By Steven Levine, Senior Market Analyst at Interactive Brokers

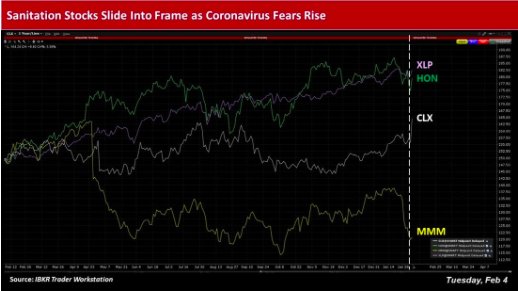

Several companies that have joined the fight to stave-off the recently unleashed novel coronavirus (2019-nCoV) have seen a recent spike in their stock prices, amid rising demand for their products and services.

Clorox (CLX), 3M (MMM) and Honeywell International (HON) have been generally in the spotlight, as an increasing number of consumers wax more cautious about contracting the virus.

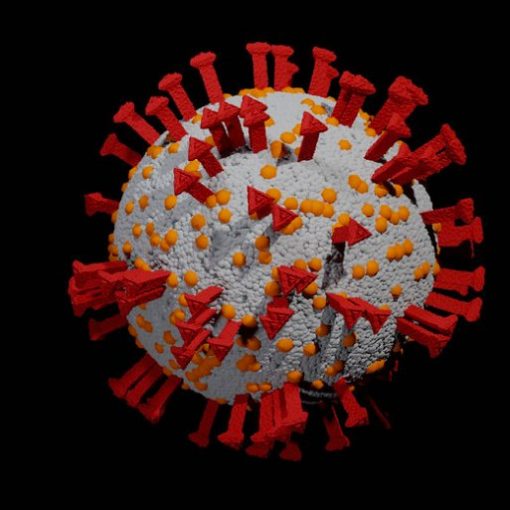

China Virus

The Centers for Disease Control and Prevention (CDC), which is closely monitoring the spread of the respiratory illness, noted there have been thousands of confirmed cases in China, including cases outside Wuhan City, China, where it was first identified.

To date, cases of 2019-nCoV have also been detected in a long list countries outside of China, including the U.S., Hong Kong, Taiwan, Australia, India, Singapore, Japan, South Korea, the Philippines, Thailand, Vietnam, as well as Germany, France, Finland, Italy, Spain, Russia, Canada and others.

As of February 3, the CDC identified 260 cases of the disease across 36 U.S. states, with reported global fatalities exceeding 425.

Financial Market Fallout

The financial markets have generally responded violently to the novel coronavirus’s threat to thwart global growth – with a trail of losses already having been left in its wake, including the cost of crude oil, as well as a myriad of other commodities.

Although the respiratory illness has been likened by industry experts to the severe acute respiratory syndrome (SARS) epidemic of 2002-2003, uncertainties persist over the economic costs and fatalities wrought by the newly unleashed illness.

Invesco’s global market strategist Kristina Hooper, for example, said she expects the coronavirus to have the greatest impact on China’s and Asia’s GDP in the first quarter of 2020, with a “slight improvement” in Q2’2020.

Hooper noted that compared to SARS in 2003, “expectations this time are for a stronger, more negative impact toward the beginning stages, as new cases should peak in this quarter,” while the number of new infections are likely to moderate starting sometime in Q2, as China’s and other government’s remediation responses have been “swifter and much more transparent than in 2003.”

Trade Deal

Hooper continued that as the number of new infections moderates — “and as consumption returns and positive impacts of the Phase 1 trade deal work their way through positive corporate and consumer sentiment — we think that a rebound in economic activity will start to occur by the end of the second quarter, which should continue into a more powerful recovery in the third quarter.

“While more stock market volatility is likely, we expect the market to rebound in advance of an improvement in economic activity, especially given that both China and the Federal Reserve (Fed) stand ready to provide stimulus as necessary.”

Overall, risk appetite had returned to the financial markets Tuesday, following liquidity injections and other policy measures by the People’s Bank of China, as well as other Chinese government agencies, to contain any adverse impacts from the coronavirus on its – and the global economy.

Meanwhile, the relatively small number of domestic 2019-nCoV cases currently under investigation has spurred other analysts to anticipate an overall muted impact on certain U.S. corporate sectors.

Fitch Ratings, for instance, recently noted it does not yet expect the virus to have a material adverse effect on the operating performance, or overall credit profile, of U.S. health insurers.

Cleaning-up

Against this backdrop, many U.S.-based companies have been touting the necessity of their products to help ward-off contagion from the respiratory illness, amid ongoing headline-stoked fears about its outbreak and victim count.

Most of these firms have recently seen their stocks lift, along with shares of the broader Consumer Staples Select Sector SPDR Fund (XLP), which has among its top holdings Procter & Gamble (PG), as well as beverage giants The Coca-Cola Co (KO) and PepsiCo (PEP).

California-headquartered Clorox, for example, has pointed out that its disinfecting wipes and bleach have “demonstrated effectiveness against viruses” like 2019-nCoV and, according to the U.S. Environmental Protection Agency’s (EPA) Emerging Pathogen Policy, certain of its products can be used against the novel coronavirus “when used as directed.”

Meanwhile, Minnesota-based industrial and consumer goods company 3M said in late January it was increasing global production of its personal protective equipment products – including respirators – in response to the 2019-nCoV outbreak.

The firm noted it observed a rise in demand in China, as well as in other regions, and has been working with customers, distributors, and government and health officials to help them obtain needed supplies.

Medical Supplies

To this effect, the company donated medical supplies such as respirators, surgical masks and hand sanitizer in affected areas in China and promised to continue working with its humanitarian aid partners, including the Wuhan Red Cross, Direct Relief and MAP International to provide needed equipment.

Also, Honeywell has reportedly ramped-up on its face mask production, citing a surge in demand for the product across North America, Europe and China.

Investors will be likely watching the spread of the virus closely, as sanitation-related firms continue their campaign to fight against further contagion.

Photo Credit: 葉 正道 Ben(busy) via Flickr Creative Commons