by Michael Tarsala

by Michael Tarsala

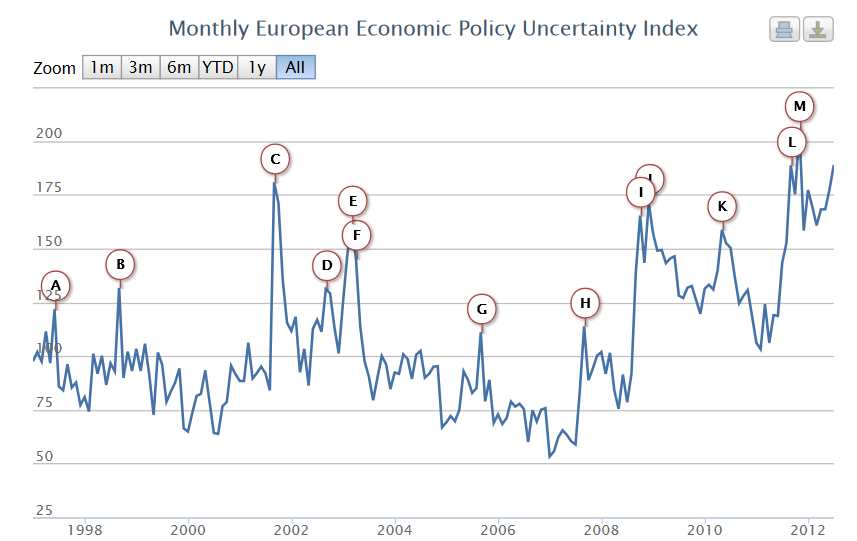

ECB chief Mario Draghi’s announced bailout plan this week is not a cure-all for the European debt crisis, but it has real substance.

It doesn’t eliminate the worries that U.S. investors face from Europe in coming months — mainly earnings pressure and slower growth rates for large-cap multinational companies. Those problems will not be solved overnight. Companies

It should help in the long term, though, by taking the euro zone’s monetary union and turn it into something closer to a real fiscal union — something that should have been done many years ago. It should help buoy long-term investor confidence.

The most important part of the plan is this: Participating governments need to agree to spending and debt-reduction measures before the ECB shows them the money. Play nice, though, and the ECB agrees to buy government debt without any limits. Countries will get access to loans without nosebleed interest rates.

In a speech, Draghi set out five main tenets:

- It’s not a free ride. Countries that want to receive the stimulus will need to agree to ECB monitoring of their finances.

- There is no limit on how many bonds can be bought. The program has no fixed start or end date. Bond purchases will focus on 1-to-3-year maturities.

- Euro area bonds backed by the central bank are expected to be granted the same treatment as bonds from private or other creditors (ECB-backed debt is not senior).

- The central bank plans to drain liquidity in proportion to each of its bond purchases.

- Purchases are to be transparent, and there will be a schedule of weekly and monthly reports that reveal the ECB’s holdings, market values and bond duration.

What remains to be seen is if all countries — particularly Italy and Spain — will get on board with the required austerity measures to participate in the program. It also is not clear how much the plan can stimulate growth. Rates and bond-buying can only do so much.

Regardless, the ECB now has an unlimited bailout in place. It’s a reasonable plan with some real guts. It could help in the long term.