By Steven Levine, Senior Market Analyst at Interactive Brokers

Parisian luxury goods retailer LVMH Moët Hennessy Louis Vuitton (LVMUY) recently agreed to acquire New York-based iconic jeweler Tiffany & Co (TIF) for around US$16.2bn.

LVMH said that its US$135 per share cash purchase of Tiffany is aimed at transforming its watches and jewelry division, in large part by expanding its footprint in the U.S. market.

Alessandro Bogliolo, Tiffany’s CEO, said that the transaction, which occurs at a time of internal transformation, “will provide further support, resources and momentum for those priorities as we evolve towards becoming The Next Generation Luxury Jeweler.”

2020 Close

While the deal, which is expected to close in the middle of 2020, has been greenlit by the boards of directors of both companies, it remains subject to approval by Tiffany’s shareholders, as well as regulators.

Meanwhile, it appears the tie-up may already be facing certain legal hurdles after corporate law firm Johnson Fistel reportedly launched an investigation into whether Tiffany’s board failed to satisfy its fiduciary responsibilities to shareholders, including whether it adequately pursued alternatives to the acquisition and whether it obtained the best possible price for its stock.

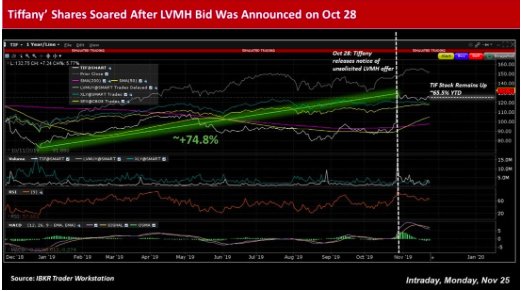

For their part, shareholders seemed uplifted, with Monday’s news of the merger having sent Tiffany’s shares skyward. In mid-morning trading activity, the stock was up nearly 6% to US$132.93, according to the IBKR Trader Workstation.

In fact, the equity value of the more than 180-year-old firm had soared following its October 28 notice that LVMH had submitted an unsolicited buyout offer of US$120 per share in cash. Tiffany’s shares had jettisoned about 74.8% on the announcement from its most recent 52-week low set in late December.

Year-to-date, Tiffany’s stock remains up close to 65.5%.

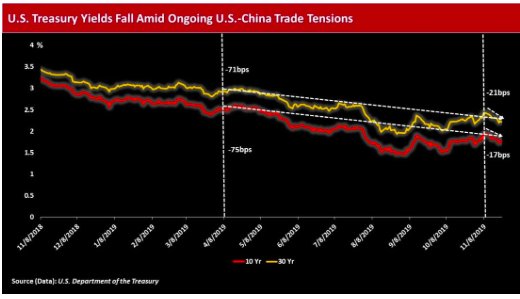

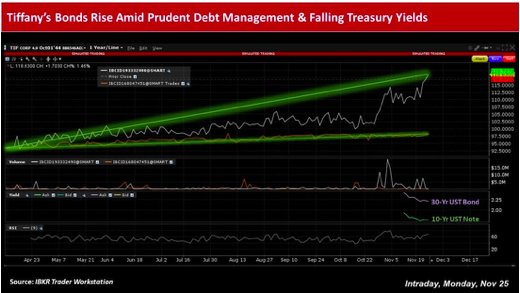

Stronger BondsThe company’s bondholders also seemed pleased, especially amid a recent receding of U.S. interest rates, which has been fueled by ongoing U.S.-China trade tensions, as well as the Federal Reserve’s commitment to a more dovish monetary policy path as global growth concerns increase.

Tiffany’s 3.8% notes due October 2024 were last bid at around US$106.54, a rise of roughly 0.75% on the day Monday and over 5% from their latest trough in early April. Also, recent quotes on the firm’s 4.9% October 2044s were last in the area of US$119.36, up around 2.1% on the day and a whopping 27.7% since April 8.

Yields on the 10-year U.S. Treasury note and 30-year bond have fallen around 17 basis points and 21 bps, respectively, since November 8 and have plunged between 70bps-75bps since April 8.

Debt Picture

Tiffany also appears to have maintained prudent debt management. In its second quarter of 2019 earnings report, it recorded total debt, comprising short- and long-term borrowings at July 31, 2019, of US$1.0bn, representing 32% of stockholders’ equity, unchanged from the previous year.

In mid-June 2019, Moody’s Investors Service said its investment-grade, ‘Baa2’ credit rating on Tiffany largely reflected “consistent execution evidence in sustaining operating margins,” as well as “moderate financial leverage.”

However, Moody’s analyst Christina Boni noted that while the company is “well positioned with its target customer, the rating is constrained by its relatively narrow focus on jewelry, and a more limited product offering than its peers in the global luxury goods market.”

Black BoxesMarket participants have further highlighted recent ‘black box’ uncertainties faced by retailers in certain Asian markets, as well as increased domestic consumption challenges posed by overseas travelers, amid reports of escalating violent protests in Hong Kong, ongoing threats of trade-related tariffs, and continued tensions between the U.S. and China.

Indeed, during its Q2’2019 earnings call, Tiffany CEO Bogliolo said that the firm’s 3% drop in global revenues was due in part to “a significant decline in both sales attributed to Chinese and all other tourists and meaningful business disruptions in Hong Kong.”

According to the U.S. Census Bureau, sales at jewelry stores fell to US$2.36bn in September 2019 from US$2.54bn in the previous month.

Trade Tensions

Tiffany also underscored it is watching developments in the tariff situation closely.Tiffany CFO Mark Erceg said that prior to July 1, 2018, before tariff cuts went into effect, products such as silver, yellow and white gold and platinum held an “all-in blended weighted average tariff” of roughly 28%.

However, should tariffs be imposed in December, the dial could be moved to the low 30% area, he added. To date, progress toward a so-called ‘Phase One’ trade deal has been largely responsible for the U.S.’s delay to impose tariffs on certain imported Chinese goods in December.

Analysts have widely warned that certain levies could impinge on profitability at several major U.S. firms, including sportwear producer Nike (NKE), iconic department stores Macy’s (M), Kohl’s (KSS) and Walmart (WMT), as well as electronics giant Best Buy (BBY).

Moreover, a recent swelling of merger and acquisition activity – notably in the luxury goods sector – may signal that many firms anticipate reduced organic growth in the near-term.

S&P Global recently noted that a “great deal of the recent M&A activity is driven by luxury houses’ attempt to seek out new areas of growth and demand from the increasingly affluent middle and upper classes of China, India and the Middle East, but there are other factors at play too.”

S&P said that Richemont’s acquisition of YOOX Net-A-Porter Group, for example, was driven by the Swiss company’s desire to boost its e-commerce presence, while Michael Kors acquired Versace to help diversify its product range and offset challenging times at its core brands.

Chinese GrowthIn the meantime, Tiffany, along with the lion’s share of the luxury goods market, has been dwarfed by the current trajectory and potential further growth of China.

McKinsey analysts Lan Luan, Aimee Kim and Daniel Zipser pointed out that China is set to become “the engine of global spending on high-end shoes, bags, fashion, jewelry, and watches,” with spending expected to double to 1.2 trillion renminbi by 2025, delivering 65% of growth in the market globally.

The burgeoning Chinese retail landscape has generally made competition more challenging on a price basis for luxury goods companies, which have also been hampered by a recent increase in U.S. retail jewelry manufacturing costs. The impact is certainly more pronounced on firms such as Tiffany, which have a more dominant domestic presence and concentration in jewelry inventories.

Analysts at Finimize recently noted that the luxury goods industry has seen a wave of mergers and acquisitions in recent years, in part “because expanding into growing markets – like China – is so pricey.

“Tiffany’s has also taken the trade war to heart: it can’t rely on Chinese tourists coming to the U.S. to buy bling, and doesn’t have many of its own stores over there. It’d benefit from LVMH, then, which has a massive presence in China. LVMH would benefit from Tiffany’s too: it’d have a younger, less wealthy customer base to tap into.”

Investors will likely be watching the unfolding of further developments in the luxury goods sector, as companies continue to seek growth amid more challenges in the Chinese market, as well as increasing global trade and tariff-laden uncertainties.

Photo Credit: Mike via Flickr Creative Commons