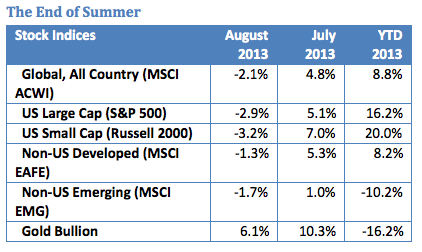

Summer ended with a whimper in August, as a combination of slowing growth expectations in the U.S. and market fears of Federal Reserve tapering contributed to negative returns in most asset classes in August. U.S. stock markets were most strongly impacted by the decline in expectations, falling off July highs and somewhat reducing still impressive year-to-date gains.

Fears of U.S. involvement in the Syrian civil war contributed to an increase in equity volatility and a return to the fear trade as gold bullion rebounded off very poor first half performance lows.

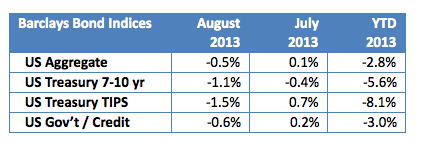

Global inflation expectations remain low although the U.S. inflation rate for the 12 months ended July 2013 hit 2%. The low inflation expectations have contributed to inflation-protected bonds’ poor performance, despite a record global monetary accommodative policy.

Volatility also returned to the markets at the end of August, returning to levels not seen since the Fed-induced bond riot in late June and the fiscal cliff resolution in the last days of 2012.

Signs of rebirth in the European economy contributed to a strong third quarter-to-date for European equities, a trend that is expected to continue with higher European consumer confidence. However, the Japanese latest foray into massive monetary stimulation to grow the domestic economy and inflation rate (“Abenomics”) has not yet contributed to real economic growth, leading Japanese equity investors to take early 2013 profits.

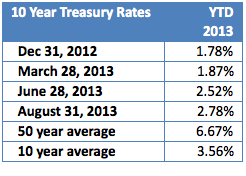

Somewhat higher yields are now available to the fixed income investor as the yield on the ten-year Treasury bond hit 2.78% at the end of August, up one percent from the beginning of the year. The speed of interest rate acceleration in 2013 has exceeded all expectations. Despite the higher yields, longer duration fixed income remains a questionable short term investment as the market still anticipates further interest rate increases. Our expectation is for the ten year interest rate to move above 3% over the next few months.

Looking forward to the end of 2013, we expect political tensions in the Middle East to keep volatility high and for the U.S. economy to grow at an uneven pace with continued high unemployment. The Commerce Department announced that the second quarter grew by 2.5% annualized from April through June, sharply higher than the advance estimate of 1.7% released in early August.

If growth is increasing, as expected in a late stage economic recovery, then equities should still represent a better risk-adjusted asset class than fixed income in my opinion. European equities should benefit from expectations of further growth in the Eurozone, while most emerging markets equities will remain soft. Weaknesses in some emerging economies have been exposed recently (witness the Indian rupee losses) and we expect this trend to lead to short term losses in emerging economy stock markets.

Certain information contained in this presentation is based upon forward-looking statements, information and opinions, including descriptions of anticipated market changes and expectations of future activity. The manager believes that such statements, information and opinions are based upon reasonable estimates and assumptions. However, forward-looking statements, information and opinions are inherently uncertain and actual events or results may differ materially from those reflected in the forward-looking statements. Therefore, undue reliance should not be placed on such forward-looking statements, information and opinions.