Author: Jerry Gehman

Author: Jerry Gehman

Covestor model: Undervalued Growth Companies

Disclosure: Long FNSR

The stocks in my portfolio got hammered in March, but I believe current prices provide an excellent buying opportunity.

Some issues that caused these declines are:

(1) Small cap stocks were over-valued because of early 2011 price increases.

(2) Japan’s tragedy raised concerns for worldwide personal safety and also created uncertainty in the supply channels of many companies.

(3) National conflicts increased concerns about political stability and oil supplies.

(4) The timing of the Chinese New Year slowed comparable sales numbers.

(5) In semiconductors, some customers worked off excess inventory.

None of these factors should cause long term disruptions to the profitability and success of my investments. For the month of March 2011, the portfolio lost a bit over 15%. As of end of day 3/31/11, the portfolio is up over 8% since its inception in Oct 12, 2010.

I think my portfolio remains compelling. Exterior events – not events that affect each company specifically – caused stock prices to tumble. I think profits and future projections will cause the portfolio to move to levels even higher than in the past.

Missed trading opportunity, but I am not unhappy

My portfolio strategy is to sell stocks when they go too high in price, but I did not sell Finisar (Nasdaq: FNSR) stock.

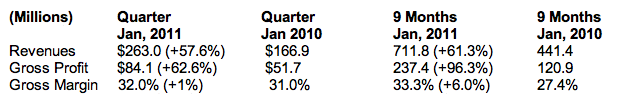

Finisar had a strong run from late October 2010 to mid February 2011. Then, on March 9, Finisar reported a 62.6% increase in gross profits, but projected reduced sales for the next quarter. The stock dropped from around $40 at close on March 8, to under $25 at the close on March 9, and to a low around $21 on March 18. (Source: Yahoo Finance)

Normally, I would have started scaling out of Finisar at higher prices, but Finisar has made tremendous progress in reducing expenses and the demand for their optical networking gear is growing because of the extreme growth in internet traffic. Finisar is known for their conservative projections. I expect even higher prices in the future.

See numbers below from Finisar’s March 9, 2011 report (Source: Yahoo Finance):

At times, I just accept volatility such as this as the price of being in the business.