart also shows how challenging the stock market has been since October 2022. When stock prices rally higher, those gains are often met by selling pressure. So it’s easy to understand that it has been a difficult period to remain focused as an investor.

It’s also a period that reminds us how important it is to “tune out the noise” and focus on what you can control, like your time horizon, risk tolerance, and goals.

PHOTO CREDIT:https://www.shutterstock.com/g/grinvalds

Via SHUTTERSTOCK

Disclosure:

Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost.

The forecasts or forward-looking statements are based on assumptions, may not materialize, and are subject to revision without notice.

Please consult your financial professional for additional information.

This content is developed from sources believed to be providing accurate information. The information in this material is not intended as tax or legal advice. Please consult legal or tax professionals for specific information regarding your individual situation. This material was developed and produced by FMG Suite to provide information on a topic that may be of interest. FMG is not affiliated with the named representative, financial professional, Registered Investment Advisor, Broker-Dealer, nor state- or SEC-registered investment advisory firm. The opinions expressed and material provided are for general information, and they should not be considered a solicitation for the purchase or sale of any security.