U.S. stocks blasted out of the gates in 2015 and kind of fell on their face. The Dow Jones Industrial Average, S&P 500 Index and Nasdaq are all in negative territory as of January 12.

The good news is that U.S. economy is growing briskly and the jobless rate tumbled in December 5.6 percent in December, the lowest level in six and a half years.

For the entire year, the U.S. registered its best overall job growth since 1999.

So what does this mean for U.S. stock prices? We don’t have a crystal ball at Covestor, but here are 4 factors worth considering.

Bullish sentiment

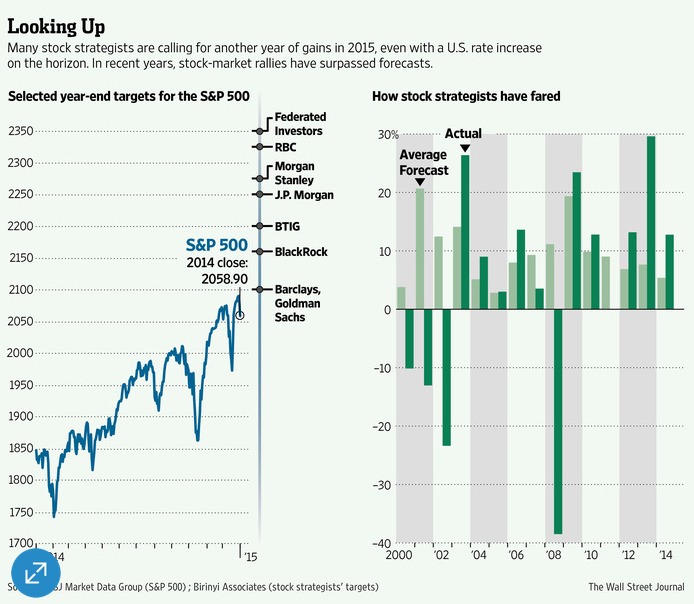

Wall Street’s equity strategists are in an upbeat mood and on average predict the S&P 500 will advance 8.2% in 2015, according to a survey of banks and money-management firms polled by research firm Birinyi Associates.

True, stock forecasts are just that, predictions that can end up wide off the mark.

However, it’s worth noting that Wall Street’s best and brightest have actually underestimated the market’s strength in the last three years.

Economic backdrop

The U.S. economic expansion has been accelerating in recent quarters, a trend that continues to power U.S. corporate-earnings growth.

For the full 2014 calendar year, forecasts call for a 5.6% rise in profit per share for the companies in the S&P 500 index when the final numbers for last year come in.

For 2015, consensus estimates tracked by Barron’s has companies in the index enjoying a 7.5% gain.

True, there will be widely divergent results among the large-cap companies represented in the S&P 500.

Energy producers will take a hit from the collapse in oil prices. Big energy consuming industries, like airlines, will enjoy an earnings windfall. Yet overall the earnings picture looks bright.

Beauty contest

The U.S. economy is the only game in town in many respects.

The world’s biggest economy is expected to grow 3.2 percent or more this year, according to forecasts by JPMorgan Chase & Co., Deutsche Bank AG and BNP Paribas SA.

If so that would be the best showing since 2005.

Meanwhile, the Eurozone is coping with deflation, Japan is in recession and China is growing at its slowest pace since 1990.

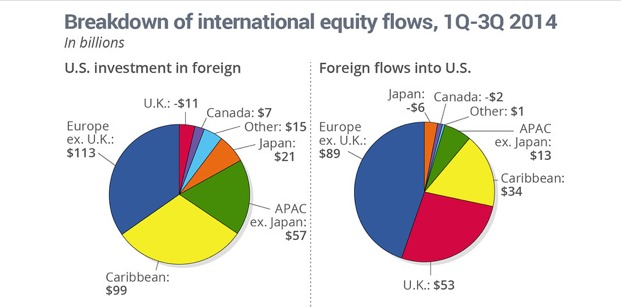

According to a recent Goldman Sachs report, foreign ownership of U.S. stocks reached 16% of the total last year. That’s the highest mark in 69 years.

Valuations

Stocks aren’t cheap. In fact, by some valuation measures they are completely off the charts.

James W. Paulsen, Wells Capital Management Inc.’s chief investment strategist, recently published a report that caught the attention of Bloomberg and other media outlets.

Drawing on data from Dartmouth University Professor Kenneth R. French, Paulson compared the share price of New York Stock Exchange-listed companies with their cash flow and book value.

The share-to-cash flow multiple was the highest on record, while the share-to-book reading was the highest since 1998.

You remember 1998. That’s when the dot.com bubble was raging at full gale force.

Takeaway

Despite the rocky start, there are some nice tailwinds that could support share prices this year and extend the bull market that started back in March of 2009.

The U.S. economy is in far better shape than Europe, Japan and China. American companies are on course for another strong year of profits.

Unfortunately, all of this good news is priced into stocks, which are very expensive by any number of measures.

Does this aging bull market have another run in it? Or is this the top of the market? If so, investors will pay dearly for buying stocks at these sky-high valuations.

Such are the dilemmas stock investors face in 2015.

Continued Learning: The mighty tailwind behind airline stocks

Photo credit: Marine Corps New York via Flickr Creative Commons

DISCLAIMER: The information contained in this article is general in nature and not intended as specific advice. Past performance does not guarantee future results.