‘Tis the season for that pointless exercise of Wall Street offering up its forecasts of where the S&P 500 will be a year from now.

Unfortunately, a survey of 2013 predictions from top strategists at investment banks reveals they missed by nearly 18% this year, based on Dec. 10 closing prices.

Of course, trying to guess exactly where the S&P 500 will be trading 12 months from now is a fool’s game.

A better approach for investors might be to step back and sketch out broad potential scenarios for 2014 when conducting their year-end portfolio checkup. A diversified portfolio in line with investors’ risk tolerance and financial goals should help them navigate the coming year, no matter what the market throws at them.

Here are four potential scenarios for 2014 and some Covestor managers with strategies that could perform well in that particular U.S. market backdrop. In fact, a diversified mix of these managers is one possible approach to potentially limit overall portfolio volatility:

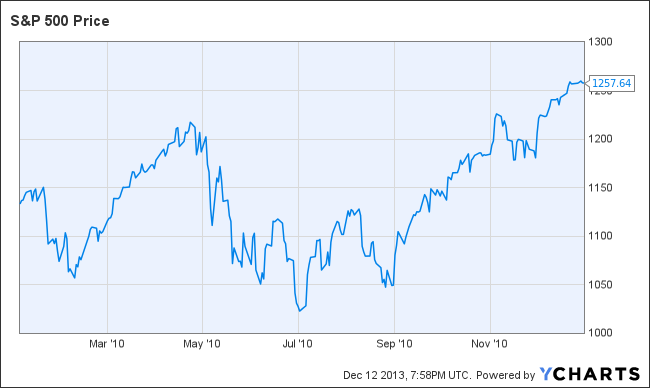

1) 2014 looks like 2010: In this scenario, volatility picks up in the market but the S&P 500 ends the year with a decent gain. In 2010, the S&P 500 posted a total return of about 15% although investors endured the Flash Crash that May, and the Eurozone debt crisis burst upon markets. Although it’s a mistake to rely solely on history when making investment decisions, the S&P 500 does have a tendency to have a “good” year following a “great” year like 2013, although volatility typically picks up. Some portfolios on the Covestor platform that might benefit from this market environment include Undervalued Opportunities managed by Eric Steiman, Long/Short Opportunistic managed by Dan Plettner, and Macro Yield managed by Dickenson Bay.

2010

2) 2014 looks like 2013: This may be hoping for too much, but what if we get another big rally next year? Portfolios to consider in this scenario include Margin of Safety managed by MCO Investments, All Cap Value managed by Patrick Larkin, Absolute Returns managed by Brian Skally, Buy and Hold managed by Aaron Pring, and Buyback Income Index managed by David Fried, and Net Payout Yield managed by Stone Fox Capital.

2013

3) 2014 looks like 2011: This would be a flat year where the S&P 500 finishes pretty much where it started on a total-return basis. In this scenario, investors would want diversification, lower risk and income. These portfolios might fit the bill: Income Portfolio managed by Island Light Capital, Diversified Target Yield Bond ETFs managed by Rahul Diddi, Stable High Yield managed by John Gerard Lewis, and High Dividend Low Volatility managed by LakeView Asset Management.

2011

4) 2014 looks like 2008: This is the bear-market scenario. In a down market, investors may want to consider portfolio managers who can short stocks and potentially profit from weakness. Portfolios on the Covestor platform that may thrive in a correction include Technical Swing managed by Michael Arold and Crow Chaser managed by Leonard Fox.

2008

Of course, history rhymes, it doesn’t repeat, so 2014 might look quite unlike the markets that investors have seen in recent years. However, these four base-case scenarios offer at least a starting point from which investors can research portfolio managers on the Covestor platform.

Disclaimer: The information in this material is not intended to be personalized financial advice and should not be solely relied on for making financial decisions. All investments involve risk and various investment strategies will not always be profitable. Past performance does not guarantee future results.