by Michael Tarsala, CMT

Ever watch a stock in your portfolio sell off on a good earnings report and guidance?

It happens. It’s not a reason to panic. And it’s one reason an active manager who knows the stock well and understands the psychology can take precautionary positions ahead of time when he or she sees this kind of thing coming.

Let’s take Coach’s (COH) Q1 report as an example.

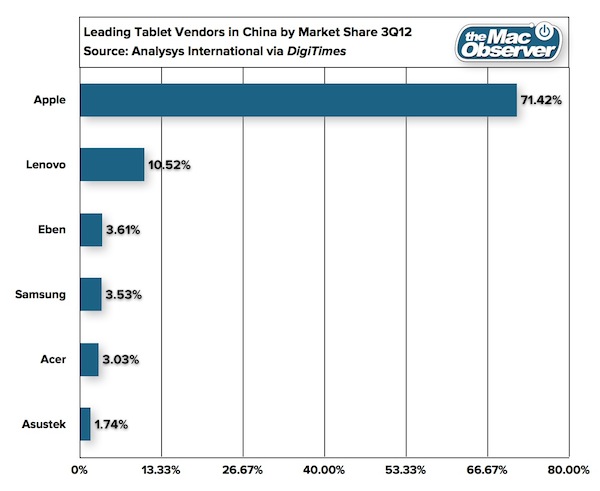

On its face, the retailer posted a very strong report. By most accounts, it remains a strong growth story, driven by a long-term growth story in China. Earnings rose 21% from the year-earlier period. The company posted higher margins across the board. It beat EPS expectations by 2 cents a share, and even raised its dividend.

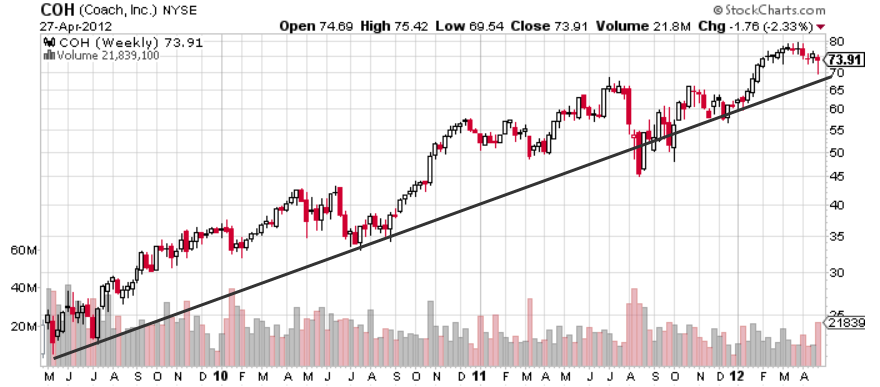

Yet Coach saw more than a 6% intraday drop following its report. It looked like this:

Source: Stockcharts.com

Instead of focusing on the positive, Coach holders were concerned with a slight shortfall in its U.S. same-store sales. Some took profits, which led to a negative head-and-shoulders pattern breakdown.

So why this heavy on the same-store sales?

Because expectations were for pretty much flawless results — and that still might not have been enough to keep shares moving higher without at least a breather.

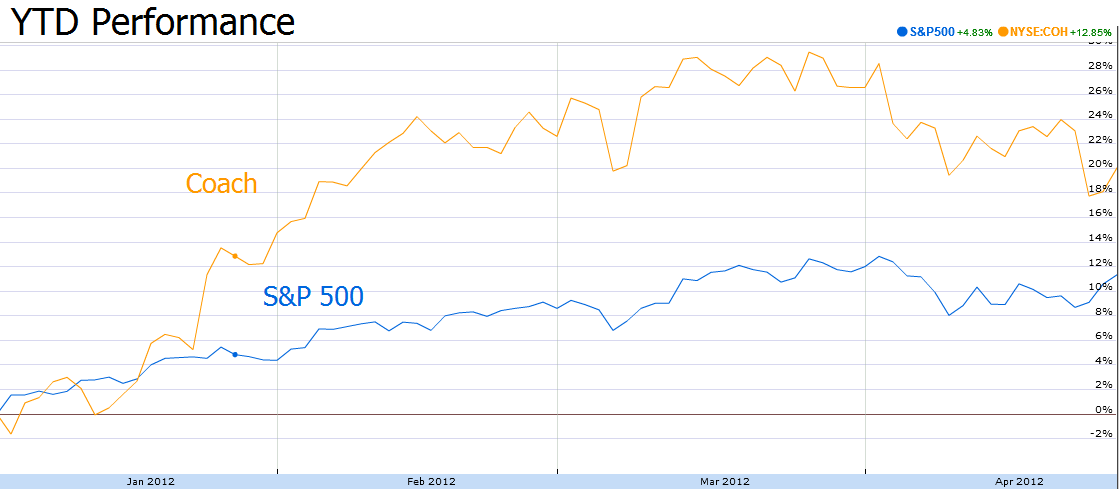

Source: Google Finance

As of last week, Coach shares had risen more than 70% since the October lows. Its performance roughly doubled that of its peers in the Retail Sector HOLDRs ETF (RTH), and it’s also doubled up on the S&P 500 so far this year. Because of that run, it really was expected to hit on every cylinder.

Valuation also plays a role. Coach is certainly not grossly overvalued, and some would say it’s not overvalued at all. However, it does trade at a forward P/E premium versus other upscale retailers including Tiffany & Co. It’s one more factor that keeps overall expectations high.

There are a few lessons I think that the Coach selloff after earnings can provide:

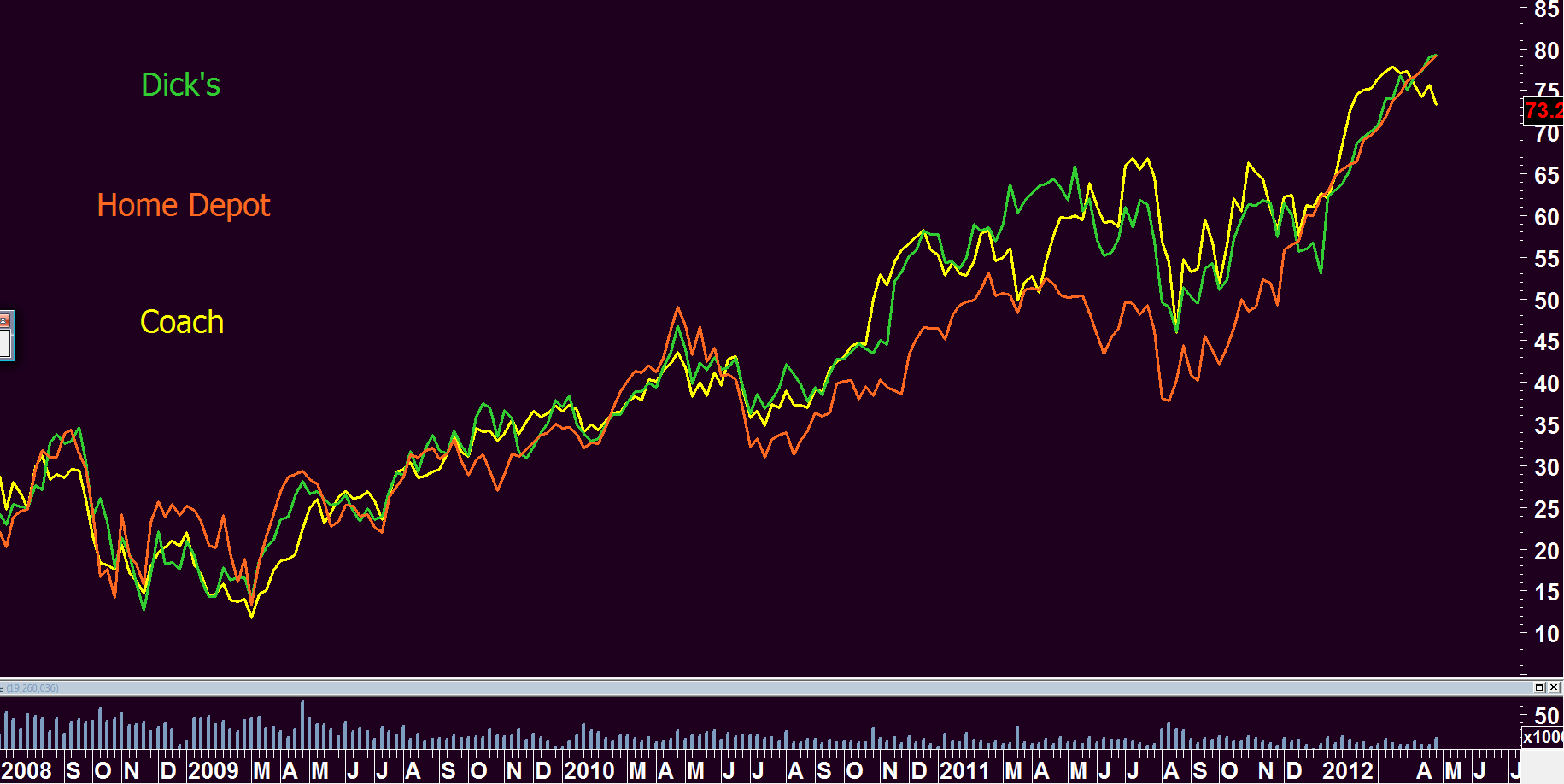

1) Similar scenarios happen often in the markets, and may happen again in Q1, for that matter. Keep an eye on Dick’s Sporting Goods (DKS) and Home Depot (HD). They are other highly regarded retailers that have had a big run that may also need to execute their reports almost flawlessly to keep moving higher after earnings. Each has a correlation coefficient of 0.97 relative to Coach. They had moved pretty much in tandem since late 2008. So the fact that Coach is now moving differently than those peers is of interest.

Source: MetaStock

2) An earnings selloff for a strong stock can be just a wrinkle in a long-term growth story. As an investor, keep a long-term perspective. In Coach’s case, the long-term cross-trendline for the stock remains intact. The daily pattern suggests that it could be tested in coming weeks, sure. But it remains in its long-term uptrend.

Source: Stockcharts.com

3) There are arguments for and against active management. We at Covestor are in the active camp. And I, for one, see this kind of research and attention to detail as important, and something you might not be getting in a passive strategy that relies on ETFs.