Author: Cheng Yuan

Author: Cheng Yuan

Covestor model: Value with Catalyst

Disclosures: Long RDI, ENZN

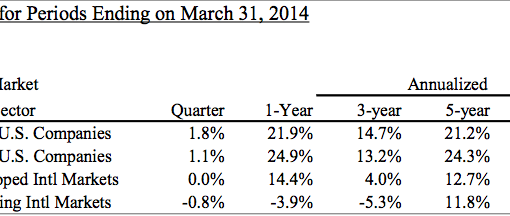

The model portfolio continued its recent horrid performance in the month of July, down 2.27% while the benchmark Russell 3000 was down 2.39% and the S&P 500 dropped 2.15%.

The biggest losers were Reading International and Enzon Pharmaceuticals. The theses behind both holdings have not changed. I have written at length about both holdings – here’s my recent writeup on Reading and on Enzon.

Holding nearly 30% of the portfolio in cash while watching the portfolio lose almost 9% in a period of three months (5-7/11) is excruciating. Such a drastic change in market valuation necessarily prompts an immediate re-examination of both one’s investment theses and the sanity of one’s mind. Fortunately, I believe one of the two still holds true. The other demands a sane mind to make that call.

Sources:

“Reading International’s underappreciated value” Covestor Blog. https://investing.interactiveadvisors.com/?p=9636

“Enzon Pharmaceuticals: Plenty of cash and a promising royalty stream” Covestor Blog. https://investing.interactiveadvisors.com/?p=10619