By Lee Clements, director, SRI Research

Europe is a leader in the global efforts to mitigate climate change. Its political classes have lobbied for more ambitious global targets, set strong national targets and are marshaling banks and investors to support climate finance. This can be seen from the relative performance of Europe vs. the rest of the world in cutting carbon emissions and the amount of further efforts to achieve a global warming compliant level of 2° C degrees.

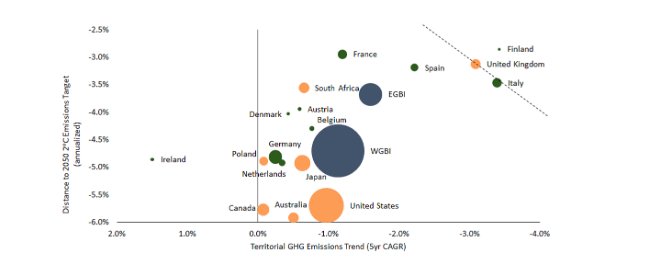

Annualized cuts in territorial carbon emissions until 2050 required to limit global warming to 2° C degrees vs actual 5 years carbon emissions CAGR

Source: FTSE Russell, emissions as at 2016. Bubble size indicates absolute size of emissions. Countries shown are members of the FTSE World Government Bond Index (EGBI), those in green are members of the FTSE EMU Government Bond Index (EGBI), in grey is the aggregation of members of the WGBI and the EGBI.

However, not all European countries have performed equally in cutting carbon emissions or face the same physical risks. Surprisingly, some Northern European countries such as Ireland, Germany and the Netherlands stand out as weak performers, worse than a world average on some metrics.

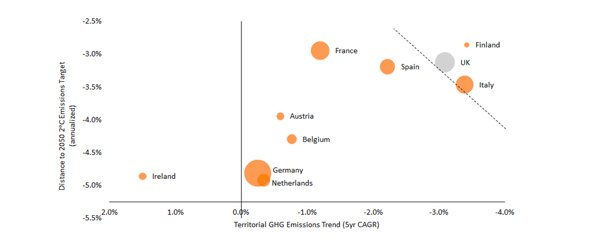

Annualized cuts in territorial carbon emissions until 2050 required to limit global warming to 2° C degrees vs actual 5 years carbon emissions CAGR

Bubble size indicates absolute size of emissions. Countries shown are members of the FTSE EMU Government Bond Index (EGBI) plus UK for comparison.

For the investor, understanding such relative performance is important as climate change has rapidly risen up the agenda of many stakeholders and European countries face both climate related risks and opportunities. The continent is already experiencing some of the physical and social impacts of climate change with extreme heat-related deaths in France in the summer of 2019, multiple climate-related social protests and immigration related issues driven, in part, by the physical impacts of climate change in the developing world. Governments are under pressure to increase their actions, with the Dutch government recently losing a supreme court battle around their poor performance in cutting carbon emissions.

At the EU level, the Green New Deal is aiming to mobilize €1 trillion of capital to finance the climate transition. Given the current and future impacts, climate change is not just physical, social and political issue, it is an increasingly important economic issue, as well. As investors’ portfolio allocation processes are rapidly incorporating climate risk, countries that score badly will see less demand over time for their bonds (albeit at the margin in the near term), with an associated impact on their cost of capital.

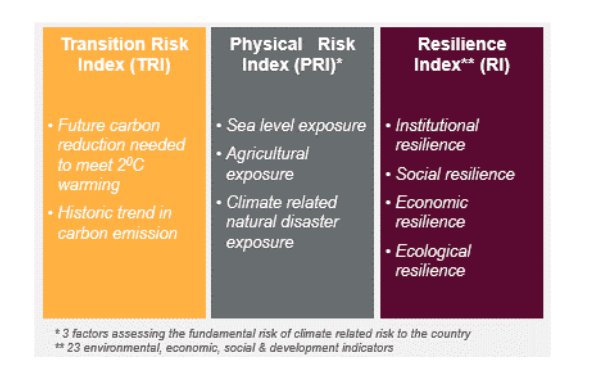

Reflecting this, FTSE Russell has measured the climate related risks of European countries using three distinct climate risk pillars:

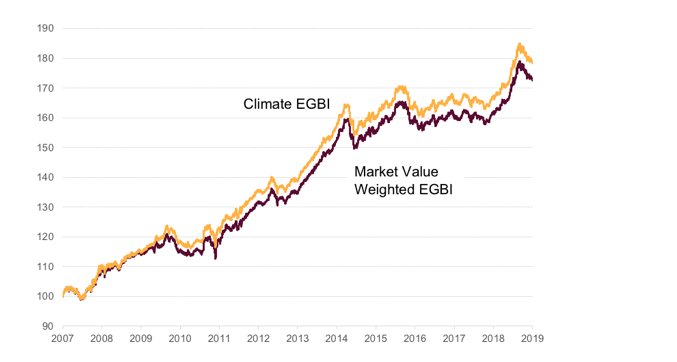

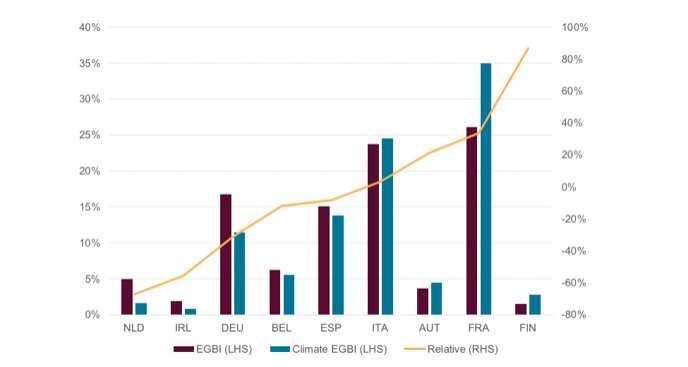

These climate risk pillars are amalgamated into individual country-level climate scores, which are then used to tilt the market value weight of each country included in the FTSE Climate EMU Government Bond Index (Climate EGBI). Those countries that exhibit relatively healthy climate performance are over-weighted compared to those countries that score less favorably. This unique climate methodology results in weight increases to Finland, France, Austria and Italy, and leads to corresponding under-weighting for the Netherlands, Ireland, Germany, Belgium and Spain. From the European Government bond cohort, Finland is the leading overweight (+87%), owing to strong performance in cutting carbon and climate resilience and contrastingly, the Netherlands has the largest underweight (-67%), due to poor performance in cutting carbon and relatively high climate physical risk. The Climate EGBI has been optimized to maximize alignment with 2° C degrees while minimizing deviation to index characteristics of the conventional market weighted EGBI, such as duration, yield and tracking error.

Relative Index Performance

Source: FTSE Russell as of January 2020. Past performance is no guarantee of future results. Returns shown prior to index launch represent hypothetical, historical data. Please see the end for important legal disclosures.

Country Weights – EGBI vs Climate EGBI

Source: FTSE Russell as of January 2020.

EU Taxonomy shines a light on green claims

This article first appeared on Feb. 7 on the FTSE Russell blog

Photo Credit: Pedro Szekely via Flickr Creative Commons

© 2020 London Stock Exchange Group plc and its applicable group undertakings (the “LSE Group”). The LSE Group includes (1) FTSE International Limited (“FTSE”), (2) Frank Russell Company (“Russell”), (3) FTSE Global Debt Capital Markets Inc. and FTSE Global Debt Capital Markets Limited (together, “FTSE Canada”), (4) MTSNext Limited (“MTSNext”), (5) Mergent, Inc. (“Mergent”), (6) FTSE Fixed Income LLC (“FTSE FI”), (7) The Yield Book Inc (“YB”) and (8) Beyond Ratings S.A.S. (“BR”). All rights reserved.

FTSE Russell® is a trading name of FTSE, Russell, FTSE Canada, MTSNext, Mergent, FTSE FI, YB and BR. “FTSE®”, “Russell®”, “FTSE Russell®”, “MTS®”, “FTSE4Good®”, “ICB®”, “Mergent®”, “The Yield Book®”, “Beyond Ratings®” and all other trademarks and service marks used herein (whether registered or unregistered) are trademarks and/or service marks owned or licensed by the applicable member of the LSE Group or their respective licensors and are owned, or used under licence, by FTSE, Russell, MTSNext, FTSE Canada, Mergent, FTSE FI, YB or BR. FTSE International Limited is authorised and regulated by the Financial Conduct Authority as a benchmark administrator.

All information is provided for information purposes only. All information and data contained in this publication is obtained by the LSE Group, from sources believed by it to be accurate and reliable. Because of the possibility of human and mechanical error as well as other factors, however, such information and data is provided “as is” without warranty of any kind. No member of the LSE Group nor their respective directors, officers, employees, partners or licensors make any claim, prediction, warranty or representation whatsoever, expressly or impliedly, either as to the accuracy, timeliness, completeness, merchantability of any information or of results to be obtained from the use of FTSE Russell products, including but not limited to indexes, data and analytics, or the fitness or suitability of the FTSE Russell products for any particular purpose to which they might be put. Any representation of historical data accessible through FTSE Russell products is provided for information purposes only and is not a reliable indicator of future performance.

No responsibility or liability can be accepted by any member of the LSE Group nor their respective directors, officers, employees, partners or licensors for (a) any loss or damage in whole or in part caused by, resulting from, or relating to any error (negligent or otherwise) or other circumstance involved in procuring, collecting, compiling, interpreting, analysing, editing, transcribing, transmitting, communicating or delivering any such information or data or from use of this document or links to this document or (b) any direct, indirect, special, consequential or incidental damages whatsoever, even if any member of the LSE Group is advised in advance of the possibility of such damages, resulting from the use of, or inability to use, such information.