By: Sreeni Meka, Lakeland Wealth Management

Despite 500-basis-points rates raised by the Fed, the market for new houses is on a tear. The short supply of new home inventory and lower unemployment kept the momentum in the new home prices. A third of the inflation is the rental prices or Owners’ equivalent rent (the rent that substitutes a currently owned house as a rental property). There are several reasons for the persistent inflation stemming from excess cash on hand, rising salaries, and the pricing power of corporations.

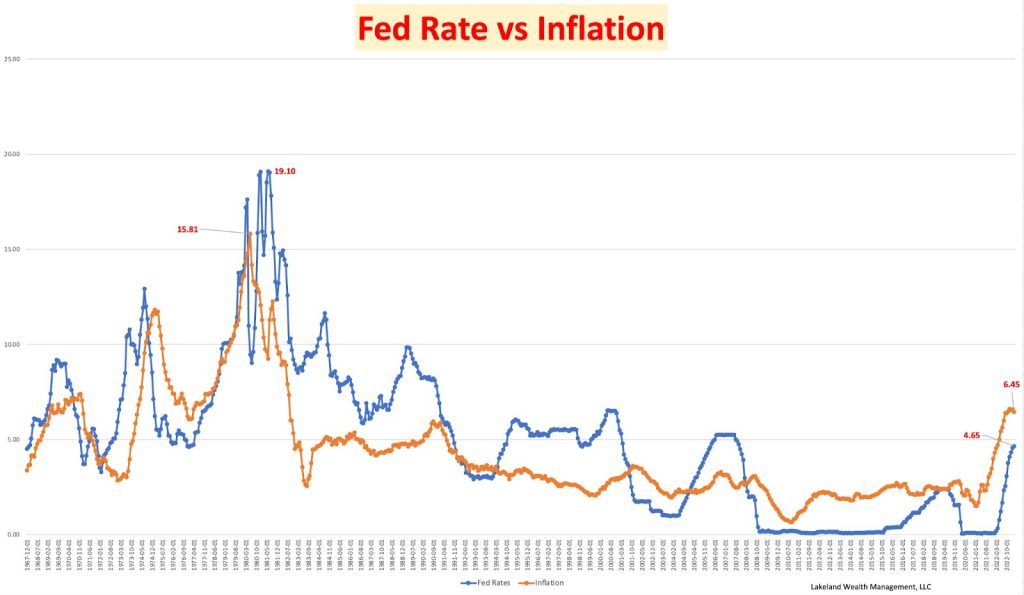

Tighter credit conditions, recent banking turmoil, and higher mortgage rates gave a well-needed break to the acceleration of Fed rate hikes. Instead, they gave a false signal to the markets as the Fed was going to slow its pace. When the last hyperinflationary period in the early 70’s Fed compromised with rate hikes and went back and forth, causing the inflation to peak at 15.8 percent in June 1980, and Fed was forced to raise the rates to 19.10 percent, almost 1000 basis points above the inflation during June 1981, and kept the Fed rates 400 to 500 basis points above the inflation for a decade. Empirical evidence states inflation is hard to bring down to the target rate unless the Fed acts with a heavy-handed approach with interest rate hikes.

The Fed cannot control the easy fiscal policies often set by unrealistic policymakers. One of the powerful tools the Fed has is tightening the money supply with interest rates and open market policies. We assume the Fed is independent, does not budge under political pressure, and keeps up the rate hike pace.

The following chart shows the historical inflation and Fed rates. In the past, when Fed rates were higher than inflation for a prolonged time, then only inflation was in control. The exception for lower inflation was in the 1990s and the first part of the 2000s because technological innovations, supply chain improvements, and online retailing helped to manage inflation at lower levels. However, recent fiscal stimulus during Covid, excess supply of funds, and prolonged lower rates caused bubbles in the housing markets and inflated consumer goods.

PHOTO CREDIT: https://www.shutterstock.com/g/Ausettha

Via SHUTTERSTOCK

DISCLOSURE

Investing involves risk, including the possible loss of principal. Diversification does not ensure a profit nor guarantee against a loss.

This material represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. This information is not intended to be individual or personalized investment or tax advice and should not be used for trading purposes. Please consult a financial advisor or tax professional for more information regarding your investment and/or tax situation.