Author: Patrick McFadden, M2 Global

Author: Patrick McFadden, M2 Global

Covestor model: M2 Global

Central bankers in the euro zone and the U.S. are the focal point of investors — not just economists — this summer.

Secondary market yields on Spanish sovereign 5 year bonds went up 40% in the first three weeks of July, then dropped nearly 20% by July 30, with the spread over comparable German bonds at nearly 575 basis points.

Both the Fed and ECB are using language in the public forum to scare short sellers out of their positions. That tactic has worked so far.

The question is, will that tactic continue to work until a clear election winner emerges in the United States?

The San Francisco Fed has a good piece that lays out the battleground:

Source: Federal Reserve Bank of San Francisco

Figure 1 above shows expected inflation that is at or below the Fed’s target, even though forward rates may indicate some upside bias.

Source: Federal Reserve Bank of San Francisco

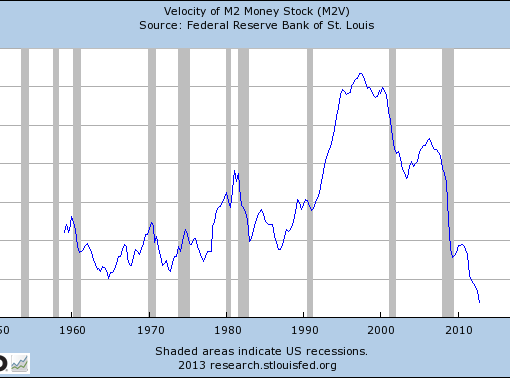

Figures 2 shows how the increase in banking reserves by nearly $1.5 trillion has surprisingly coincided with a severe drop in the velocity of money. Essentially, there is little inflation due to very little lending on a relative basis.

Will the Fed decrease interest rates on reserves and promote more lending or will they continue to target asset purchases?

Clearly the Fed has been biased toward continued leverage reduction for U.S. business and consumers. Rising financial asset prices can be a stimulus without any increase in leverage.

The shorts know the Fed needs a debt ceiling increase in the U.S. in order to continue quantitative easing or asset purchases on a sterilized basis. However, the Fed and the ECB are using language that keeps direct and indirect non-sterilized purchases of stocks and bonds on the table.

Fighting the Fed is a dangerous occupation. Nevertheless, there is an undemocratic quality associated with this type of monetary stewardship, especially since it seemingly favors money-center banks and Fortune 100 companies that can self-finance out of cash flow vs. small LLCs, S-corporations and proprietorships that cannot.

We believe the Fed chairman is cognizant of this and would like to talk the economy into the election without taking additional QE action. That will put the economic ball firmly back in political hands.

Geopolitical and macroeconomic factors may conspire to create market weakness, however, it will take a brave soul to bet on such weakness alone prior to November.