By Steve Sosnick, Chief Strategist at Interactive Brokers

Just under three months ago, I published a piece called “Confessions of a Market Nihilist,” in which I stated my frustration that equity markets seemed to be ignoring a wide range of warning signs in a push to new highs. That piece, like this one, was published on a Friday before a monthly expiration. During the following week, the S&P 500 Index (SPX) did indeed set a new record. Two weeks later, SPX closed the month 18% lower.

In early February I noted that markets were rising in the face of a spreading coronavirus, a reduced pace of repo purchases by the Federal Reserve and gloomy economic statistics. I was also concerned that the bond markets were painting a much gloomier view of the economy than the stock markets. Compare that to today, when we are rallying once again – this time on the continued spread of coronavirus in states that are quickest to reopen, a reduced pace of growth in the Fed’s balance sheet, a 2- year Treasury note that is flirting with negative rates, and truly terrifying economic statistics. Of course we’re up again, right?

By now, I will assume you have seen that over 20 million Americans lost their jobs during the prior month, and that the unemployment rate spiked to 14.7%. To put this in perspective, we have lost all the employment gains made in the past 20 years. There was immediately an effort to put as positive spin on that statistic as possible: the -20.5 million statistic wasn’t as bad as the -22 million expectation (“better than feared” has become the new rallying cry), and about 78% of those 20.5 million were only temporarily furloughed (meaning that about 5 million people are permanently unemployed). No matter – the futures were up overnight and kept those gains until morning.

Skepticism Rising

I recently posted a video entitled “Insomniacs Have All the Fun”, noting how the recent pattern is to see futures rallying overnight and having that rally carry into the main US trading session. I find it curious, if not suspicious, that much of the recent gain in the broad market indices are occurring while North American investors are asleep. Those overnight rallies seem to coincide with the return of vague, unsourced rumors about progress in US-China trade talks. That was a common theme during the prior market rise as well. At best I greet those with some skepticism considering the nasty rhetoric that is being thrown around by US government officials. One could certainly envision an incentive for someone to throw out rumors about positive trade developments into a thin overnight market, knowing that algorithms are programmed to buy on that move and knowing that others use the morning’s opening price as a new starting point for their trading decisions.

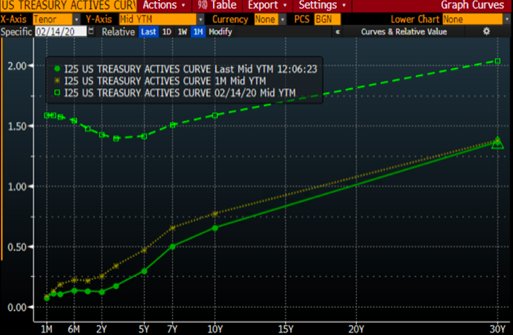

In February, we noted that the Treasury yield curve was inverted until about the 3 year mark, meaning that the bond market was pricing in economic weakness that failed to concern the stock markets. Currently, with rates approaching zero, there is little room for an inversion, but we still see one in the 6 month to 2 year range. Furthermore, those rates are lower than where they were just a month ago, when stock markets viewed economic prospects as dimmer than they do today. It is once again the case that the stock and bond markets are telling different stories about economic prospects. As I noted three months ago, when the stock and bond markets have divergent views about the economy, the bond market is usually proven correct. The question of course, is when.

Fed Balance Sheet

Despite all the prior commentary, there remains a solid explanation for the recent rise in US equities. As we have noted before, most recently in Tuesday’s piece “Revisiting the Fed’s Balance Sheet”, the monetary accommodation provided by the Federal Reserve has been historic. In February we were concerned that the 10% growth in the Fed’s balance sheet over the prior 6 months was petering out. Over the past 2 months we have seen a roughly 30% rise. That money has to flow somewhere. The intended purpose was to backstop a wide range of borrowing that threatened to bring a wave of corporate defaults and financial distress. If there is one thing that a central bank fears more than inflation, it is deflation. A financial system that relies on credit is destabilized if borrowers are forced to pay their debts in a currency that has suffered deflation.

We have been constantly checking the pace of growth in the Fed’s balance sheet, noting that equity markets typically respond to changes with about a 2-3 week lag. After yesterday’s weekly update, we see that the pace of growth has begun to drop dramatically. It is unclear if equity markets respond more the first derivative or the second derivative of the balance sheet – whether absolute growth or the change of pace to that growth is more important.

Takeaway

Considering the lack of data points and the unprecedented scope of the rise in the Fed’s balance sheet – according to my former professor, Dr. Jeremy Siegel, it has grown about as much in the prior 2 months as it did in all of 2009 as we emerged from the prior crisis – it is simply too early to know whether the decline in the second derivative will prove meaningful to equity investors. But when we consider that we have seen the 3rd consecutive week of slowing Federal Reserve balance sheet growth, and the usual 2-3 week lag in the response of equity markets to Fed balance sheet changes, one needs to be vigilant.

Otherwise we must remain with the nihilist’s view that nothing really matters.

Sources for all charts: Bloomberg

Photo Credit: Zooey via Flickr Creative Commons

For further reference:

Confessions of a Market Nihilist

Insomniacs Have All the FunRevisiting the Fed’s Balance Sheet

DISCLOSURE: INTERACTIVE BROKERS

The analysis in this material is provided for information only and is not and should not be construed as an offer to sell or the solicitation of an offer to buy any security. To the extent that this material discusses general market activity, industry or sector trends or other broad-based economic or political conditions, it should not be construed as research or investment advice. To the extent that it includes references to specific securities, commodities, currencies, or other instruments, those references do not constitute a recommendation by IBKR to buy, sell or hold such investments. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.