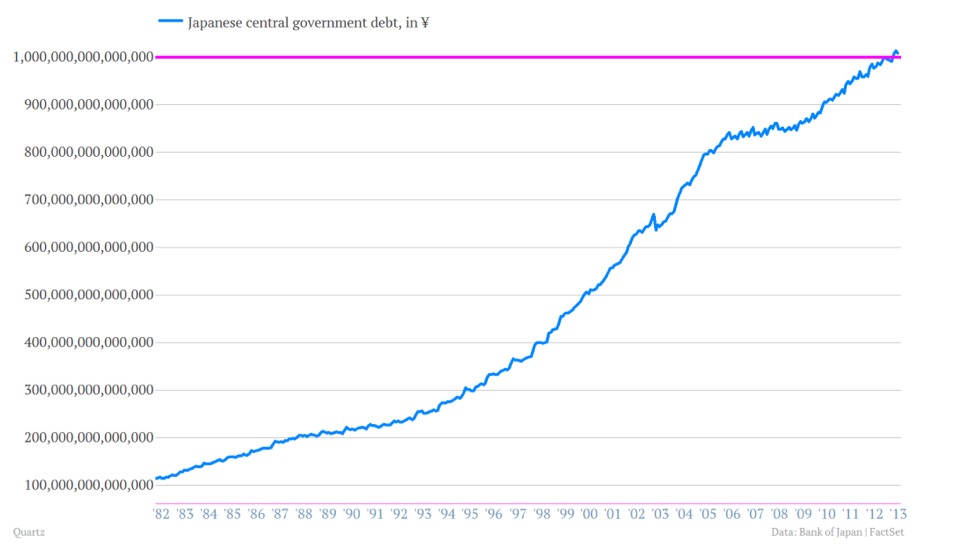

Japan recently set another dubious milestone in the annals of government indebtedness. The nation’s outstanding debt surpassed the 1,000 trillion yen for the first time at the end of June.

A quadrillion yen is a mind-blowing number–and at current exchange rates is the equivalent of about $10.46 trillion. Quartz posted a useful chart (below) to help readers get their minds’ around Japan’s epic debt load.

Japan’s debt woes will preoccupy Prime Minster Shinzo Abe for years to come, even if his high-octane mix of monetary, currency and fiscal policies (dubbed Abenomics) get the country back in the economic fast lane. A disappointing quarterly GDP figure out today suggests that hasn’t happened yet.

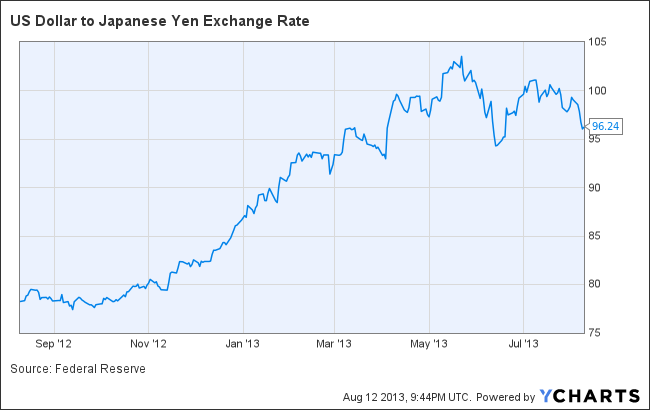

The Japanese yen has weakened against the dollar, but the impact has been a mixed bag for the economy. As the Guardian’s Economics Blog points out:

Firstly, driving down the value of the yen was supposed to boost the Japanese economy by making life easier for its key export sector. But it has also raised the cost of imports, particularly fuel, at a time when domestic energy production remains hampered by the Fukushima nuclear plant. Dearer energy raises business costs and eats into consumers’ real incomes. As some analysts noted, Japan is getting higher inflation as planned, but it is the wrong sort of inflation.

US Dollar to Japanese Yen Exchange Rate data by YCharts

Abe needs the economy growing at an accelerated pace so it can withstand the kind of tax increases and spending cuts needed to cut Japan’s debt load to more manageable levels.

Japan has the rich world’s highest ratio of gross public debt to economic output, projected by Japan’s Ministry of Finance to hit 224% of gross domestic product in 2013—and that forecast came before Abe proposed 10.3 trillion yen in spending on public works and other measures in January. The government’s debt servicing costs consume 24% of its budget, according to the Finance Ministry.

Abe has already indicated he wants to double Japan’s consumption tax to 10% and achieve a primary budget balance—in which government revenue equals outlays, excluding debt-service costs on existing liabilities—by 2020. The Daiwa Research Institute figures that if the government is serious about hitting that goal, the consumption tax actually needs to hit 19%, given rapidly expanding outlays for social security and the state-run health-care system.

Hedge fund manager J. Kyle Bass, whose Hayman Advisors made $500 million during the U.S. subprime crisis, predicts a Japanese fiscal collapse. “Abe and the BOJ face what I call the rational investor paradox, ” Bass told Bloomberg News. “If JGB investors begin to believe that Abenomics will be successful, they will ‘rationally’ sell JGBs to buy foreign bonds or equities.” That will place upward pressure on Japanese bond yields and government debt-service costs.

When will Japanese finances stretch to the breaking point? Barron’s Leslie Norton interviewed Morgan Stanley’s long-time Tokyo-based economist Robert Alan Feldman on Japan’s debt dynamics. Feldman sees the day coming when Japan’s export-led economy will stop generating trade surpluses, which will have repercussions for the nation’s bond market.

The trade balance will go negative in 2015 or 2016, and the earthquake has probably accelerated that process. Once the trade balance goes negative, then the money-flows to buy all the JGBs that are issued will be substantially smaller. That will cause yields to rise sharply despite major deflation. But I don’t think it will take that long for this funding issue on JGBs to become serious. The Japanese government owns nearly a trillion dollars of U.S. Treasuries. That money isn’t really available to fund deficits or to buy JGBs. With the trade balance, we’re getting 2015, 2016 for it to go negative. Is that a decisive call on when JGBs blow up? Not necessarily. But it’s certainly one milestone that we can look at, for how people might change allocations.

The best way for Japan to escape its debt trap is to grow, and getting there will require delivering on painful structural reforms that, inconveniently, hit business interests and rural regions that are a huge part of the LDP’s electoral base. Abe faces a tough slog ahead.

Photo Credit: Rie Shiro