by Michael Tarsala

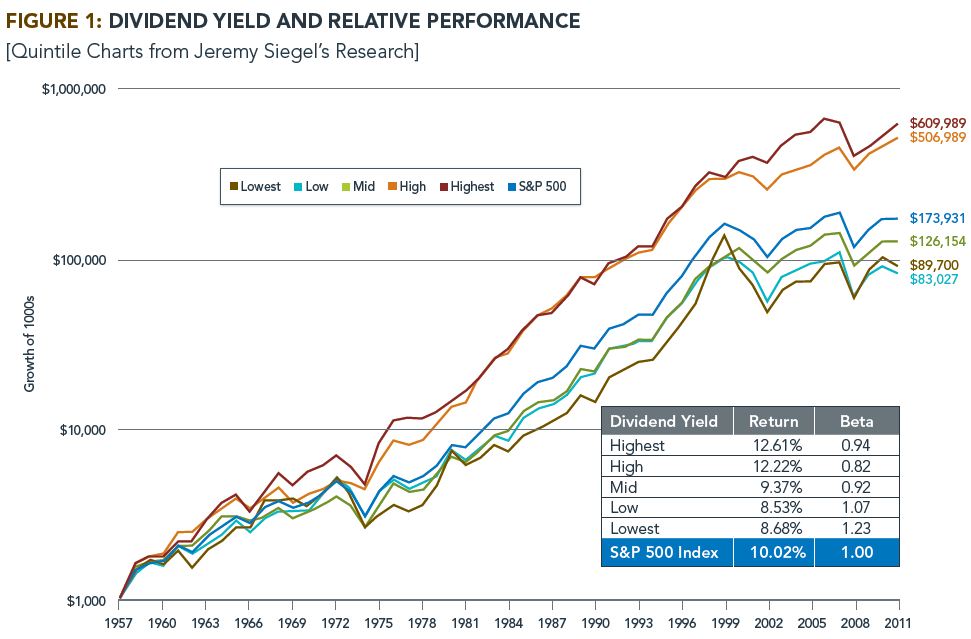

The latest research from the folks at Wisdom Tree makes it pretty clear: Dividend stocks outperform the market and do so with less volatility.

Source: TheReformedBroker.com, WisdomTree

Josh Brown has a great post on this. But the upshot is that dividend payers outperformed the S&P 500 by more than 2 points a year, on average, in the WidsomTree study. And those 2 extra points a year was more than 3x outperformance for the highest dividend payers over 55 years. Not only that, the dividend-payers had lower volatility, or beta, than the market.

This work backs up an earlier study by O’Shaughnessy Asset Management that suggests there’s a performance advantage to buying dividend-paying stocks over time among large-cap stocks, all U.S. stocks, and two different baskets of global stocks. Sharpe ratios were lower for the dividend stocks, too, reflecting a greater reward relative to the risk.

Dividend stocks are no panacea, of course. Asset bubbles can develop in those names, the same way they can in pretty much any asset class.

Yet the latest from the WSJ argues that a dividend bubble has yet to build.

At Covestor, we offer four different models that are geared toward dividend stocks, including one from Bill DeShurko that he says is invested only in stocks with lower volatility than the overall market right now.

Call us if you would like to know more about dividend investing, or managers or any of our models.