Author: Michael Arold

Author: Michael Arold

Covestor model: Technical Swing

Disclosures: None

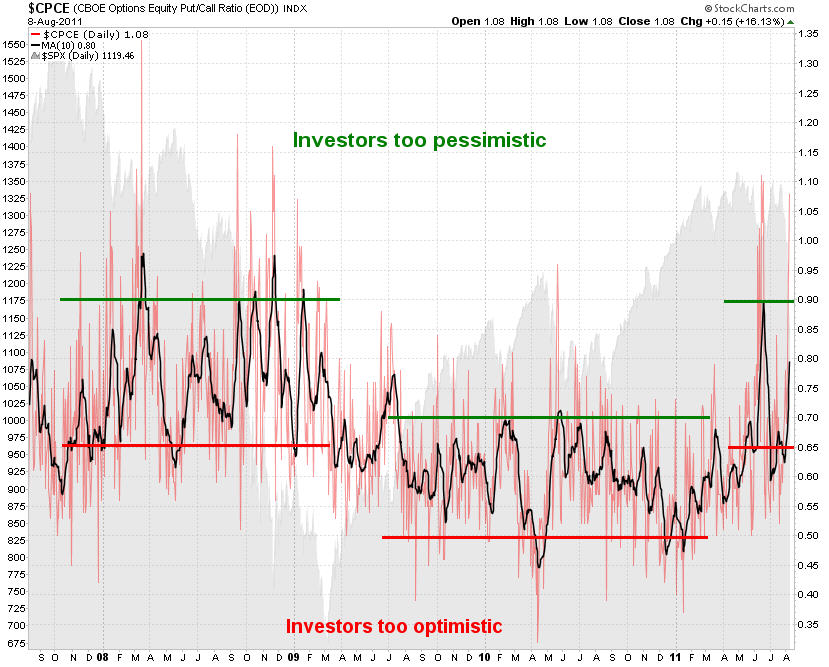

It sounds obvious in the light of recent stock market declines, but bearishness is finally showing up in the sentiment indicators I am following. That was different at the beginning of August. The equity put/call ratio is now moving into “panic territory”, which is good news.

Only caveat: I haven’t gone long yet because the ratio has now entered bear market domain. Basically, this means that whatever is considered oversold in a bull market doesn’t mean oversold in a bear market. In 2008/09 the 10 day moving average of the ratio could easily move above 0.9 before a short-term price reversal occurred. As of 8/8, the reading was at 0.8:

Sources:

CBOE Options Equity Put/Call Ratio Chart as of 8/8 from StockCharts.com