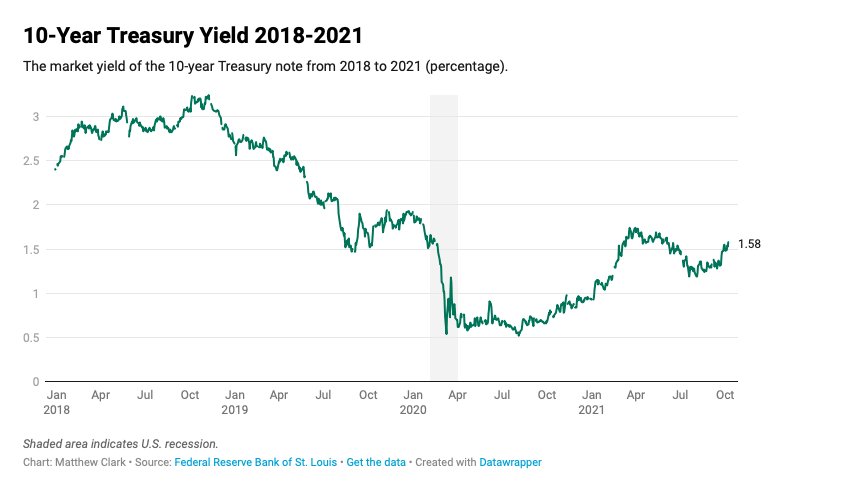

You’ve seen headlines: Bond yields are rising. That’s been true for the most part over the last several months.

But here’s the thing. In my opinion, when you’re starting at close to zero, you have a lot of ground to make up before yields get anywhere close to attractive. As a case in point, the 10-year Treasury yield has increased over the past year, yet it still yields a pitiful 1.6%.

Inflation Factor

You aren’t getting rich on that. In fact, you’re getting poorer. Yields that low can’t even keep up with inflation. Plus, if bond yields continue to rise from here, you’ll likely take losses on any bonds you don’t plan to hold until maturity. (Assuming you buy a bond at a positive yield and it doesn’t default, it’s unlikely to lose money on a bond held to maturity, at least before inflation.)

I don’t think you should put all of your money into stocks at today’s valuations. But, in my view, there may be better alternatives than low-yield bonds.

Pay Down Debt

This isn’t an “investment.” Yet, in my opinion, it’s just as important to your financial well-being.

If you carry debt, chances are good you’re paying a higher rate than what you’re receiving on any funds invested in bonds or other interest-bearing investments. Using excess cash to pay down (or preferably pay off) debt is a sensible move.

I hate debt … even my mortgage. It feels like a noose around my neck. My income stream is pretty variable. I have good and bad years. Yet, the mortgage payment remains constant.

So, when I have extra cash lying around that I don’t have an immediate need to invest, I’ll make extra payments on my mortgage. Chipping in an extra thousand dollars here or there can shave years off of your mortgage, particularly if you do it early in yourmortgage.

Steady Payments

Every additional dollar you pay above and beyond the normal payment goes straight to principal.

I get that mortgage rates are low by historical norms. I also know that you likely pay next to nothing in financing costs once you include income tax breaks..

I don’t care. There is a freedom and a peace of mind that comes with being debt free. And I’ll take that over a measly 1.6% in the bond market.

Adopt an Active Strategy

What do bonds do for you? Sure, they pay coupon payments. Great. But reducing volatility is their more important role. Having bonds in the portfolio lowers your overall volatility because stocks and bonds tend to be minimally correlated. One zigs when the other zags.

Well, we could make the same argument for active trading strategies. An active strategy could offer the same diversification benefits to your standard buy and hold positions and make a lot more than what you’d earn holding bonds.

Naturally, you have to be smart here. Placing large, reckless bets in an active strategy won’t reduce overall portfolio risk. In my opinion, you need to take a disciplined approach to risk.

Stay Liquid

Finally, there’s nothing wrong with cold hard cash. Yes, over time you will lose ground to inflation. I get that. But you’re also losing ground to inflation in bonds, and the difference between making 0% on cash and 1.6% in bonds is not enough to matter over stretches of time in my view.

Meanwhile, having cash on hand maximizes your “optionality.” If we hit a rough patch in the market and buying opportunities present themselves, you have the option to deploy that idle cash in an instant without having to agonize over what to sell first.

Warren Buffett enjoys the returns he does because he always has excess cash on hand to pounce when the moment arrives. If it works for the Oracle of Omaha, there’s no reason why it can’t work for us too.

This post first appeared on October 12 on the Money & Markets blog.

Photo Credit: Pictures of Money via Flickr Creative Commons

DISCLOSURE

This piece is provided as educational information only and is not intended to provide investment or other advice. This material is not to be construed as a recommendation or solicitation to buy or sell any security, financial product, instrument, or to participate in any particular trading strategy.

This article is not intended as tax advice and is provided for educational and information purposes. Interactive Advisors does not provide tax advice. All references to tax matters or information provided here are for illustrative purposes only and should not be considered tax advice and cannot be used for the purpose of avoiding tax penalties. Investors seeking tax advice should consult an independent tax advisor.