A recent AOL DailyMarkets article points to Covestor as an option emerging markets investors should explore.

As long as my overall portfolio moves with the market, I don't worry when quality stocks drop in price, as that helps move stocks on my watch list onto to the buy list.

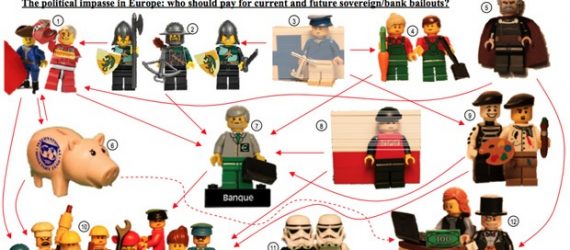

If Europe breaks apart, there's not much the Fed, Congress or the President could come up with to jump start our economy.

With a lot of risk in the air, I'm holding a large cash position and putting on leveraged ETF shorts.

Plettner's Well-Intentioned Activism, Long/Short Opportunistic and Core portfolios hold this closed-end fund.

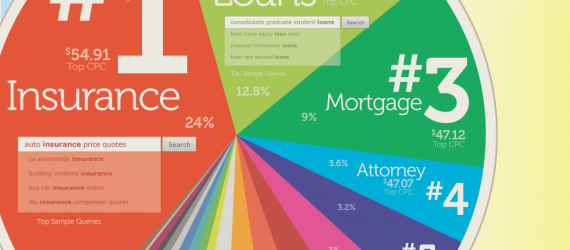

It's almost entirely from ads, and 4 of the 5 most expensive keywords on AdWords are for financial services.

People often get so excited with a rising price of a stock in their portfolio that they sell when it's just starting to move in their favor.