Many industry experts have said that prescriptions for telemedical solutions are likely to proliferate, amid the potential for increasing, virus-induced isolation measures within local populations.

While COVID-19 – the deadly new respiratory illness that emanated from China – has triggered waves of fear in the financial markets, the shape of societal communication could also stage a seismic shift, as communities generally relegate themselves to stay-at-home activities.

Nancy Messonnier,director of the Center for the National Center for Immunization and Respiratory Diseases (NCIRD), recently said that, in general, social distancing, school closures, and canceling mass gatherings are some examples of nonpharmaceutical interventions that are likely to spur a rise in the use of telemedical, teleschooling and teleworking tools – “so that at a societal level we try to disrupt the spread.”

She added that in “a situation like this where we don’t have a vaccine and we don’t yet have a specific countermeasure, those kind of nonpharmaceutical interventions at a community level are really important.”

Indeed, recent advances in telemedical technology have already broadly redefined the healthcare industry, enabling a wider spectrum of patients – including the physically disabled, elderly, geographically remote and highly contagious – to exploit the conveniences of personal communications such as email, phone and video communications, when seeking medical assistance and sharing files.

In fact, the global telemedicine market is expected to grow at a compound annual growth rate (CAGR) of around 19% over a five-year period to 2022 (from a valuation of roughly US$29.6bn in 2017), according to a recent research report.

The anticipated uptick is due in large part to a likely rise in telemedicine adoption, as well as increasing cases of chronic diseases, growing geriatric population, government initiatives, and shortage of physicians.

Helping the Cause

Moreover, telehealth would also likely help secure supply chains in times of growing unease, as panic-stricken populations commit to rampant buying of items such as gloves, medical masks and respirators.

The World Health Organization (WHO), for example, recently warned that “severe and mounting disruption to the global supply of personal protective equipment (PPE) – caused by rising demand, panic buying, hoarding and misuse – is putting lives at risk from the new coronavirus and other infectious diseases.”

They observed that shortages are leaving doctors, nurses and other frontline workers

“dangerously ill-equipped to care for COVID-19 patients, due to limited access to supplies.”

By employing certain telehealth solutions, patients may remain confined to their homes, reducing the need for PPE, while freeing-up space at hospitals and lowering the risk of contagion for healthcare professionals and other patients, while helping frontline workers to better prioritize their services.

On a broader level, WHO also touted some of telehealth’s positive environmental, social and governance (ESG)-related impacts, such as a reduction of transport-related emissions – given the ability to treat patients remotely – as well as lowering needs for construction materials, reducing waste and saving on energy and water consumption, as fewer space demands spur smaller health facilities.

Healthy Outlooks

Against this backdrop, companies engaged in providing telemedical services, as well as developing the sector’s supporting information and communications technology (ICT), could find themselves in a unique position to prosper financially from the gloomy prospects of a COVID-19 pandemic.

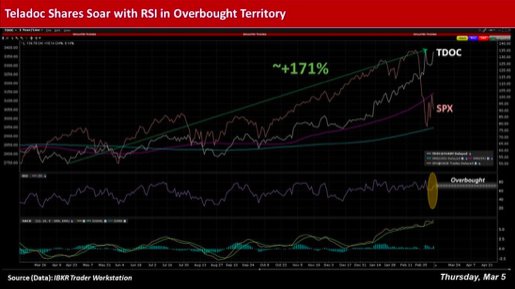

Teladoc Health (NYSE: TDOC), a virtual healthcare firm based in Purchase, New York, for instance, has seen its shares surge around 171% from its latest 52-week low set in mid-April 2019 to late February 2020. The company’s shares in Thursday’s intraday trading session were last up roughly 7.75% to US$134.33, while the broader S&P 500 Index and the Nasdaq were down 2.25% and 1.5% on the day, respectively.

Teladoc has also been optimistic about its growth prospects in 2020, with expected revenue to fall within the range of US$695m-US$710m from US$553.3m in 2019, with an anticipated increase in visits to between 5.5m-5.9m from 4.1m over the same period.

The telehealth services firm also comprises the largest share (~2.2%) of the Robo Global Healthcare Technology and Innovation exchange-traded fund (ETF) ‘HTEC’ (NYSEARCA: HTEC), which focuses on the healthcare and life sciences sectors as part of its robotics, automation and artificial intelligence (AI) investment strategies.

HTEC has gained about 2.2% over the past three months but has erased about the same amount over the past month, likely due to its allocations in virus-laden lands such as China (~2.0%) and Italy (~1.7%), amid the growing contagion of COVID-19.

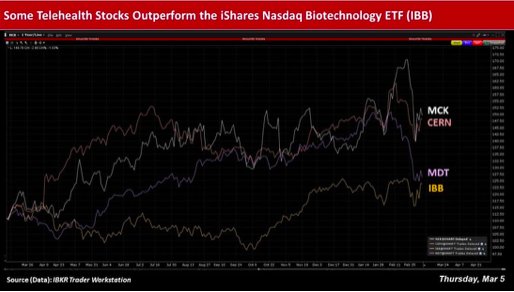

Other telehealth-related companies, including San Francisco pharma supplier McKesson Corp (NYSE: MCK), ICT-centered Cerner Corp (NASDAQ: CERN) and medical device-maker Medtronic (NYSE: MDT) could each reap benefits from growth in the industry, with their shares outperforming The iShares Nasdaq Biotechnology ETF (NASDAQ: IBB).

Market Shivers

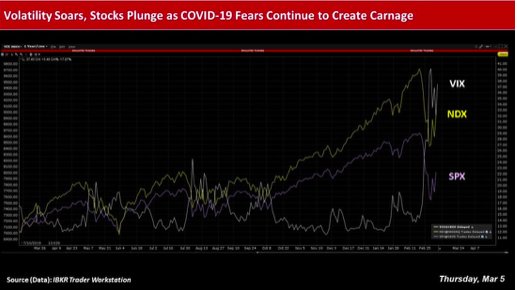

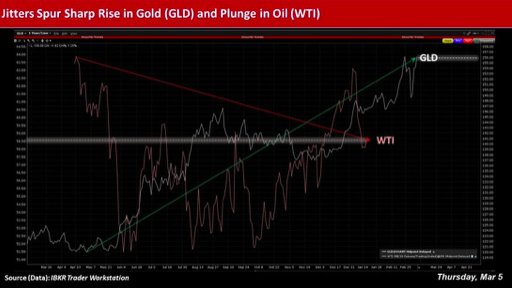

Meanwhile, recent global and domestic responses to the virus’s outbreak have only bolstered bouts of volatility in the financial markets, underscored by the Federal Open Market Committee’s (FOMC) 50-basis point reduction in the federal funds rate Tuesday to 1.0%-1.25%, as it continues to monitor risks to the economy.

In intraday trading action Thursday, the VIX Index remained at an elevated level of around 37.45 after climbing over the 40 mark at the end of February, according to the IBKR Trader Workstation. The carnage has also been reflected in equities and oil, with safe-haven assets such as U.S. Treasuries and gold spiking stratospherically.

To date, nearly 97,000 cases of the novel coronavirus have been confirmed, with a little more than 83% of that figure emanating from Mainland China.

Outside of China’s borders, South Korea (~6.3%), Iran (~3.6%) and Italy (~3.2%) appear to have suffered more cases than other nations, while the U.S. houses around 162 persons infected with the respiratory illness, according to the Center for Systems Science and Engineering (CSSE) at Johns Hopkins University.

The death toll from the illness has increased to a little more than 3,300, which seems dwarfed by the more than 53,600 that have recovered from the disease— prompting many in the market, and in government, to urge public calm.

Among the emergency declarations issued in the U.S. due to the spread of the virus include California and King County, Washington, which has suffered the brunt of the domestic fatalities.

Photo Credit: Stock Catalog via Flickr Creative Commons