The outlook for long-term Treasury bonds is pretty grim, with the U.S. Federal Reserve likely to dial back on its quantitative easing program later in the year and eventually starting to hike interest rates in 2014 and 2015.

Yet not all bonds are created equal. The appetite for below-investment-grade junk bonds remains robust. And the same goes for high-end corporate bonds. Here’s a spin through the good, the bad and the ugly in bond land.

U.S. Treasuries bonds have been taking a beating for many months now. Bespoke Investment Group recently noted that the long bond future has declined 14.46% over the last 391 days (as of August 19). If it falls another 6% and crosses the negative 20% threshold, that would mark the first bond bear market in 13 years.

Or consider the exodus by investors out of bond funds. During the first 12 days of August, investors yanked $19.7 billion from bond mutual funds and exchange-traded funds on Fed worries, according to research provider TrimTabs Investment Research. Since the start of June, investors have taken $103.5 billion from bond funds, TrimTabs found.

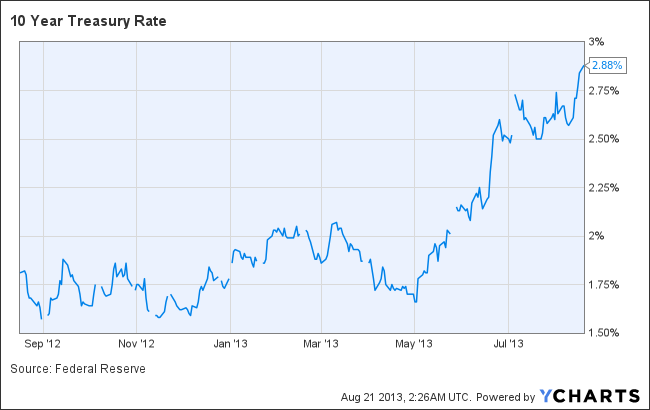

So far the downturn in the Treasury market has been orderly. Yields haven’t spiked to the point of causing any serious harm to the economy. The yield on the benchmark 10-year Treasury bond rose to 2.88 percent this week, a two-year high, but hardly Armageddon.

10 Year Treasury Rate data by YCharts

Meanwhile, bond guru Bill Gross, co-founder of Pacific Investment Management Co., remains bullish on bonds, at least long-term. He’s been adding Treasuries to the Pimco $268 billion Total Return Fund that he manages. The proportion of U.S. government debt in the fund rose from 37% to 38% in May. In his June Viewpoint investment outlook, Gross makes his long-range case for bonds:

It’s important for investors to remember the reasons they own bonds in the first place – namely for the potential for the preservation of capital, income and growth, relative steadiness and typically low to negative correlations with equities. These needs – which will only become more urgent as millions of baby boomers head to retirement over the next decade and a half – are long term, regardless of what markets are doing today. So fixed income should always have a place in a portfolio. Still, there are ways to navigate challenging markets without feeling stuck. One is to expand your investment universe by going global. Here at PIMCO we like to say that there is no “bond market,” but rather “a market of bonds.” So, you should prize flexibility in your fixed income manager or core bond strategy.

If you are still not convinced, there are other options in fixed income. As Ron Silverblatt at U.S News points out, not all the news is bad when it comes to bond funds, especially if you have an appetite for risk.

Even as the broader bond market has tanked, high-yield funds have demonstrated some resilience. According to Morningstar, high-yield (junk bond) funds are one of just three types of bond funds (the other two categories are ultra-short bond funds and funds that invest in bank loans) still in the black so far in 2013. (As of August 19), funds that focus on junk bonds were up by an average of 2.6 percent in 2013, according to Morningstar. By comparison, funds that specialize in long-term U.S. government debt fell by an average of 13.5 percent.

Meanwhile, the big revival in earnings on Wall Street and among global banks has these financial institutions stepping up bond sales – and there seem to be plenty of buyers. New bond offerings from global banks such as Bank of America (BAC) and Goldman Sachs (GS) are getting snapped up. Almost 60 percent of high-grade sales in the U.S. this month are from banks, the biggest proportion in two years, according to Bloomberg.

Add it all up and while it’s true Treasuries have fallen out of favor, other fixed income investments still are in demand. For discriminating investors, there are still attractive opportunities out there.

For more on how to invest in fixed income today, see John Gerard Lewis’ posts on Smarter Investing.

Photo Credit: Michael Minella

![Chasing Madoff [movie trailer]](/content/default.jpg)