When it comes to active management and investment portfolios, putting too much faith in a trendy strategy or flashy computer algorithm can often lead to disappointing results.

For example, volatility and uncertainty over Federal Reserve economic stimulus is making life very difficult for some quantitative, trend-following hedge funds that employ computer programs to trade markets.

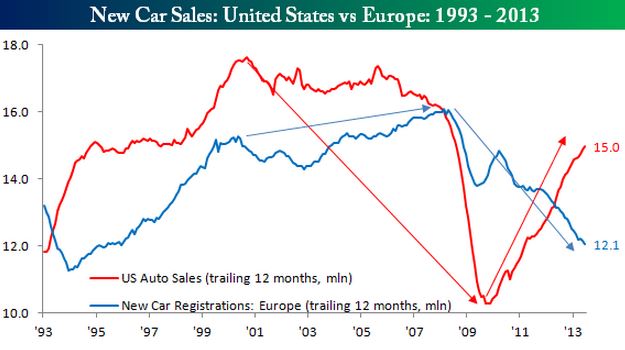

Commodity trading advisors (CTAs) are piloted by algorithms rather than humans, and over $300 billion is invested in these strategies. CTAs have grown popular in the wake of the financial crisis but now these specialized hedge funds are seeing outflows for the first time in years due to disappointing performance. Simone Foxman at Quartz reports that the average CTA is down 3.5% so far this year, while the S&P 500 is up 19.6% with dividends.

Hedge Fund Research Inc. categorizes these quantitative strategies as those designed to identify opportunities in markets that are trending or showing momentum. The strategies work best in markets characterized by persistent, discernable trending behavior. However, financial and commodity markets have traded in a volatile range in recent months due in part to uncertainty over Fed tapering, who might succeed Ben Bernanke, Syria and the U.S. debt ceiling.

The investment approach popularized by Yale University’s endowment is another strategy that has faced scrutiny recently. The Yale Model is known for its heavy exposure to private equity and non-public markets.

The Yale endowment has a nice long-term track record but lackluster returns in recent years have led to concerns the strategy is suffering from copycats and overcrowding.

The bottom line for investors: chasing any hot strategy can lead to high expectations, then frustration.

Photo Credit: Mechanekton