Let’s face it. Today’s digitally-driven society is all about speed.

Want information? It’s just a click away on your smartphone.

World events, which used to be transmitted by national television networks, now get tweeted instantaneously worldwide.

Instant Gratification

With the power of digitization and quick access to all manner of data come the societal expectation that decisions can and should be made quickly.

When it comes to investing substantial sums of money, however, it is best to make assessments in a systematic way in my opinion.

Charlie Munger and Mohnish Pabrai advocate having detailed checklists for investors similar to those used in pilot training academies.

Analytical Rigor

As one spends more time in the financial world, you realize the wisdom in this approach.

In retrospect, quite a few of the capital allocation mistakes I made would have been quickly eliminated with a more rigorous methodology.

Still, I think nobody is born a great investor and these are the kinds of experiences one has to go through to improve.

Stay Smart

As time passes, if one elevates analysis, decisions are on a better foundation and there’s a greater chance of a favorable outcome.

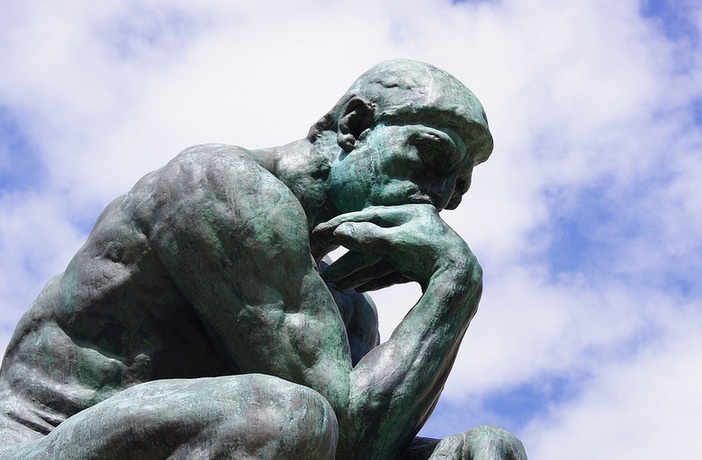

In my view smart thinking still matters in today’s click, click world.

Photo Credit: Fredrik Rubensson via Flickr Creative Commons