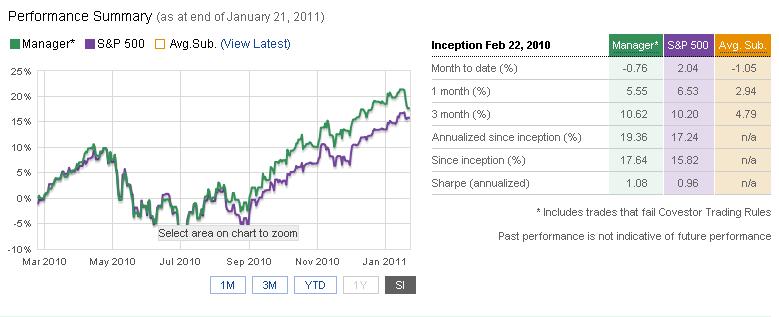

John Ballard uses a long-term buy and hold strategy in his Mid-Cap Fundamentals model. A buy and hold strategy generally results in fewer instances of short-term capital gains tax penalties. But because little attention is paid to the short-term price movements of the equities in a buy and hold model, companies that are likely to be profitable and growing over the long haul tend be chosen for the model. In addition, the companies must have the potential for additional stock price growth so that there can be profit at the end of the hold period.

John Ballard uses a long-term buy and hold strategy in his Mid-Cap Fundamentals model. A buy and hold strategy generally results in fewer instances of short-term capital gains tax penalties. But because little attention is paid to the short-term price movements of the equities in a buy and hold model, companies that are likely to be profitable and growing over the long haul tend be chosen for the model. In addition, the companies must have the potential for additional stock price growth so that there can be profit at the end of the hold period.

Last week, Ballard added to his Apple (NASDAQ: AAPL) holdings. As we discussed in our blog post last week, AAPL has an uncanny track record of dipping when Steve Jobs’ announces some negative news about his health, or when rumors abound about it, and then gaining by year’s end. Jobs’ health has been in the news pretty steadily since 2004, and yet the stock price has risen from December 31st 2003’s closing price of $21.37 to $337.45 today, even after a 2 for 1 stock split in February 2005.

Last week, AAPL shares sank from $348.48 before the announcement to $326.72 by the Friday after the announcement. Today, the stock closed almost $10 higher at $337.45–even though we still do not know why Jobs is taking a leave of absence. Is this because, at least for the short term, investors believe that AAPL’s planned product releases will still help the company profit regardless of whether or not Jobs is there when it does? Or is it because most investors don’t buy into the mob mentality of the ultimate power of the CEO to create profitability in a company?

*Prices courtesy of Yahoo Finance.