October really reminded people how volatile the markets can be. And investor reaction is kind of analogous to the week-by-week mindset of the National Football League fans.

Both investors and fans tend to overreact to each game’s scoreboard. In truth, NFL teams, like markets, are rarely as good or as bad as the fans (and market over-reactors) think.

Fickle fans

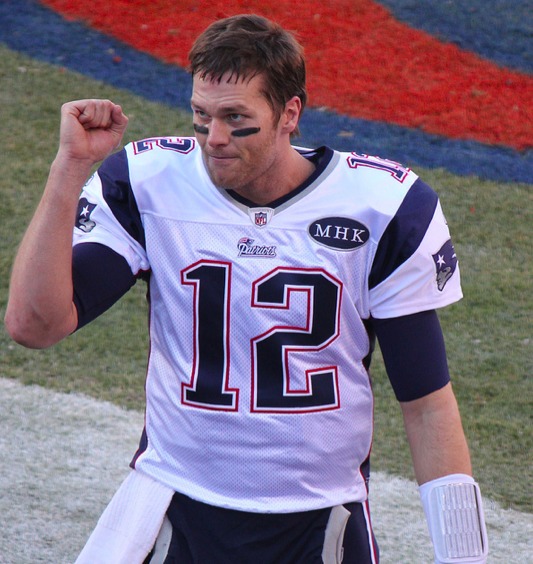

After the New England Patriots lost 41-14 in week 4, they were home underdogs for Week 5! Tom Brady and Bill Belichick were thrown to the proverbial scrap heap!

The team then peeled off 5 straight wins, most recently dominating Peyton Manning’s team.

Herd psychology overreacts. On October 15th, the bull market was declared over by many, and CNBC seemed to be telling the world how things were doomed to get far worse.

I bought opportunistically where I saw the strongest signs of panic.

Buying opportunities

I purchased the Cornerstone Progressive Return Fund (CFP), the Cornerstone Strategic Value Fund (CLM), and the Cornerstone Total Return Fund (CRF), all of which were trading at relative valuations (premium/discount) that varied dramatically from their trading history.

My buys also included the Boulder Growth & Income Fund (BIF), which is my favorite way to gain exposure to the equity markets.

The reorganization of the several other funds, Boulder Total Return Fund (BTF), The Denali Fund (DNY) and the First Opportunity Fund (FOFI), into BIF may improve the fund’s improve liquidity and expense ratio.

While I am not fond of the sponsor of BIF, the relative valuation is attractive versus peers. Such value will be increasingly hard for the investing community to eschew with post-merger liquidity and expense advantages.

Dialing back

That said, I did reduce my position in BIF (and my equity exposure) in the Core Total Return portfolio after the market rebounded so strongly in the latter half of October.

In the Long Short Opportunistic and the Well Intentioned Activism portfolios, exposure to asset classes other than equities has made S&P 500 comparisons difficult.

The MLP Direct Ownership and Taxable Income portfolios are benchmarked to alternate asset classes such as master limited partnerships and bonds by Covestor.

In the income-producing universe, my favorite idea is Nuveen’s Diversified Real Asset Income Fund (DRA), which is the subject of what I see as positive governance initiatives.

I am not calling an end to the U.S. equity bull market. I don’t have a crystal ball here, but there might be stronger performance to be found in different asset classes.

Much like I still recognize Tom Brady as a good quarterback, I think it is still wise to have exposure to multiple asset classes.

Photo Credit: Jeffrey Beall via Flickr Creative Commons, NFL and all associated logos are property of their respective owners.

DISCLAIMER: The investments discussed are held in client accounts as of October 31, 2014. These investments may or may not be currently held in client accounts. The reader should not assume that any investments identified were or will be profitable or that any investment recommendations or investment decisions we make in the future will be profitable. Past performance is no guarantee of future results.