Author: Tarquin Coe

Author: Tarquin Coe

Covestor model: Market Timing Technicals

Disclosure: None

Our view for equities remains bullish and we plan to review this once the S&P 500 has visited 1381.5 (a Fibonacci 78.6% retracement of the bear market). Should trading stall at that level, coupled to a tired indicator action and excessive sentiment, we will likely commence a defensive rotation.

A number of trades in the portfolio, such as the Transports ETF (NYSE: IYT) were a play on anticipated crude oil weakness.

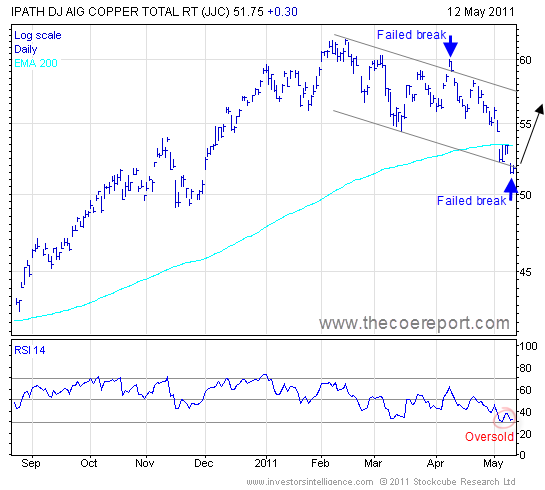

However, regarding the sell-off in commodities, the worst looks to be over. This is evident from the chart for the iPath Copper (NYSE: JJC) ETF, one of the leaders in recent months (in both directions):

Source: Tarquin Coe, Stockcube plc; source data from Bloomberg

As of May 12, that index is now oversold, with the 14-day RSI down to its lowest level in twelve months. Trading is also finding some magnetism around the 200-day exponential moving average (EMA) as well as support from the bottom of a counter-trend channel.

Overall, the technicals for JJC suggest an imminent reassertion of the primary uptrend and in doing so it would provide confirmation that the “risk-on” trade was back on.

Our bullish view will be updated should conditions change.