By Steven Levine

Senior Market Analyst

Interactive Brokers

Although rosy economic conditions have generally spurred a rise in consumer spending, I think that organizational changes and structural shifts at L Brands (LB) have helped keep the company from fully enjoying the benefits.

The Columbus, Ohio-based company, which operates brands that include Victoria’s Secret, PINK and Bath & Body Works, recently provided disappointing third quarter guidance and cut its outlook for the full year.

Earnings per share for Q2 2018 were US$0.36, down from US$0.48 in the same year-ago quarter, while net sales rose to roughly US$2.98bn from US$2.76bn over the same period.

Earnings Guidance

LB’s comparable sales for the 13 weeks ended August 4, 2018, increased 3% compared to the same year-ago period – driven mainly by performance at Bath & Body Works.

However, although the company beat analysts’ earnings expectations, it downwardly revised its guidance for 2018 full-year EPS to US$2.45- 2.70 from US$2.70-3.00 previously, and issued guidance for Q3’18 EPS between US$0.00 and US$0.05.

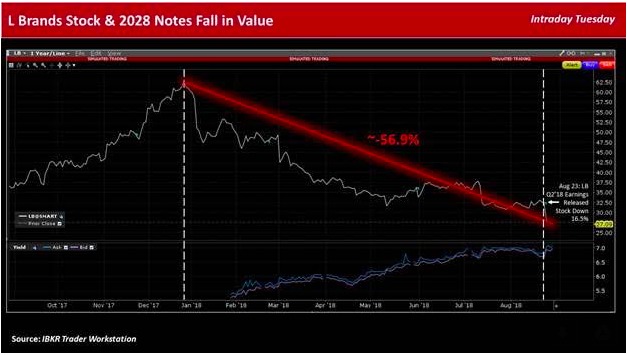

LB’s stock has fallen around 16.5% since its Q2’18 earnings release, and has shed almost 57% since its 52-week high of US$62.95 set in late December 2017.

Credit deterioration

In my view, LB’s creditworthiness has also recently deteriorated along with its share value, amid structural changes and C-suite shifts.

In tandem with its earnings release, LB said that Denise Landman, CEO of Victoria’s Secret PINK, elected to retire at the end of 2018, to be replaced by Bath & Body Works’ merchandising and product development president Amy Hauk.

Gimme Credit analyst Evan Mann noted that these “factors suggest that a turnaround in Victoria’s Secret comparable sales and margin won’t be happening in the near term and its problems are more structural in nature requiring an uncertain amount of time to correct.”

While Bath & Body Works continues to “deliver strong results,” Mann said, Victoria’s Secret faces ongoing headwinds from restructuring initiatives intended to streamline operations, accelerate growth in core categories, and enhance operating margins.

Cash Flow

Mann added that he doesn’t expect LB’s credit ratios to improve “anytime soon” as a potential turnaround at Victoria’s Secret remains “elusive.”

I believe the company will also likely continue to use its free cash flow to pay dividends and repurchase shares, which could result in flattish leverage and rent adjusted leverage through fiscal 2019 – depending on the level of share buybacks.

LB’s 5.25% notes due February 1, 2028 were recently bid at a yield of around 7.0%, up from a low of about 5.37% in late January. The firm’s 5-year CDS spreads have also widened by a little more than 50.5bps to almost 310 bps over the past three months.

Downgrade Risk?

In early January, Moody’s Investors Service, which had assigned a ‘Ba1’ junk rating to LB’s 2028 bonds, warned that the firm’s ratings could be downgraded if there was sustained deterioration in profitability at any of its key brands or financial policy turned more aggressive.

In my opinion, ratings could also be downgraded if debt increased or operating performance faltered, resulting in debt to EBITDA approaching 4.5x or EBIT to interest expense approached 2.5x.

For the last twelve months, LB’s leverage was 2.7x (4.2x rent adjusted), up from 2.6x (4.0x rent adjusted) in fiscal 2017, according to Mann.

Furthermore, LB appears to be lagging in its marketing approach, as companies such as American Eagle Outfitters (AEO) outperform by a large margin.

In the meantime, LB’s financial position could continue to erode as the company works through its structural issues.

This post was originally published on Aug. 29 at IBKR Traders’ Insight.

Photo Credit: Eternity Portfolio via Flick Creative Commons