by Michael Tarsala

by Michael Tarsala

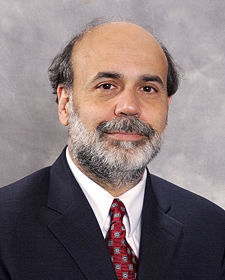

I never thought I would say this, but Ben Bernanke is looking very smart right now with his wait-and-see approach to turning on more economic stimulus.

Bernanke in recent months has set a high bar for justifying QE3, despite people like me who thought he should have turned on that spigot months ago.

So far, that looks to be the right move — even if investors still desperately want any additional juice for their stocks that the government might provide.

Bernanke made it clear in his Jackson Hole speech that any additional stimulus would hinge on the employment reports. While he remains deeply worried about the unemployment rate, further stimulus may not be justified unless the jobs numbers really begin to start tailing off. He’s very aware that more stimulus is expensive, and there are no guarantees that it will be as effective as it had been in the past.

As of last week, the employment numbers were holding steady, even though an uncomfortably low number of jobs are being created. Ben and the FOMC stood ready to act should the data worsen.

The just-released August data, however, showed welcomed hiring momentum. Companies added staff at the fastest pace in five months. Service sector employment improved, even though manufacturing jobs declined. Also, new claims for jobless benefits fell last week to the lowest level in a month.

None of that news may be enough to move the stubbornly high unemployment rate right away. There’s no “all clear” sign that we won’t see another recession.

But the U.S. economy hanging in there despite tough global conditions. The stock market, meanwhile, is still moving higher — even without more QE.

At this point, it looks like a September QE3 announcement is unlikely.

Criticizing the Fed chief’s every move will always be a favorite pastime of investors. But by standing ready to act on QE3 but not yet pulling the trigger, Bernanke appears to have made the right call — even if it’s the unpopular call.

Photo by: Capitalistbanter.com