Author: Tom Konrad

Author: Tom Konrad

Model: Alt Energy Stocks

Disclosure: Long 7 clean energy stocks

Bubbles are a social phenomenon at least as much as they are a financial phenomenon. What characterizes them?

- At the top of bubbles, participants ignore glaringly obvious risks. In October 2007, Meredith Whitney pointed out the almost glaringly obvious fact that Citigroup was paying out more in dividends than it was earning in profits (i.e. it was being run like the US government, but without a friendly Federal Reserve to bail it out by printing money.) She said that Citigroup would need either to raise capital, sell assets or slash its dividend — possibly all three. That’s what happens when you spend more than you earn, yet other Wall Street analysts were dismissive of “the easiest call [she] ever made” (as she called it.)

- Critics are ostracized. Remember how Warren Buffett was ridiculed because he did not “get” the Internet? This allows the “in” crowd to ignore warnings from those not caught up in the mania. During the housing bubble, if you told someone you were a renter, not a homeowner, you were greeted with looks of puzzlement and/or pity. If you went on to explain that you thought the rental yield on homes was much too low to justify valuations, people would start to look around for the men in white suits to take you away. (I know this from personal experience.)

- Participants enjoy financial success far beyond what their skills or efforts should reasonably justify. That financial success imbues bubble participants with an aura of infallibility. We tend to think “He made a lot of money in real estate/internet stocks/tulip bulbs, so he must be a smart person, and I should be doing what he is doing.” Think of all the people who grew rich (and full of themselves) flipping houses during the mid-2000’s. And then think of the even greater number of people who emulated them, only to get into the housing market in 2007, right before it started heading down.

- “This time it’s different.” The internal logic of the bubble creates its own reality. People don’t question when a single tulip bulb costs as much as a middle-class home, or when a strawberry picker earning $15,000 a year can get a loan to buy a $750,000 home.

Alan Greenspan was wrong. It’s not impossible to spot bubbles before they burst. What’s hard is going against the consensus, when everyone around you is ignoring the risk that should be obvious, causing you to question your own reasoning; when they are making money hand over fist for seemingly no effort, telling you they’ve found a “new truth” and ridiculing you if you don’t agree, that’s when you’ve spotted a bubble.

Energy

I introduced this article by saying bubbles are a social phenomenon. As a social phenomenon, they don’t have to be financial: The same dynamics of group behavior can also lead to bubbles that don’t necessarily manifest themselves in asset prices, but they’re still real, and they still bear the very real risks of financial bubbles.

I believe we’re in just such a bubble now. To me, it’s glaringly obvious. Like Meredith Whitney said about her Citigroup call, it’s the easiest call I ever made:

We can’t keep using traditional energy sources and expect the economy to grow forever.

In other words, our society and economy are built on an energy bubble. Oil powers our transportation system, and coal, natural gas, and nuclear power our electrical infrastructure. All of the signs outlined above are there.

Ignoring risks

How many nuclear disasters like the ongoing one in Japan, and the earlier ones at Chernobyl and Three Mile Island will it take us to realize that nuclear generated electricity is picking up quarters in front of a steam roller? Yes, the risks of nuclear failures are absurdly low, but the consequences of such failures are absurdly high, and the pools of spent fuel that we still have not agreed on a permanent home for aretempting targets for any ambitious terrorist.

Why do the people who are trying to convince us that shale gas extraction is safe spend so much time talking about the economic benefits? Isn’t that a lot like someone trying to sell you a tranche of a highly rated MBS in 2007 saying “sure, it’s safe, the yield is 100 bps higher than any other security with a triple-A rating from S&P?” Shale gas fracking has only been going on commercially for five years. Perhaps it is safe, when done properly, but why, exactly, do we expect it to always be done properly? Before putting our faith in environmental regulators to ensure that shale gas extraction is done properly, we should consider the plight of the financial regulators overseeing mortgage backed securities in the last financial crisis.

And then there is Climate Change. We know that burning fossil fuels emits CO2. We know that CO2 levels are rising rapidly. We know that we’re burning a lot of fossil fuels. We have known since the 19th century that CO2 traps heat in the atmosphere. We know that so much Arctic sea ice is melting that countries are squabbling over newly accessible Arctic oil and natural gas reserves. Yet the number of Americans worried about Climate Change is falling, and not a single Republican on the House Energy Committee will say that Climate Change is real.

Critics are Ostracized

I don’t believe that each of the 31 Republicans on the House Energy committee necessarily thinks that Climate Change isn’t happening. They are not stupid, they simply are all politicians, and if being ostracized and forced out of the “in” group is dangerous in any profession, it’s dangerous in politics. Politicians know which way the wind blows, and this level of consensus in the face of basic science is one of the surest signs of the bubble mentality.

Participants enjoy financial success beyond what their skills and effort merit.

The US consumes about 22 percent of world oil production, so we’re certainly participants in the bubble. We have the highest living standards in history, higher than any other country. Yet are we smarter than our grandparents, or our immigrant ancestors who came from all over the world? Do we work harder than an Asian laborer in a factory doing 12 hour shifts seven days a week in order to send a little money back to his family? If you resent the implications of those questions, you now have a visceral understanding of how hard it is to escape the bubble mentality when you are already caught up in it. When you’re making money or enjoying cheap energy today, it’s very hard to look at the long term costs of your actions. This is the same reason that the United States has so much trouble getting our deficit under control. We all want the US to live within its means, but support vanishes when it comes tocutting Social Security, Medicare, or Defense Spending.

“This time it’s different”

Whether you believe the oil and other fossil fuels in the ground got there over millions of years of heat and pressure on organic matter, or were put there by God during creation, there is only so much of it in the ground to extract.

We started extracting the easiest, most accessible reserves, and now the only easy oil that’s left is in the unstable Middle East. In the rest of the world, we’re left with drilling in increasingly difficult and risky situations, such as deep water (as theDeepwater Horizon oil spill and the consequences for BP’s stock price demonstrated, .) The rising price also reflects the lack of oil prospects that are cheap and easy to extract. Yet the discussion about what to do about rising oil prices revolves around “how can we drill for more oil?” not “how can we use less oil?” Richard Nixon promised in 1977 that “gasoline will never exceed $1.00 a gallon” and the United States has been striving for Energy Independence ever since. It has not worked: in 2005 we imported twice as much oil as we produced.

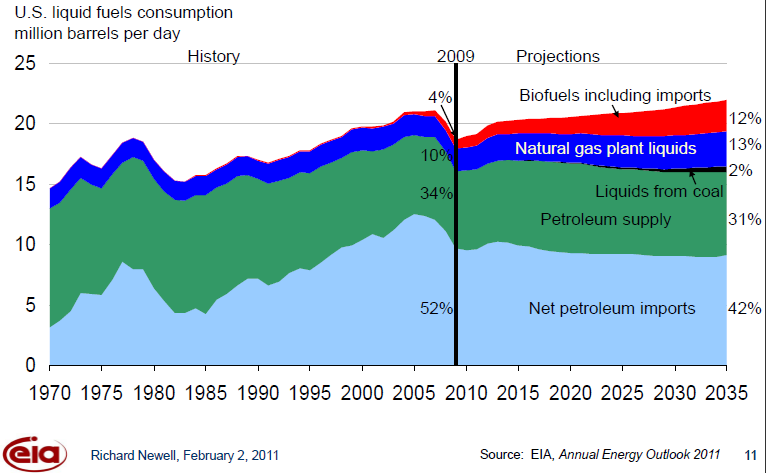

The progress towards energy independence we’ve made since 2005 is almost entirely due to reduced consumption (see chart.) Despite over three decades of effort to increase domestic oil production, production has declined. Nevertheless, if you listen to the popular debate, the implication is still that the secret to energy independence is trying harder. Trying harder is not going to more than double our oil output when we’ve been trying harder for over three decades and we’re now producing less than we did in 1970.

What to Do About It

During the 2007 Housing Bubble, the smart investors were buying credit default swaps (CDS) on mortgage backed securities. During the Internet bubble, they were scooping up REITs yielding 15% or more.

I’m a stock guy, and I didn’t (to my regret) buy any CDS’s in the last bubble, but I was one of those buying REITs in 1999 and 2000. This time around, I’m buying Green Stocks: Renewable Energy, Energy Efficiency, Efficient and Alternative Transport companies that will be selling the services that help us shift away from traditional energy sources like oil, coal, natural gas, and nuclear. But like most bubbles, it’s a lot easier to see the Energy Bubble happening than it is to predict when it will burst. Hence, it’s important to buy the stocks of companies that can survive (or even thrive) in the current environment, yet still benefit from the end of the current Energy paradigm.

Just buying green stocks is not going to allow our Energy Bubble to deflate safely, but it should cushion the fall for those of us who do, and we’ll also have the comfort of knowing that the companies we invest in are doing just a little to build the beginnings of a post-bubble energy infrastructure.

This article was first published on Forbes.com Green Stocks blog.

Sources:

“The Rise and Rise of Analyst Meredith Whitney: Michael Lewis” Michael Lewis. Bloomberg, 4/9/08. https://www.bloomberg.com/apps/news?pid=newsarchive&sid=aSApdA59SFok

“The Big Short: Inside the Doomsday Machine by Michael Lewis” John Arlidge. The Sunday Times, 3/21/10. http://entertainment.timesonline.co.uk/tol/arts_and_entertainment/books/non-fiction/article7067955.ece

“Greenspan Admits ‘Flaw’ to Congress, Predicts More Economic Problems” Jim Lehrer. PBS Newshour, 10/23/08. http://www.pbs.org/newshour/bb/business/july-dec08/crisishearing_10-23.html

“Spent Fuel Stored in Pools at Some U.S. Nuclear Power Plants Potentially at Risk From Terrorist Attacks; Prompt Measures Needed to Reduce Vulnerabilities” William Skane. National Academy of Sciences. 4/6/05. http://www8.nationalacademies.org/onpinews/newsitem.aspx?RecordID=11263

“Shale Gas Exploration Company In Quebec Campaign Ensure Safe Drilling Process” Mining Exploration News. 9/6/10. http://paguntaka.org/2010/09/06/shale-gas-exploration-company-in-quebec-campaign-ensure-safe-drilling-process/

“Water Contamination Studies” Samantha Malone. FracTracker, 9/23/10. http://www.fractracker.org/2010/09/water-well-contamination-studies.html

“Carbon Dioxide Levels Rising Much Faster Than Expected” Lewis Smith. The Times. 10/24/07. http://www.foxnews.com/story/0,2933,304272,00.html

“Arctic Oil Rush Sparks Battles Over Seafloor” Richard Lovett. National Geographic. 8/23/07. http://news.nationalgeographic.com/news/2007/08/070823-arctic-oil.html

“Fewer Americans worry about climate change: poll” PhysOrg. 3/14/11. http://www.physorg.com/news/2011-03-americans-climate-poll.html

“Every Single GOPer On House Energy Cmte Won’t Say Climate Change Is Real” Evan McMorris-Santoro. TalkingPointsMemo. 3/15/11. http://tpmdc.talkingpointsmemo.com/2011/03/every-single-goper-on-house-energy-cmte-wont-say-climate-change-is-real.php

“Demand” US EIA. http://www.eia.doe.gov/pub/oil_gas/petroleum/analysis_publications/oil_market_basics/demand_text.htm

“US Deficit Panel Official: Congress Must Tackle All Entitlements” Wall Street Journal, 3/8/11. http://online.wsj.com/article/BT-CO-20110308-710944.html