Covestor model: Technical Swing

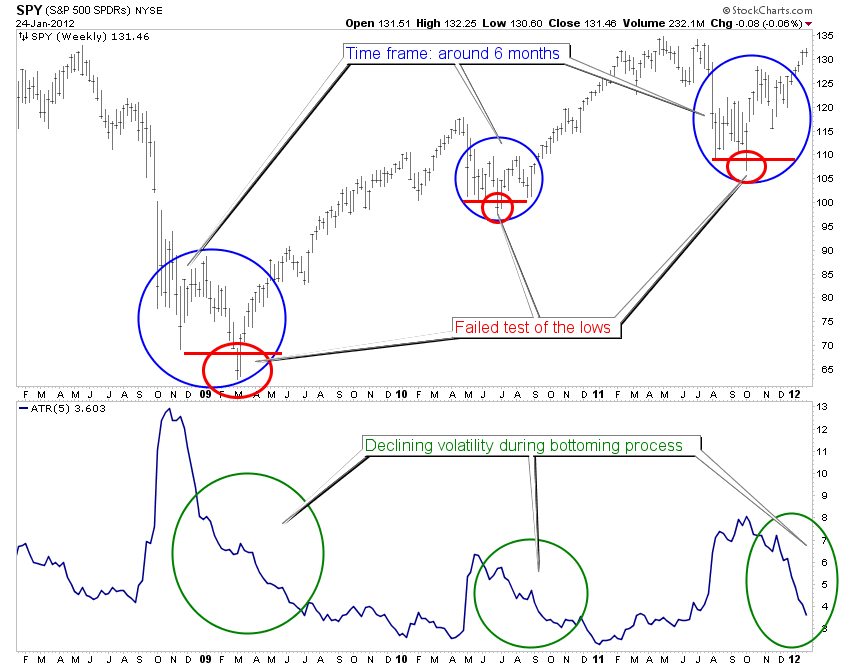

Looking at the last three stock market bottoms – including the most recent one- it feels like Mark Twain was wrong when he said: “History doesn’t repeat itself, but it does rhyme.” Repetition of this pattern is simply amazing – click to enlarge:

Source: StockCharts.com

There are three characteristics which played out almost the exact same way:

1) Duration – the entire process took around six months.

2) Failed test of the initial low, which also market the start of the rally.

3) Declining volatility during the entire process.

The chart above also shows very nicely how volatility has been clustered in recent years. Volatility clustering is a known phenomenon/market inefficiency and I’m tempted to incorporate that into my trading (shorting the VIX at cluster peek? Needs more research/work before I’ll implement it).

By the way, I didn’t play this structure well when it first occurred in 2009, which was the only year where my Covestor Model Portfolio underperformed the S&P 500. However, in 2010 and 2011 I got much more aggressive on the long side when this pattern showed up, which is one of the reasons why the portfolio is up about six percent in 2012 so far.