Market expectations are low, fear is high, and valuations are attractive, setting the stage for positive surprises, says manager Bill Peattie.

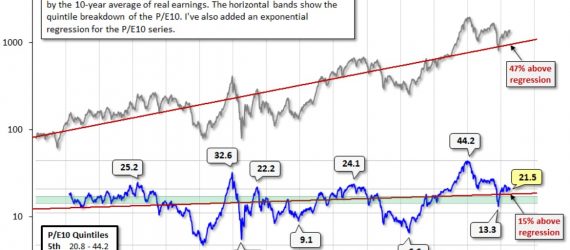

Price-to-earnings ratios look historically cheap, but that measure may also be deceptive based on the history of the 10-year PE.

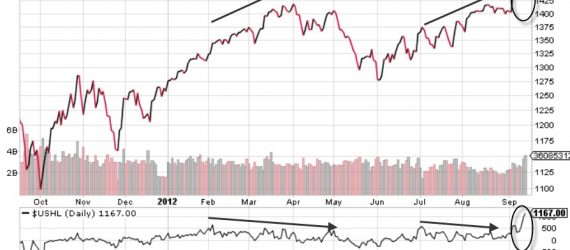

Market breadth finally looks healthy -- very healthy, in fact -- and is finally confirming the strength of the rally.

The wealth effect from higher asset prices such as stocks has become a primary monetary policy tool.

Valuation factors are modestly negative even though interest rates are quite low and the Federal Reserve has pledged to keep them there for some time.

Client Agreement with us but never got around to completing it. We’d really appreciate the opportunity to have you as a client and would like to facilitate

The Fed’s QE3 announcement is welcome by a lot of people on the Street, but not many retirees on Main Street.

There are three reasons to think that the Fed’s latest fiscal stimulus announcement could have a big economic and markets impact.