By Xavier Bremner

Paddy Hirsch at American Public Media’s Marketplace notes in a new Whiteboard video that four years after the U.S. financial crisis America’s shadow banking system is as big and potentially risky as ever.

Fed Chairman Ben Bernanke recently argued that unsupervised financial transactions and entities (special purpose vehicles, derivatives trading, nonbank mortgage origination companies and so on) that fell outside of the reach of regulatory authorities were the true cause of the financial crisis.

While the government has moved to set up mandatory clearing and exchange trading of derivatives, much work remains, according to Hirsch.

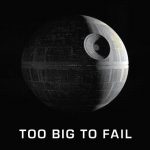

Yet here’s the thing: There is also still plenty of systemic risk on the regulated, more visible side of the U.S. banking system. According to a recent report (.pdf) by the Federal Reserve Bank of Dallas, the assets of the country’s top 5 Wall Street banks represent about 50% of U.S. gross domestic product. At the end of 2011, JPMorgan Chase (JPM), Bank of America (BAC), Citigroup (C), Wells Fargo (WFC) and Goldman Sachs (GS) held more than $8.5 trillion in assets.

That’s up from 43 percent five years earlier. Too big to fail lives on.