By:Steve Sosnick, Chief Strategist at Interactive Brokers

This morning’s payrolls report offered an upside surprise. Nonfarm payrolls rose by 372,000, well above the consensus estimate of 265,000. Other key statistics were in line with estimates, including an unemployment rate holding at 3.6% and a monthly real wage increase of 0.3%, which was unchanged from last month’s report (though it was revised higher to 0.4%).

It is important to keep the Federal Reserve’s dual mandate in mind. Their goals are price stability and full employment. Today’s report certainly checks the latter box, leaving the Fed more leeway to fight inflation. As of now, the market is pricing a 75 basis point hike at this month’s FOMC meeting as nearly certain.

After the release, the bond market responded predictably, with rates once again rising across the curve. The current move in 2-10 year maturities is about 10 basis points higher, pushing all of them definitively above 3%. Stock traders seemed a bit more uncertain about how to react. Futures fell modestly in the pre-market and into the open. Stocks bounced back to unchanged, then fell, then bounced up to trade positively by midday.

When asked why stocks were performing well today, I offered two theories. One is that we have been seeing positive momentum this week after an oversold bounce, and that the payrolls report was not sufficient to snuff that short-term trend. The other is that stocks are shifting their focus from the Fed to economic recovery. Let’s try to figure out which is the more likely answer.

For the past few sessions, stocks have followed bond yields rather than moving inversely. The logical explanation for that correlation is that stock traders are embracing what bond traders fear – an economy that is not as bad as feared. Note the trends for the past two weeks:

2-Week Charts, 5-Minute Bars, 2-Year Yields (white), SPX Mini Futures (ES1, red), NDX Mini Futures (NQ1, purple)

Source: Bloomberg

I understand the innate desire for equity investors to hope that things aren’t as bad as they could be. We were deeply oversold at the end of last week, and it was quite sensible for traders to play a bounce during a holiday shortened week. But it is important to keep a few things in mind, few of them pleasant.

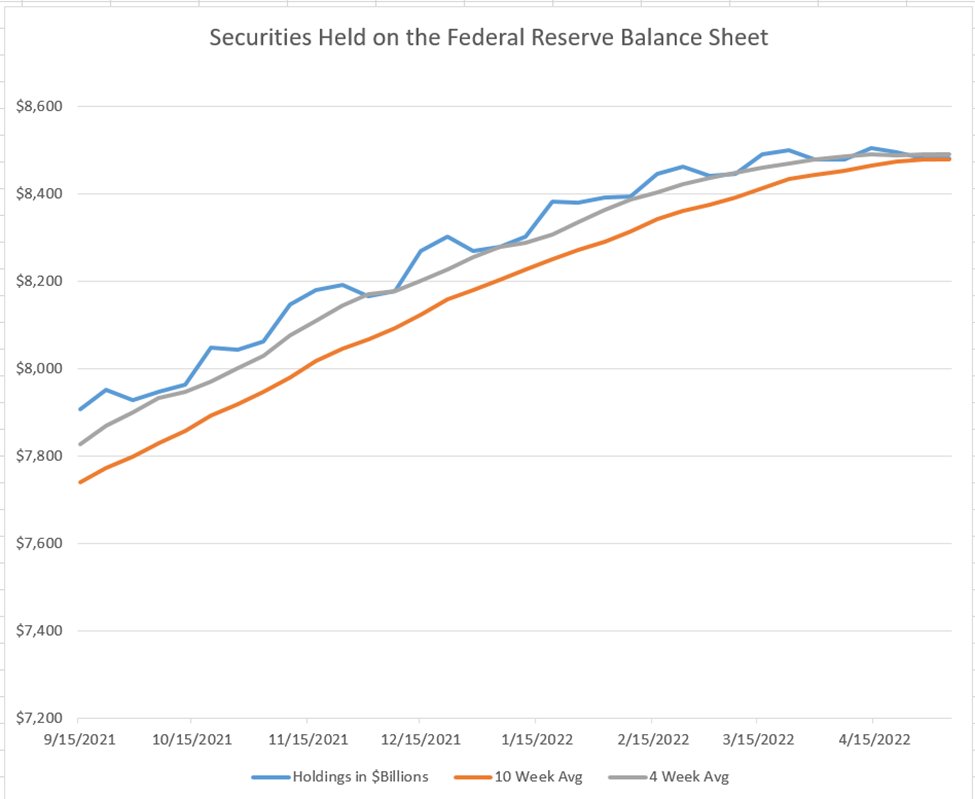

First and foremost should always be “Don’t Fight the Fed.” As we noted, today’s numbers strengthened the consensus around another 75 basis point hike. Taking that as a bullish signal seems like you’re trying to pick a fight with the Fed. Investors should also remember that while interest rate hikes are the most visible way that the Fed is trying to rein in inflationary expectations, quantitative tightening (QT) is in its infancy. For now there is still plenty of liquidity in the market, as evidenced by the stubbornly high levels of reverse repo activity at the New York Fed. We see that the amount of securities held on the Fed’s balance sheet is starting to decrease, but only barely so far, as evidenced in the following chart:

Sources: Federal Reserve H.4.1 Data, Interactive Brokers

At the risk of bringing up uncomfortable reminders, the last time the Fed attempted to shrink its balance sheet was mid-2018 to mid-2019. The 2018 period was accompanied by a series of rate hikes that brought about a nasty bear market in that year’s fourth quarter. Stocks recovered when the Fed indicated that the December 2018 hike would be its last. There’s no indication yet that the Fed will act similarly in the near future. Most of 2019 was OK for stocks, but behind the scenes there was trouble brewing. By late summer, banks were shunning each other in the repo market. Only then did the Fed step in to help, and stocks enjoyed the fresh bout of liquidity until Covid fears took over. We’re far from the Fed needing to reverse QT. It’s barely started, and a soft landing or modest recession actually makes it less likely that the Fed will stop attempting to drain liquidity from the market.

Throw in the idea that bear market rallies are short, sharp and ferocious, and you can see why I remain skeptical that the recent rally will provide anything more than temporary relief to anguished markets. Of course it is entirely possible that earnings season, which begins late next week, will prove that skepticism to be misguided. Until or unless that occurs, I continue to suggest that traders be tactical, willing to sell the rips as well as buy the dips.

This post first appeared on July 8th 2022, the Interactive Brokers Traders’ Insight blog

PHOTO CREDIT: https://www.shutterstock.com/g/wanpatsorn

Via SHUTTERSTOCK

DISCLOSURE

Investing involves risk, including the possible loss of principal. Diversification does not ensure a profit nor guarantee against a loss.

This material represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. This information is not intended to be individual or personalized investment or tax advice and should not be used for trading purposes. Please consult a financial advisor or tax professional for more information regarding your investment and/or tax situation. Investors cannot invest directly in indexes. SPX Mini Futures E-mini S&P 500 futures are traded on the Chicago Mercantile Exchange (CME) and allow traders to gain exposure to the S&P 500 index, a widely recognized barometer of the U.S. stock market. , NDX Mini Futures Nasdaq 100 Futures is a stock market index futures contract traded on the Chicago Mercantile Exchange`s Globex electronic trading platform. Nasdaq 100 Futures is based off the Nasdaq 100 stock index.