In 1936, economist John Maynard Keynes likened investor behavior in the stock market to a beauty contest gone awry:

It is not a case of choosing those [faces] that, to the best of one’s judgment, are really the prettiest, nor even those that average opinion genuinely thinks the prettiest. We have reached the third degree where we devote our intelligences to anticipating what average opinion expects the average opinion to be.

The team at NPR’s Planet Money tested out Keynes’ idea with a novel experiment:

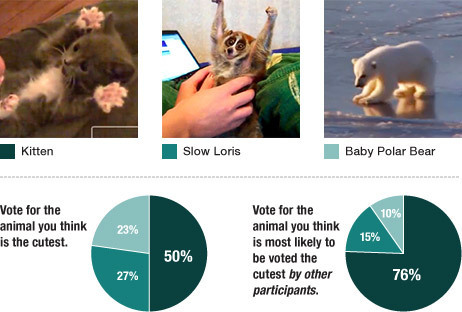

Instead of photos of people, we used videos of cute animals. About 12,000 people participated. When they came to our experiment page, they saw three videos that showed a kitten, a slow loris and a baby polar bear.

Half the people in the experiment were asked to pick the animal they genuinely thought was the cutest. And half were asked to pick the animal they thought everyone else would find the cutest. Here are the results:

The discrepancy between the kitten results shows how a market can get out of whack from individual rational assessment:

It might look something like the housing bubble. People kept buying houses — not necessarily because they thought home prices made sense, but because they thought everyone else would keep buying houses at any price.

This does however leave us wondering: To what extent was the second group influenced by the proliferation of cute kitten websites?