The Net Payout Yields model was up 0.01% (net of advisory fees) in November versus a 0.3% gain for the benchmark S&P 500 Index (SPX). The model slightly underperformed the market in November, which can happen in solidly positive months.

As of the end of November, the model was up 27.6% for the year, net of fees, compared to 12.6% for the S&P 500. In general, the model had a very uneventful month with flat returns and no trades.

While the model was flat for the month, several stocks had meaningful moves in November. The weakest stocks were Kohl’s Corporation (KSS), WellPoint, Inc. (WLP) and Entergy Corporation (ETR).

Kohl’s lost nearly 16% due to a weak earnings report at the end of the month. The stock plunged from nearly $51 to below $46 on disappointing sales. In my opinion, the company continues a large buyback and should be able to load up on shares at these attractive levels.

WellPoint plunged at the beginning of November due to the reelection of President Barack Obama, which secured the future of his health care overhaul. Ironically, the stock has regained most of the November losses by early December.

Entergy plunged 12% after a weak earnings report at the beginning of November sent the stock down for most of the month. The stock now offers over a 5% dividend yield thanks to the decline.

Several stocks had good months to offset the weak stocks. The biggest gain though came from Lowe’s Companies, Inc. (LOW), which jumped over 11% for the month. The home improvement company continues to benefit from a rebound in the housing market.

Amazingly the stock just surpassed the all time highs from early 2006. With those gains, the stock has now become the largest position in this model making it a target for selling.

Other big gainers were Cisco Systems (CSCO) and Time Warner (TWX) that both gained nearly 10% during the month.

As the year ends and the new year rolls around, the majority of Wall Street rolls out the annual predictions for the next year. The great part about the Net Payout Yields model is that it doesn’t rely on economic conditions or financial predictions. In essence, the model enlists the management teams of these mega cap stocks to do all the forecasting and decision-making.

Instead of undertaking massive research efforts, history has shown that the companies with the highest yields outperform. The management teams willing to execute massive buybacks combined with large dividends indicate a level of value that the market misunderstands. Those teams are forecasting cash flows that exceed what the market expects.

Specifically in the case of the expected dividend tax increases, the companies will tell the investors whether the tax rates require a shift to buybacks, a reduction of dividends, or nothing at all. The ones able to continue paying the highest yields will remain in the model.

Covestor editors asked me a question: What is your outlook for dividend taxes, and is there anyway to handicap the outcome?

Naturally the outlook is that taxes on dividends will increase at least for the top 1-2%. With a lot of dividend investors in tax-free retirement accounts, the impact is uncertain. Even with higher tax rates, investors likely don’t have better alternatives at the moment.

In general, it is difficult to handicap a political process. Fortunately, this model lets the market do the heavy lifting. Whatever stock rises to the top yield at the end of the day will offer the best potential return.

The model is designed to purchase the highest yielding stocks whether dividends or buybacks. Naturally it will continue to keep investing in dividend stocks. Fortunately though, the model has the flexibility to be tilted towards buyback stocks that can take advantage of a system where less focus is placed on dividends.

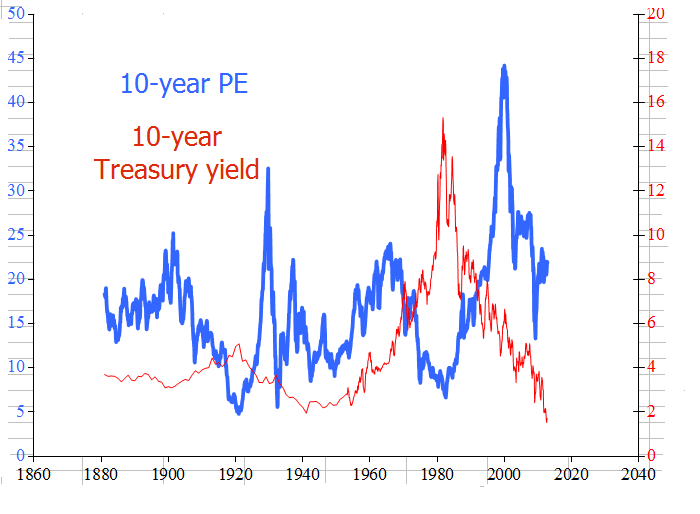

The dividend trade is very popular now, but not too crowded as of yet. Lots of stocks still offer relative value compared to interest rates. If any trade were too crowded, it would be bonds. Until that potential bubble pops, I wouldn’t expect any issue with dividend stocks.

My favorite stocks for 2013 are the ones with the largest net payout yields (see Top 10 list). Seagate Tech (STX) and Kohl’s offer the best yields, hence making them the favorite stocks for 2013.

Similar to the favorite stocks, the biggest opportunity lies in the stocks with the highest yields in my opinion. When a stock yields 10, 15, or 20%, the market is clearly ignoring the opportunity presented. In the case of this model, the opportunity lies within stock buybacks. Market reports continuously ignore the benefits of a strong, strategic buyback plans.

Typically the focus is placed on failed plans from fast growing stocks that overpaid on buybacks. Generally those stocks spend a lot of money, but it encapsulates a very small part of the market cap.

When a company is able to purchase a significant amount of the outstanding shares, the market presents an opportunity that shouldn’t be ignored, in my opinion. Those situations need to be distinguished from a random 1-3% buyback that isn’t material.

As the year ends, the market now seems to ignore the possibility of any major financial collapse in Europe. The relentless headline risk that never came to fruition is basically over, yet investors aren’t exactly moving out of bonds and cash into stocks.

As with the fears over a European collapse, the markets appear fatigued by the constant fiscal cliff talks in the US. Stocks remain very complacent considering the looming danger and most of the rhetoric suggesting a resolution is far away. Dividend stocks appear the most at risk, but one has to wonder if the stocks will sell off at this point.

As repeated every month, the average stock in this model yields greater than 10% with the majority of yields coming from buybacks.

Performance discussed is net of advisory fees, and includes reinvestment of dividends or other earnings. Past performance is no guarantee of future results.

The investments discussed are held in client accounts as of November 30, 2012. These investments may or may not be currently held in client accounts. The reader should not assume that any investments identified were or will be profitable or that any investment recommendations or investment decisions we make in the future will be profitable.

Any index comparisons provided in the blog are for informational purposes only and should not be used as the basis for making an investment decision. There are significant differences between client accounts and the indices referenced including, but not limited to, risk profile, liquidity, volatility and asset composition. The S&P 500 is an index of 500 stocks chosen for market size, liquidity and industry, among other factors.

Certain information contained in this presentation is based upon forward-looking statements, information and opinions, including descriptions of anticipated market changes and expectations of future activity. The manager believes that such statements, information and opinions are based upon reasonable estimates and assumptions. However, forward-looking statements, information and opinions are inherently uncertain and actual events or results may differ materially from those reflected in the forward-looking statements. Therefore, undue reliance should not be placed on such forward-looking statements, information and opinions.