Author: Bill DeShurko, 401 Advisor

Author: Bill DeShurko, 401 Advisor

Covestor model: Dividend and Income Plus

During a choppy period in the stock market over the last couple of years, we’ve seen a strong rotation to low beta and dividend paying stocks.

With constant turmoil from Europe and a questionable recovery in the U.S., such a flight to quality and lower-risk stocks has been both rational and profitable.

Below I’ve copied a graph showing the Standard and Poor’s Index’s major ETFs: the S&P 500 (SPY), the S&P Low Volatility Index (SPLV), the S&P High Beta Index (SPHB)and i-Shares Dow Dividend Index (DVY). Clearly, since the inception of SPLV and SPHB, low beta and dividends have been the winning choice.

Figure 1. SPY v. DVY v. SPHB v. SPLV

Source: www.freestockcharts.com

This has been an ideal situation for income investors, especially retirees who count on regular dividend checks to pay the bills, as low volatility and dividend payers have been the market’s total return leaders, in terms of broad strategy. However, if we zoom in on the chart above, as shown below in Figure 2, roles have been reversing since around June 1 of this year.

Figure 2. SPY v. DVY v. SPHB v. SPLV – 6 month returns

Source: www.freestockcharts.com

The recent rally in the SPHB, and high beta stocks in general, has left valuations flipped-flopped from what one would expect between SPLV and SPHB. SPLV now sports a P/E ratio of 15.4; SPHB a P/E of 11.87 (according to Powershares as of 6/30/2012).

SPY has a P/E of 14.90 (data from spdr.com as of 8/19/2012); and DVY a P/E 16.30 (source: iShares as of 7/31/2012). Clearly the outperformance of SPLV and DVY has come due to the lower drawdowns incurred during July – September of 2011.

This brings me to my current question: Will the “lower risk” holdings offer lower drawdowns in the near future, if they are both already sporting P/E ratios significantly higher than the overall market, as measured by SPY? And with a clear momentum change in leadership since June, could we expect both higher performance and equal or greater drawdown protection from the relatively undervalued SPHB?

While for many investors a simple momentum trade might be in order, the strategy for my portfolio is focused on dividend yield. So while a higher beta trade might appear appropriate, I have to do so while looking for yield for my portfolio. On a broader spectrum, I think this is a valuable question for all income oriented investors that are presumably looking to satisfy the dual objective of lower risk (than the market as a whole) and maintaining yield. So my goal here is to find high dividend (relative to SPY) investments that behave more like SPHB than SPLV.

While my income portfolios usually hold mostly individual stocks, for this trade I am looking at ETF’s and closed-end mutual funds. Whenever I look at a new position I always ask myself, what could go wrong? And if the market does turn against me, I’d at least like to have the theoretical cushion that the diversification would give me.

To start my search, I looked at the top sector holdings for SPHB. After all, if I want to mimic the performance, I need to replicate the holdings as closely as possible, keeping in mind my yield focus. According to PowerShares, the top three sectors held by SPHB are: financials at 36.66%, energy at 21.26%, and IT at 11.65%.

For the financial sector allocation, I found the Power Shares High Yield Financial ETF (KBWD). KBWD has a yield of 9.17% compared to the SPDR S&P Bank ETF (KBE)with a yield of 1.87%. And with an inception date of December 2010, we have a modest track record to look back on.

Not surprisingly, pickings in the technology sector were pretty slim. However, First Trust has a new ETF offering: the First Trust Technology Dividend ETF (TDIV). With an inception date of 8/13/2012, we don’t have much to go on other than the holdings of the underlying index. Based on the holdings’ prior 12 month dividend payments, the new ETF has an indicative yield of 4.65%. Knowing that several holdings have increased their dividend in the past 12 months, I’m assuming that yield will approach 5% over the next 12 months.

In the Energy sector, First Trust came through again, as apparently sector dividend income ETF’s and closed end funds have become one of their niches. Their two offerings are the FT Energy Infrastructure Fund (FIF) and the FT Energy Income and Growth Fund (FEN). An added bonus is that FIF is selling at a 5.97% discount to NAV as of 8/17/2012. Yields for FIF and FEN are 5.91% and 6.53% respectively, according to First Trust.

The second strategy I looked at was to find income oriented ETF’s and closed end funds that have sector weightings similar to SPHB. I came up with four ETF’s and two Closed End Funds (CEF’s). The ETF’s: FT Global Select Dividend (FGD); FT Multi-Asset Diversified Income Index; the Macquarie/FT Global Infrastructure/Utilities Dividend & Income Fund; and the Guggenheim International Multi-Asset Income ETF (HGI). The CEF’s: Advent Claymore Convertible Securities and Income Fund (AVK); and the Advent/Claymore Enhanced Growth & Income Fund (LCM) – which also sells at a 10% discount to NAV (as of 8/17/2012).

This last group adds international stocks, which in general have lagged the U. S. market this year offering another layer of “value”. There is also a heavy emphasis on convertible securities. In theory, if higher beta stocks continue to lead the market it will indicate a healthier economic outlook. This situation typically leads to higher interest rates. Convertibles can add appreciation potential to income holdings even in a rising rate environment. As a whole, these additions also add sector exposure to consumer discretionary sector which is the fourth largest sector in SPHB, but does not have a specific investment vehicle that has income as its main objective.

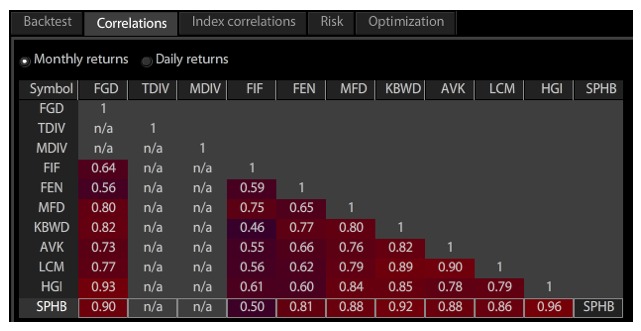

Bottom line to this is how these holdings stack up to SPHB. To answer this question I ran a correlation matrix at Kwanti and reproduced it in Figure 3 below.

Figure 3. Correlation Matrix

Source: www.kwanti.com

The bottom row shows the monthly correlations to SPHB. As mentioned, both TDIV and MDIV are too new to provide data. However, the rest of the data shows promise. With the exception of FIF, all the prospective holdings have a correlation to SPHB of at least 80%.

Using a combination of data from the individual web sites, an equal weighted portfolio of the above holdings (excluding SPHB), has an approximate yield of 6.68%. Since yields are calculated differently (SEC v. Distribution v. Indicative), you’ll need to do your own homework if looking at any of these holdings to add to a portfolio where you are targeting a specific income rate.

Dividend investing has historically been the realm of conservative investors, particularly retirees relying on income. However, the recent outperformance of this sector has led to higher than market average valuations. High valuations could be problematic in either market extreme. Valuations usually revert to below market levels in a large correction, and high valuation but lower growth holdings can be left behind in a rally.

One potential solution is to add higher beta holdings to your portfolio. Since valuations are relatively low based on the S&P High Beta ETF, normally more volatile holdings may offer equal protection in the event of a market selloff. And if the market continues to reward SPHB, high dividend holdings from those sectors could outperform as well.