After a turbulent few weeks, the U.S. stock market is retesting record levels again following a run of volatility driven by uncertainty about when the U.S. Federal Reserve might end its ultra-loose monetary policies. On Monday, the S&P 500 Index (SPX) reached a new all-time high for the third straight trading session to 1,682.50.

Now that stock investors have returned to a manic mood from a depressive one, some pundits wonder if the equities market is starting to overheat. Here’s a rundown of the major facets of the debate.

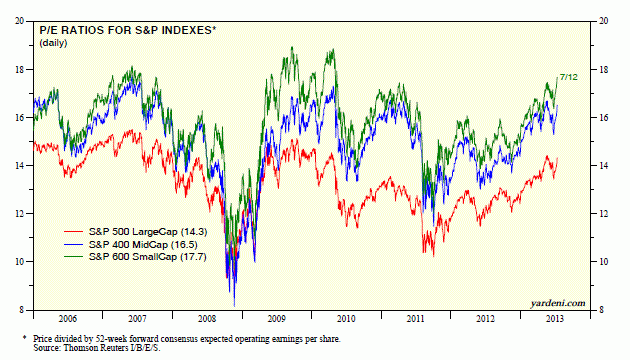

Valuations

Market analyst and economist Ed Yardeni is an optimist in a post out at the start of the week. He notes that the S&P 500 is among the world’s best-performing stock indexes this year. What’s more, the forward P/E ratio of the S&P 500 (14.3), the S&P 400 MidCaps (16.5), and the S&P 600 SmallCaps (17.7) are well below the valuation highs of 2009 and 2010. As Yardeni sees it:

The Irrational Exuberance scenario is back in play. I still assign it a 30% probability. However, it is certainly looking more credible again now that the S&P 500, S&P 400, and S&P 600 are all at record highs. Valuation multiples remain rational, and record highs in forward earnings suggest that the fundamentals continue to support those valuations. We may be in for another four years of this bull market if it doesn’t melt up over the rest of the year.

Earnings

They have generally surprised on the upside, though we are very early into the second quarter reporting season. Last week, better-than-expected earnings from Alcoa (AA) triggered a round of buying. Monday’s catalyst was Citigroup’s (C) 42% jump in profits that set a buoyant tone.

There will be more clarity later this week on earnings, what with 76 members of the S&P 500 expected to report. It’s worth noting that earnings expectations are low: Earnings for S&P 500 companies are only expected to advance 2%, according to analyst estimates compiled by Bloomberg. Stay tuned.

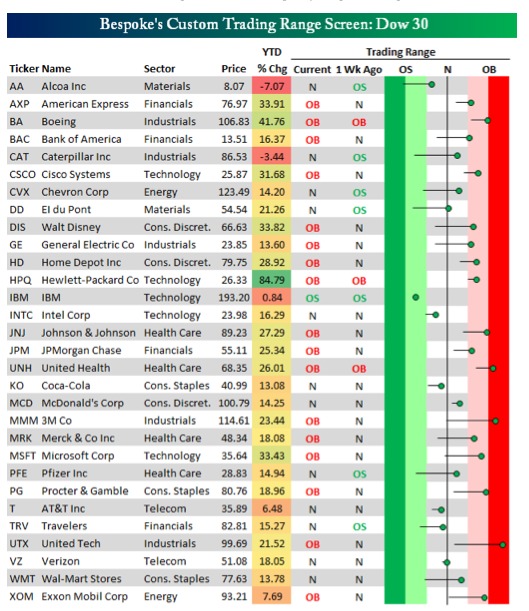

Technical Indicators

The big move up in stock prices in recent trading sessions has pushed a chunk of the market into an overbought condition, according to analysts with the Bespoke Investment Group. When Bespoke checked on July 11, 17 of the 30 Dow stocks were back into overbought territory, while just one stock — IBM — remained oversold.

Bond Bust

Even though the Fed is still buying truckloads of bonds, fixed income investors have been in panic mode since Bernanke’s recent comments about the possibility of the Fed tapering back on its quantitative easing program if the recovery stays on track.

Kopin Tan at Barron’s has an excellent story out on the debate over whether the Great Rotation out of bonds and into stocks will sustain the rally in equities. In a research note, Nicholas Colas, chief market strategist at ConvergEx Group, notes:

Fixed income as an asset class has been in a bull market longer than stocks or gold or pretty much any other investable asset. At some point the party has to end, and the first half of 2013 feels like the bartender just called the last round.

10 Year Treasury Rate data by YCharts

The Alternatives

Much of Europe is in a recession. The bloodbath in emerging stock markets has been brutal this year. And China just reported that its second quarter GDP grew 7.5%. That sounds impressive until you realizes it’s the slowest pace in 23 years. JP Morgan Chase has cut its 2013 forecast to 7.4% from 7.6%. The Shanghai Stock Composite Index recently returned to the lows it set back during the depths of the global financial crisis in early 2009.

And emerging market investors are rushing to the exits, according to this story by Bloomberg. During the first half of 2013, investors pulled $13.9 billion from equity mutual funds that are invested in these four countries, according to EPFR Global. In this climate, U.S. stocks look pretty good.

Photo Credit: Even Cool