Earlier this week we addressed Sara Lee’s (NYSE: SLE) decision to break up its meat and coffee businesses into two separate companies. Last week, we mentioned that Motorola was doing the same thing by spinning off its mobile device business and creating two new companies—Motorola Mobility Holdings (NYSE: MMI) and Motorola Solutions (NYSE: MSI). Today, ITT Corporation (NYSE: ITT) announced that it would be splitting up into three different companies—all publicly traded. One company will focus on its core industrials business, one will serve as a standalone water technology company and the third will be devoted to defense technology and information solutions. ITT states that the board of directors unanimously approved of the decision.

According to Bloomberg.com, Deutsche Bank analyst Nigel Cole said this about the trivestiture:

We believe this move makes a lot of sense… Investors have become increasingly concerned about the earnings headwind from impending U.S. defense budget cuts, which was likely to have depressed ITT’s earnings growth potential.

(“ITT Climbs on Decision to Split Into Three Companies,” January 12th, 2011, Bloomberg.com)

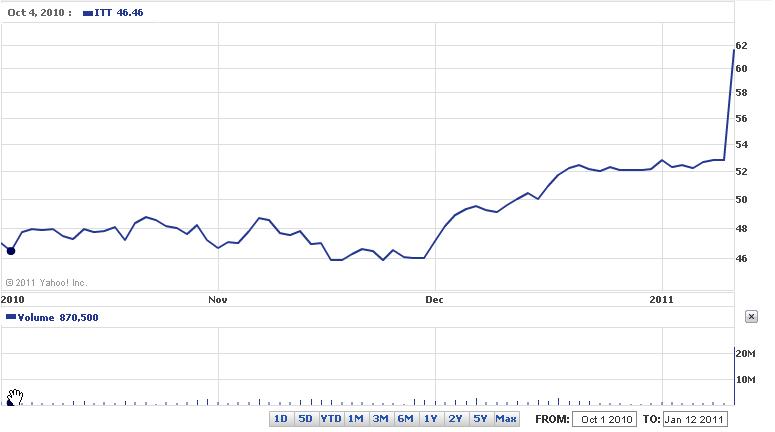

Shares of ITT climbed substantially after the announcement, rising from their January 11th closing price of $52.78 to a January 12th closing price of $61.50 (Yahoo Finance).

Covestor models with exposure to this sector include: Focus Value, Micro-Cap Aggressive, Global Clean Energy-Clean Tech, Flexible Value, and Speedboat.

*Charts and prices courtesy of Yahoo Finance.