by Michael Tarsala, CMT

As we get closer to the 6-month “sell in May and go away” period when market gains are historically harder to come by, let’s take a snapshot, then review some bullish and bearish arguments.

First, the basic facts:

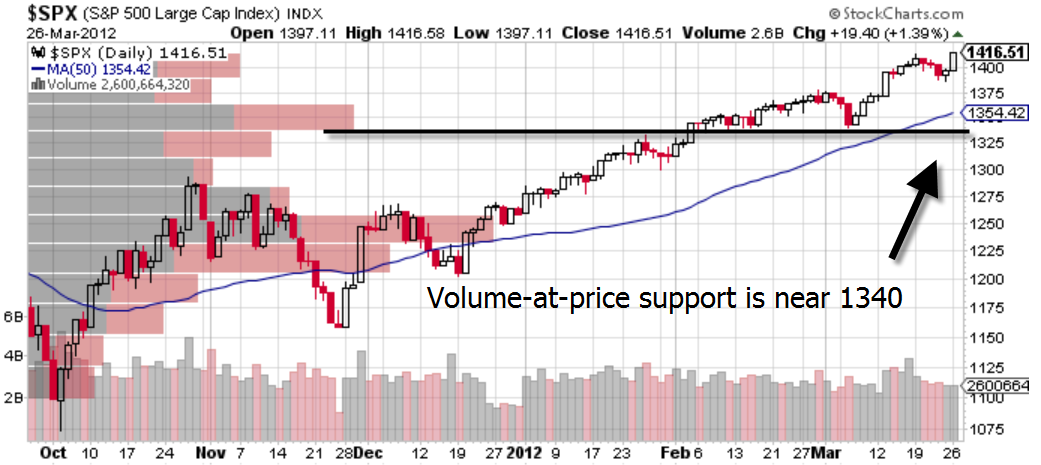

Source: Stockcharts.com

The market has now rallied nearly 30% from the October 2011 lows. It remains in a strong uptrend as long as the S&P 500 can hold major support near the 1340 area. That corresponds with the March lows, as well as the volume-at-price bars to the left of the chart. Those bars simply show where the biggest volume of trading has been conducted. A slip below volume-at-price supports can set the stage for declines.

The bullish arguments are that strong Q1s in the past continued to post gains, a recently overbought condition has been worked off, and bearish hedge funds have been forced to capitulate and buy.

1) “A gauge of hedge-fund bullishness measuring the proportion of bets that shares will rise climbed to 48.6 last week from 42 at the end of November 2011, the biggest increase since April 2010, according to data compiled by the International Strategy & Investment Group.” — Bloomberg.com

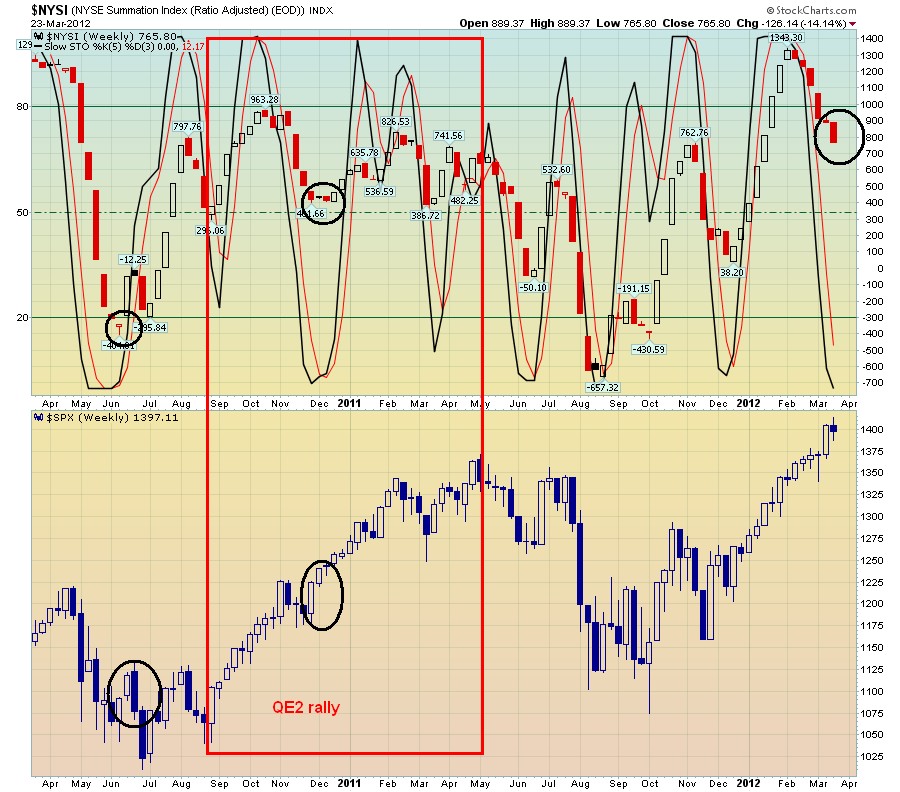

2) “The chart below shows the weekly NYSE Summation Index, which is a breadth indicator, which I have overlaid a slow stochastic, an overbought/oversold indicator. If past history is any guide, stocks are tactically oversold and likely to rally in the next couple of weeks.” — Humble Student of the Markets

Source: Humble Student of the Markets

3) “In the past three months, the S&P index is up 12 percent. Since 1950, there have been 13 other instances when the S&P benchmark rose more than 8 percent in the first quarter. And in each of those times, the index never finished the year with a loss. In fact, in 12 of those 13 occasions (with the exception of the market crash in 1987), the S&P continued to build upon a strong Q1 gain over the rest of the year.” — Giovanny Moreano, CNBC.com

The bearish arguments are that hedging activity has increased, continued gains are coming on paltry volume and the wrong sectors may be leading at this point.

1) “The latest week hedgers were net short ~$9.6 billion of the NASDAQ 100, which is an all-time record. While hedgers are not always right, history does show that markets tend to have a difficult time rallying when professional hedgers are this bearish.” — Jeffrey Saut, strategist, Raymond James

2) “The S&P 500 chalked up 11 weeks in a row without printing a down week. The only time that has even come close to happening over the past 20 years was January to April 1998 at the launch of the dot-com bubble. But that was only 10 weeks. The market has gotten every miracle it asked for. Even on exceedingly low volume, miraculous money has appeared just when the market starts to dive.”– David Gillie, ETF Digest via TheStreet.com

3) “In comparing price ratios for each of the nine largest sector ETFs on March 20, only two can be said to be gaining in relative strength: Technology and financials… Since the 2008 meltdown, leadership from the financial stock arena often marked the beginning of painful corrections.” — ETF Expert via TheStreet.com