By Pedro Palandrani and Andrew Little, Research Analysts with Global X

U.S. Infrastructure

Biden’s Infrastructure Plan Charges Ahead

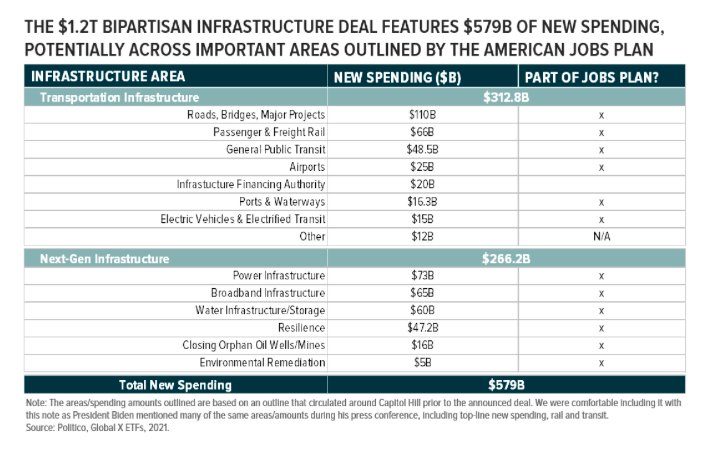

President Biden and a group of bipartisan senators finally announced an infrastructure spending deal foreseeing $1.2 trillion in expenditures over the course of eight years—the largest infrastructure investment in history.1 Of the $1.2 trillion, $579 billion is considered ‘new spending’, with $313 billion dedicated to transportation with a primary focus on roads, bridges, and major projects.2 The remaining $266 billion will be directed towards non-transportation infrastructure projects like power, broadband, water and climate resilience.

Successfully passing the Bipartisan Infrastructure Framework, budget resolution, and legislation could stimulate economic growth in the near term through accelerated job creation and purchasing of American-made materials. Over the longer term, returns on infrastructure spending are expected to have a strong positive impact on GDP, with some estimates holding that each dollar spent on infrastructure increases annual GDP by $0.20 over the long term.3 Despite an initial backlash from Republicans after Biden remarked he would withhold his signature until the passage of the separate American Families Plan through reconciliation, subsequent retraction of the statement and pledging objective support for the deal, sets the plan back on track.

E-commerce

Shopify Opens Up Shop Pay

Shop Pay, Shopify’s highly successful one-click checkout process, is no longer exclusive to Shopify’s merchants; the feature will be added to Facebook and Instagram’s platforms as social media giants are increasingly integrating e-commerce features. When a user reaches the payment step on a platform like Instagram, they can select Shop Pay as the desired method to receive a confirmation code on their phone and then enter the code to complete the order without leaving Instagram. According to Shopify, Shop Pay is 70% faster and features a conversion rate that’s 1.72x higher than a typical checkout process.4 The simplified checkout process offered by Shop Pay resulted in more than $24 billion in orders since its launch. Google will also add the payment feature in late 2021, at which point Shop Pay will be available to more than one million merchants.5

Lithium & Cleantech

Large-Scale Miners Focusing on Better Environmental Practices

Lithium miners are increasingly prioritizing sustainability. In its yearly Sustainability Report, lithium producer SQM, reaffirmed their stance on protecting the environment by making efforts to limit their own negative impact. Core goals for the company include cutting brine extraction in half by 2030, reducing continental water consumption by 65% by 2040, and achieving carbon neutrality by 2040.6 SQM also pledged to adhere to the sustainability principles of the World Economic Forum’s Global Battery Alliance (GBA). Similarly, Albemarle’s annual Sustainability Report detailed the firm’s aims to reduce energy and water use and achieve net zero carbon emissions by 2050.7 It also committed to growing its lithium business in a carbon-intensity neutral manner through 2030.8 To solidify their allegiance with climate relief efforts, Albemarle also became a signatory to the United Nations Global Compact (UNGC). SQM and Albemarle are joined by industry peers like Livent and Orocobre in committing to the green lithium movement. While lithium is a key ingredient in state-of-the-art batteries used in electric vehicles and renewable energy storage, lithium mining has historically come under fire for its negative environmental impacts.

Video Games & Esports

Gaming Numbers Continue to Exceed Expectations

Gaming thrived during pandemic-induced lockdowns, but even as the economy re-opens and the weather improves, video games continue their strong trajectory. YTD through May 2021, industry sales reached $24 billion, a 17% increase compared to the same period in 2020.9 The best-selling game in May in the U.S, was Capcom’s Resident Evil: Village, which recorded the highest sales during its launch month of any 2021 release.10 Similarly, YTD hardware sales rose 36%, totaling $1.9 billion.11 The rise is largely attributed to November’s launch of new consoles from both Sony and Microsoft. Since launch, the PS5 and Xbox Series X & S garnered sales of 9 million units and 5.33 million units, respectively.12 Long-term, the global video game console market is expected to achieve a 5.25% CAGR through 2027.13

Cloud Computing

Cloud Computing Accelerates in EMs

Historically, cloud adoption in emerging markets (EMs) has lagged behind their developed counterparts. But growing access to public cloud options are changing that paradigm. Small and medium-sized enterprises (SMEs) in the Middle East are increasingly using basic public cloud technologies, visualized hardware and computing infrastructures. Major conglomerates offering these services to SMEs in the Middle East include Oracle, IBM, and Adobe Systems. The Middle East and Africa (MEA) cloud computing market size is expected to grow from $14.2 billion in 2021 to $31.4 billion by 2026, a CAGR of 17.2%.14 Beyond a growing presence from major US cloud providers, the MEA region is able to adopt cloud technology at last because governmental initiatives and enhanced digital infrastructure.

Collaborators in Cloud Computing

Amazon Web Services (AWS) and Salesforce, two of the biggest names in cloud technology, announced plans to further integrate their companies and services. With the new improvements, data stored in AWS will automatically transfer to Salesforce’s platform with no custom coding required. Salesforce will also mimic some of AWS’ features such as voice, video, and artificial intelligence technology. Although the integration is projected to be completed in late 2022, it could have cascading impacts in the industry as different cloud providers join forces. In the first quarter of 2021, cloud infrastructure spending totaled $18.6 billion—of which, AWS comprised 37% followed close behind by Microsoft’s Azure at 23%.15

Cleantech

Companies Race Against Climate Change

Government funding and regulations are often viewed as the keys to achieving carbon neutrality. But in emerging markets, where government budgets are tight, the private sector is playing a greater role in supporting the transition to clean energy. For example, Reliance Industries, an Indian conglomerate with stakes in everything from oil refining to telecommunications, vowed to invest $10 billion over the next three years in an attempt to accelerate India’s progress towards clean energy.16 Similarly, IKEA foundation and Rockefeller Foundation plan to set up a $1 billion fund, $500 million from each foundation, to support renewable energy programs in developing nations.17 The goal is to reduce one billion tons of greenhouse gas emissions and provide one billion people with distributed renewable energy. The foundations aim to attract additional funding up to $10 billion from international development agencies, highlighting commercial viability.18

This article first appeared on July 13 on the Global X blog.

Photo Credit: Nicolas Raymond via Flickr Creative Commons

FOOTNOTES

1. The White House, “FACT SHEET: President Biden Announces Support for the Bipartisan Infrastructure Framework”, Jun 24, 2021.

2. Ibid.

3. McKinsey & Company, “Four ways governments can get the most out of their infrastructure projects,” Jan 6, 2020.

4. Ibid.

5. Shopify, “Shop Pay becomes first Shopify product to extend beyond Shopify merchants, soon available to any business selling on Facebook and Google”, Jun 15, 2021.

6. SQM, “SQM ratifies its commitment to sustainability in report on its 2020 performance”, Jun 15, 2021.

7. Albemarle, “Albemarle Releases Sustainability Report and Environmental Target Commitments”, Jun 2, 2021.

8. Ibid.

9. Venture Beat, “May 2021 NPD: Improving weather and pandemic conditions cannot slow U.S. game sales”, Jun 14, 2021.

10. Ibid.

11. Ibid.

12. VG Chartz, “PS5 Sales Top 9 Million – Worldwide Hardware Estimates for May 30-June 5 – Sales”, Jun 17, 2021.

13. KSU Sentinel, “Video Game Console Market Rising Trends, Top Brands and Global Demand 2021 to 2027: Hudson Soft/NEC, Envizions, Atari, Sega, Sony, Nintendo, Microsoft”, Jun 24, 2021.

14. Globe Newswire, “The MEA cloud computing market size is expected to grow from USD 14.2 billion in 2021 to USD 31.4 billion by 2026, at a Compound Annual Growth Rate (CAGR) of 17.2%”, Jun 24, 2021.

15. Tech Crunch, “Salesforce, AWS announce extended partnership with further two-way integration”, Jun 23, 2021.

16. Quartz, “India’s solar industry makes a huge bet on beating China”, Jun 24, 2021.

17. Reuters, “IKEA, Rockefeller foundations to pledge $1 bln in clean energy push”, Jun 21, 2021.

18. Ibid.

DISCLOSURE

Investing involves risk, including the possible loss of principal. There is no guarantee the strategies discussed will be successful. International investments may involve risk of capital loss from unfavorable fluctuation in currency values, from differences in generally accepted accounting principles or from economic or political instability in other nations. Emerging markets involve heightened risks related to the same factors as well as increased volatility and lower trading volume. Narrowly focused investments may be subject to higher volatility. The funds are non-diversified.

Information Technology companies can be affected by rapid product obsolescence, and intense industry competition. Risks include disruption in service caused by hardware or software failure; interruptions or delays in service by third-parties; security breaches involving certain private, sensitive, proprietary and confidential information managed and transmitted; and privacy concerns and laws, evolving Internet regulation and other foreign or domestic regulations that may limit or otherwise affect the operations. Healthcare, Genomics, Biotechnology and Medical Device companies can be affected by government regulations, expiring patents, rapid product obsolescence, and intense industry competition. CleanTech Companies typically face intense competition, short product lifecycles and potentially rapid product obsolescence. The risks related to investing social media companies include disruption in service caused by hardware or software failure, interruptions or delays in service by third-parties, security breaches involving certain private, sensitive, proprietary and confidential information managed and transmitted by social media companies, and privacy concerns and laws, evolving Internet regulation and other foreign or domestic regulations that may limit or otherwise affect the operations of such companies. These companies may be significantly affected by fluctuations in energy prices and in the supply and demand of renewable energy, tax incentives, subsidies and other governmental regulations and policies. There are additional risks associated with investing in lithium and the lithium mining industry.

Carefully consider the Funds’ investment objectives, risk factors, charges, and expenses before investing. This and additional information can be found in the Funds’ summary or full prospectus, which may be obtained by calling 1.888.493.8631, or by visiting globalxetfs.com. Please read the prospectus carefully before investing.

Global X Management Company LLC serves as an advisor to Funds. The Funds are distributed by SEI Investments Distribution Co. (SIDCO), which is not affiliated with Global X Management Company LLC or Mirae Asset Global Investments.

Shares of ETFs are bought and sold at market price (not NAV) and are not individually redeemed from the Fund. Brokerage commissions will reduce returns. Beginning October 15, 2020, market price returns are based on the official closing price of an ETF share or, if the official closing price isn’t available, the midpoint between the national best bid and national best offer (“NBBO”) as of the time the ETF calculates current NAV per share. Prior to October 15, 2020, market price returns were based on the midpoint between the Bid and Ask price. NAVs are calculated using prices as of 4:00 PM Eastern Time. The returns shown do not represent the returns you would receive if you traded shares at other times.

Indices are unmanaged and do not include the effect of fees, expenses or sales charges. One cannot invest directly in an index. This information is not intended to be individual or personalized investment or tax advice and should not be used for trading purposes. Please consult a financial advisor or tax professional for more information regarding your investment and/or tax situation.