Hengfu Hsu, founder of Analytic Investment, has multiple models on Covestor. One of its newest is the Deep Value model. In this model, the goal is to buy stocks priced at a deep value with low P/E ratios and high dividends. The model generally holds 100 stocks.

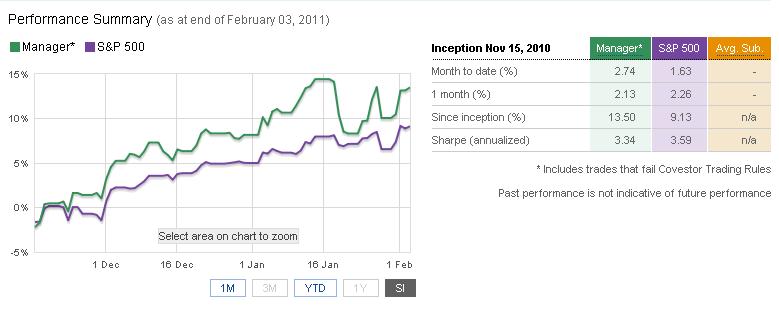

The model’s inception date was November 15th and in December (as you can see from the chart above) it beat the S&P 500. But Analytic Investment isn’t yet celebrating this fact. In his January 2011 Covestor Monthly Investment Report, Hsu says this about his December results:

Despite the S&P 500’s huge December rally, five of our seven models still managed to outperform this index in December. However, we want to de-emphasize the monthly performance data since the market tends to be irrational in the short term. We only focus on the investment disciplines of buying undervalued stocks and selling overvalued positions consistently through both good times as well as bad times, which is the key to long-term investment success.

The top holding in the model is American Axle & Manufacturing Holdings (NYSE: AXL). In January, rumors that Magna International had plans to make a cash bid for AXL prompted the stock price to rise almost 9 percent from $13.99 on January 7th to $15.23 on January 10th. Since then the price of the stock has dropped, closing at $14.49 on February 4th.

*Prices courtesy of Yahoo Finance.