In the Federal Reserve’s March 18th policy statement, the central bank removed the term “patient stance” indicating to some observers an inevitable increase in the benchmark Federal Funds rate.

However, Chairwoman Yellen also made comments that support the idea that the Fed will not aggressively start raising rates either.

Slow Walking

In my opinion, rates will go up, but not as much as many in the market expect.

The market infatuation with Fed statements has always puzzled us.

As we’ve stated, the Fed has been tightening policy for almost 2 years when they first started curtailing quantitative easing bond purchases.

Actions matter, not words.

Dollar Power

Other central banks copying the Fed’s formula for economic resuscitation with their own aggressive quantitative easing programs.

As a result, investors have grown concerned with the strengthening U.S. dollar. Another worry is whether the Fed will tighten too much, too soon.

That happened back in 1937 when aggressive tightening pushed the economy prematurely back into recession.

Common sense leads us to conclude there is only so much US rates can rise when coupled with the dislocation of collapsing energy prices, near-zero or negative foreign bond yields and an appreciating greenback.

Yellen

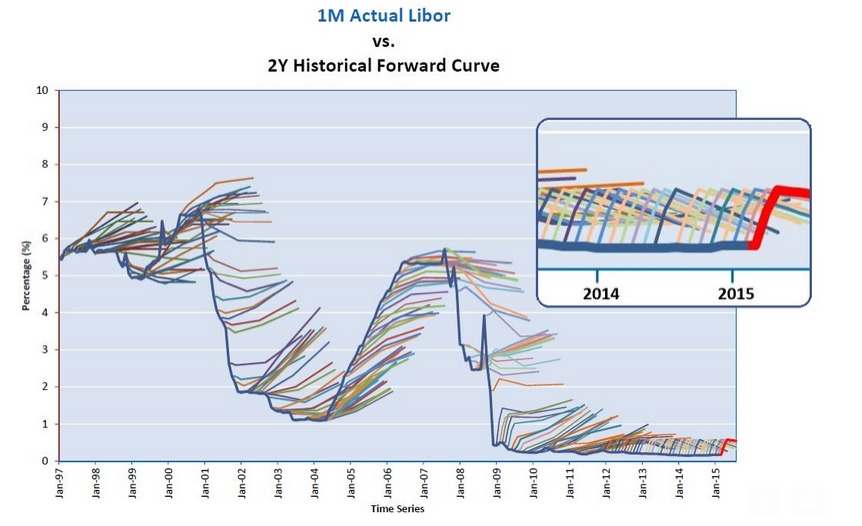

Fed Chairwoman Janet Yellen sees the same market data we see. Bond investors only lose money in markets when rates rise faster than expected.

Historically, the market (as represented by the forward curve) has overestimated the actual rate of increase in yields. (See chart below)

In my opinion, this is once again the case.

Photo Credit: <!–[if lte IE 8]></div><![endif]–> </a> </span> </span> & “>Donkey Hotey via Flickr Creative Commons