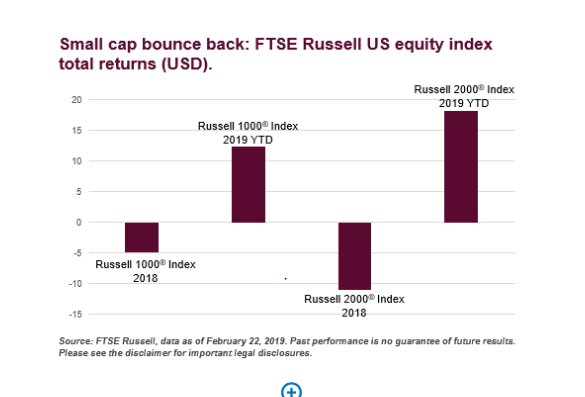

US small-cap stocks as reflected by the Russell 2000 Index are up 18.1% in 2019 as of February 22, relative to an 12.3% rise for the US large-cap Russell 1000®Index. This is a sharp departure from 2018’s US equity market performance, with the Russell 1000 losing only 4.8% while the Russell 2000 lost a much larger 11% on the year.

Smart Take

As investors look for reasons behind the 2019 surge in US equity prices, market experts from FTSE Russell help to put the large cap small cap gap into a broader perspective.

Alec Young, managing director, Global Markets Research, FTSE Russell:

“The Russell 2000 has rebounded nicely YTD, sharply reversing 2018’s underperformance of the Russell 1000 large cap Index. In 2019, small cap’s leadership stems primarily from the Fed’s dovish monetary policy pivot in January, which reinvigorated investors’ confidence in the economy. Given small caps’ greater cyclicality relative to large caps, they tend to benefit disproportionately when investors’ economic optimism increases. In addition, the Russell 2000’s lower 20% foreign sales exposure has buoyed small caps amid weak European, Chinese and Japanese economic data and a resilient US dollar, which weighs on multinationals’ profits. Lastly, after declining sharply in Q4 and early 2019, Russell 2000 consensus earnings expectations have rebounded sharply in February.”

Photo Credit: Seongbin Im via Flickr Creative Commons

©2019 London Stock Exchange Group plc (LSEG Group). All information is provided for information purposes only. All information and data contained in this publication is obtained by the LSE Group, from sources believed by it to be accurate and reliable. Any representation of historical data accessible through FTSE Russell Indexes is provided for information purposes only and is not a reliable indicator of future performance. No member of the LSE Group nor their respective directors, officers, employees, partners or licensors provide investment advice and nothing contained in this document or accessible through FTSE Russell Indexes, including statistical data and industry reports, should be taken as constituting financial or investment advice or a financial promotion.

Certain of the information contained in this article is based upon forward-looking statements, information and opinions, including descriptions of anticipated market changes and expectations of future activity. The author and its employer believe that such statements, information, and opinions are based upon reasonable estimates and assumptions. However, forward-looking statements, information and opinions are inherently uncertain and actual events or results may differ materially from those reflected in the forward-looking statements. Therefore, undue reliance should not be placed on such forward-looking statements, information and opinions.