Author: Robert Gay, GEARS Model: Earnings Surprise Disclosure: Long ENER I created the Earnings Surprise Model to exploit the earnings surprise pattern in fundamental data. The components of the surprise pattern are rising sales growth, higher gross profit margins, high and falling SG&A expenses, lower financing costs and positive and […]

Monthly Archives: March 2011

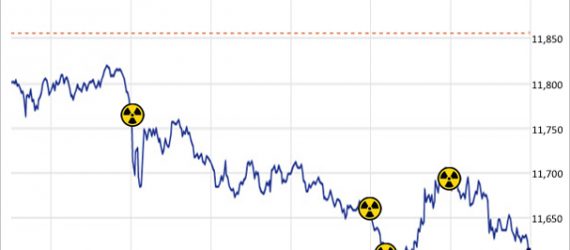

The Dow Jones Industrial Average (DIA) tracks 30 large well known American companies. Clusterstock released a chart showing how the Dow reacted Wednesday to nuclear headlines – details on each headline here: Source: “Chart of the Day: The Dow Makes Huge Swings on Every Fukushima Headline” Gregory White. Business Insider, 3/16/11. https://www.businessinsider.com/chart-of-the-day-dow-march-16-2011-3

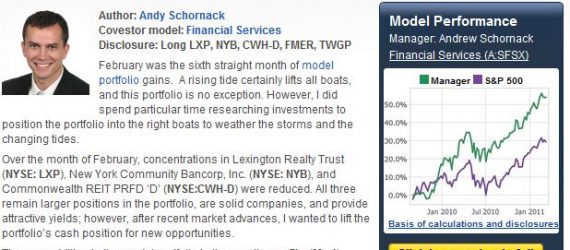

Welcome to the new Covestor blog! We’re doing a number of things here to augment our main site, but there are three elements I want to point out that I think constitute an evolutionary step forward for free market commentary: our managers’ commentary is always accompanied by a verified track […]

Visa (NYSE: V) announced a new service today that allows someone who holds a Visa account to receive and send funds to any other Visa account holder. From the press release: Bank customers of participating financial institutions will have the option to select a Visa account as the destination for […]

Author: Robert Gay, GEARS Model: Speedboat Disclosure: Long LYTS The Speedboat model is financially leveraged as a matter of policy. This characteristic can produce a higher degree of performance volatility, but is designed to contribute to superior returns over time. This return pattern is evident in the performance chart above. […]

Author: Andrew Laubie Covestor model: Russell 2000 Long-Short Disclosure: Long TWM, SRTY The Russell 2000 Long-Short model has suffered through the market rally since November 2010, but we opened the month of March with strong performance on March 1 thanks to the leveraged short ETFs (TWM) (SRTY) in the portfolio. The […]

Craigmillar Energy Fund seeks to take advantage of the global energy sector’s trend toward decarbonization by investing in alternative energy companies. One of its holdings is the Market Vectors Nuclear Energy ETF (NLR). Given the turmoil in the nuclear energy industry following the Japanese earthquake and tsunami, I asked Craigmillar portfolio […]

Author: James Hofman Covestor model: Dividend Growth Disclosure: Long NOK, FTR, ENP,MRK, HCBK, LO *See important disclosures My dividend value model is a long-term focused portfolio that emphasizes both income and valuation. I look to take advantage of opportunities that arise from companies and sectors temporally falling out of favor. Once the […]

For Capital Ideas’ Macro Plus Income portfolio, the portfolio manager seeks securities suitable for income reinvestment before retirement. The model averages around 16 trades per month and its current top holdings include the SPDR S&P MidCap 400 ETF (MDY), Baltic Trading (BALT) and the SPDR S&P Semiconductor ETF (XSD) (as of […]

Author: Bristlecone Value Partners Covestor model: Large Cap Value Disclosure: Long DELL, XOM, VMC, APOL, PFE, CSCO, WMT, NRG, CX, S, EOG, MXIM *See important disclosures In February, the portfolio roughly matched January’s return, rising approximately 3% again, slightly lower than the S&P 500’s return for the month. Year-to-date as […]

Author: Robert Freedland Covestor model: Healthcare Disclosure: Long ISRG, BAX *See important disclosures During the month of February, 2011, the Healthcare model had a decent month, but slightly underperformed the S&P 500. I continued to fine tune the holdings of the Healthcare model and made a few changes into what I […]

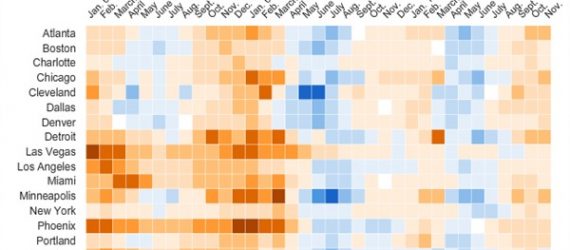

Barry Ritholtz posted this great infographic showing the month to month price changes in the price of houses using the cities that comprise the Case-Shiller Home Price Index. Source: “Housing Heat Map” Barry Ritholtz, 3/9/11. http://www.ritholtz.com/blog/2011/03/housing-heat-map/