The cruise industry has been stuck on the shoals of bad publicity for a little over a year. In January of 2012, the Costa Concordia operated by Carnival Cruise (CCL) capsized off the coast of Italy, resulting in the death of more than 30 people.

This month has seen the death of five crew members of the MS Thomson Majesty, run by by UK-based Thomson Cruises, and an engine room fire on another Carnival ship that went adrift off the coast of Mexico before being towed to safety in Alabama.

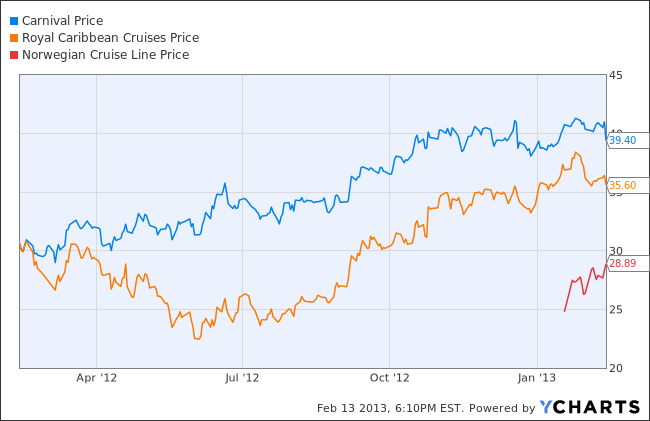

Not exactly great advertisements for the joys of the luxury high seas. Even so, the outlook for the cruising ship industry looks robust both in terms of passenger growth and investments in new ship capacity – unless ongoing safety concerns carry on in the years ahead. Here are the current stock prices of the three large players – Carnival, Royal Caribbean and Norwegian:

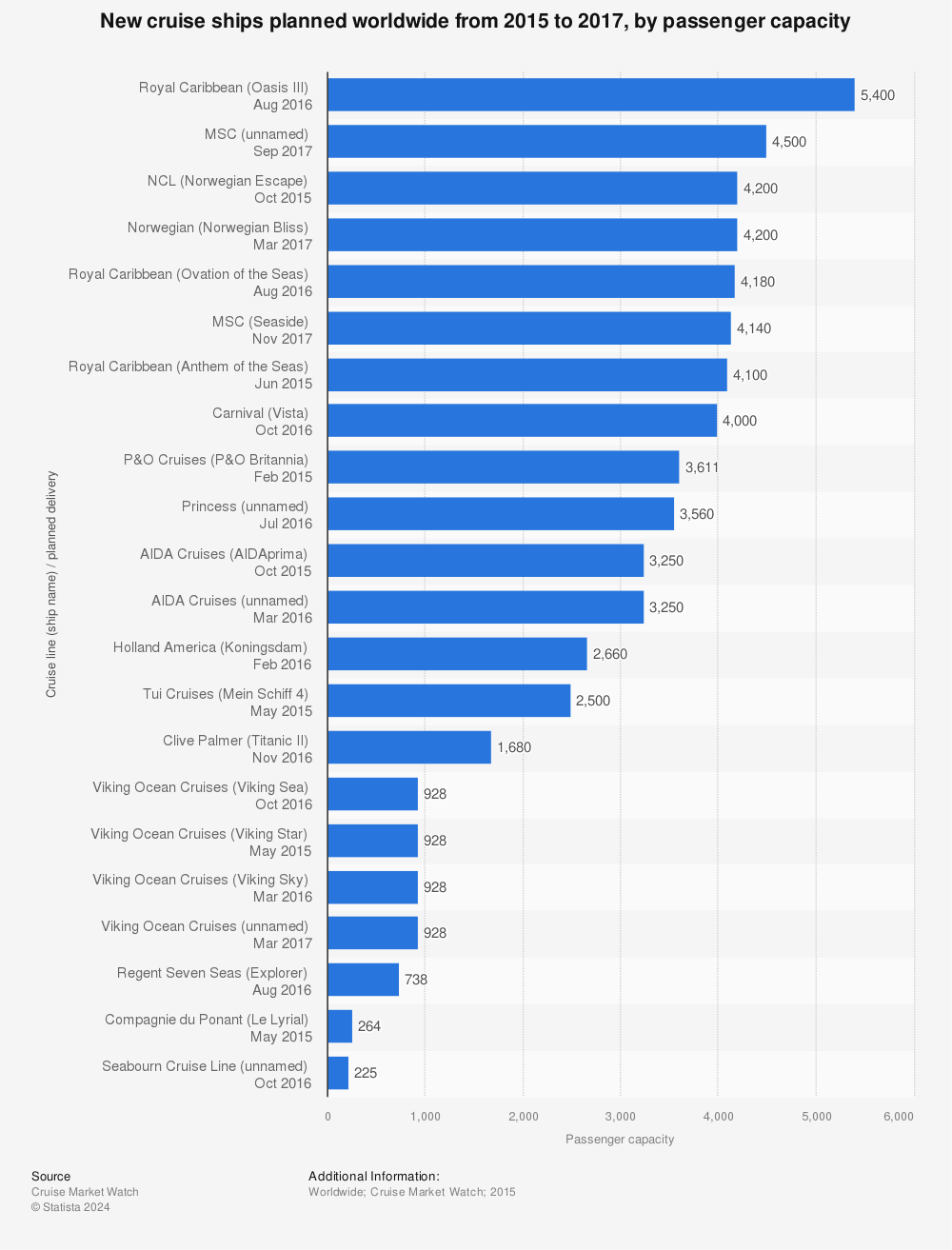

is forecasting that 20.9 million passengers will party on cruise ships in 2013, and expects average annual growth of 7% through 2017. Also, new ship capacity is coming on stream in 2013 and 2014.

You will find more statistics at Statista

The investments discussed are held in client accounts as of January 31. These investments may or may not be currently held in client accounts. The reader should not assume that any investments identified were or will be profitable or that any investment recommendations or investment decisions we make in the future will be profitable.