Silicon Valley venture capital has long been dominant in funding startup companies. There are about five or ten top players that have created enormous wealth for their clients, usually very wealthy pools of capital such as pension funds, foundations, and endowments.

For competing asset management firms, the astronomical returns by the venture firms in recent years are very high hurdles in attracting institutional investors.

The largest venture firms use their return performance to their advantage in attracting capital. They also use it in the way they structure their ownership stakes of the startups they allocate capital to.

Generous Returns

The dual-class shareholder structure and ability to only sell a small percentage of shares when one of their startups go public ensures very large returns when one of their portfolio companies successfully gets listed.

All that works wonderfully during a good market, or when the environment is placid. For roughly the last 15 years, the IPO area has attracted huge amounts of capital.

Fed Shift

Still, very little in the world has unlimited staying power, and in my view the ideal climate for venture capital may be coming to an end.

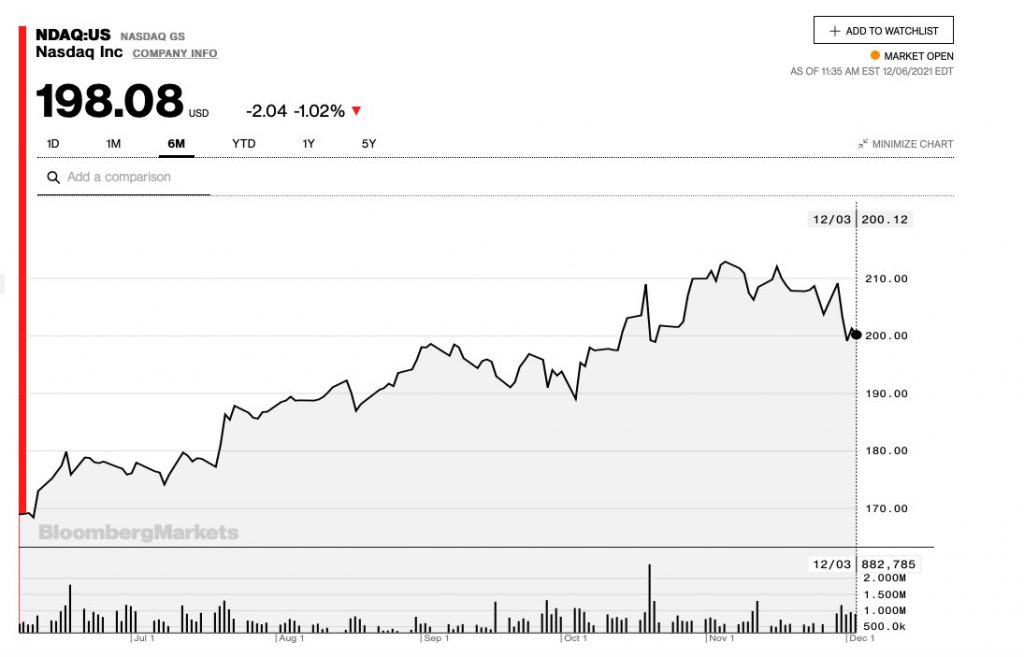

Tech stocks have had a great run throughout 2021. Over the last month, however, many high profile NASDAQ companies have lost a tremendous amount of value.

Much of the decline has taken place over the last two weeks as investors are starting to believe Fed Chairman Powell will be more aggressive about fighting inflation than previously thought.

Inflation Anxiety

It certainly would be understandable to question Powell’s commitment to a more hawkish posture. For over a decade, investors have seen the last three Fed heads keep interest rates at historically low levels.

With markets still up more than 20% in 2021 after having a great run for a long period, the Fed may not be in a hurry to tighten monetary policy and raise interest rates.

However, Powell’s hand may be forced by accelerating inflation, and this is what is bothering investors.

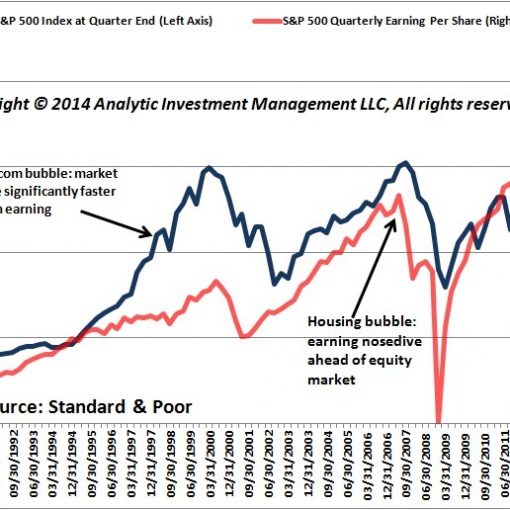

Bubbly Valuations

The central problem is that the valuations of many technology companies may be out of line with their underlying size and profitability.

Space-focused companies and electric vehicle companies that haven’t sold a vehicle are the prime examples. Then there’s the cryptocurrency arena.

Should interest rates move up from zero, more traditional metrics of valuing businesses may take hold in my opinion.

There are many companies that are backed by venture funds that are exceptional businesses. In my view, the ones that aren’t will be exposed as such when the interest rate environment changes.

Photo Credit: 401(k) 2012 via Flickr Creative Commons

Disclosure

This piece is provided as educational information only and is not intended to provide investment or other advice. This material is not to be construed as a recommendation or solicitation to buy or sell any security, financial product, instrument, or to participate in any particular trading strategy.