A recovery in oil prices, favorable earnings and economics reports helped propel stocks to record gains in early February.

Leading the pack were mid caps, with the S&P MidCap 400 Index establishing an all-time high and moving into positive territory for the year.

Dollar Exposure

So why are mid-cap stocks gaining favor these days?

For one thing, mid-cap firms tend to be U.S. focused, so they don’t have as much foreign sales exposure.

That’s a good thing given the recent strength of the U.S. dollar which has been a drag on company earnings with a lot of foreign sales.

Mid caps also tend to be economically sensitive, which is positive given signs of improvement in the health of the overall economy and with falling oil prices and low levels of unemployment (as reported by the DOL) spurring consumer confidence.

Energy

The Mid Cap Index also has minimal exposure to the recently volatile energy sector, at only 3.9% versus 8.3% for the S&P 500 Index.

Low oil prices are good for the consumer, but not for energy company earnings.

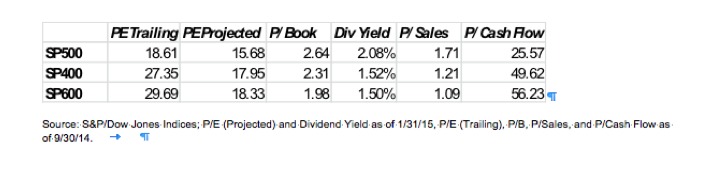

Probably the biggest knock on mid caps right now is that they are not cheap if you look at their valuation metrics relative to their large- and small-cap counterparts or on a historical basis.

But not all industry groups are overvalued relative to small and large-cap stocks.

Based on forward price to earnings (P/E) ratio analysis, the major defensive industries such as utilities, telecom, and healthcare are the most overvalued.

Mid-cap consumer stock valuations also appear stretched in areas such as consumer services, restaurants, food and staples retail, and telecom services.

Even so, in my opinion, mid-caps still look reasonably valued relative to small caps in the areas of the economy that benefit from cheap oil such as: consumer durables and apparel, commercial services, and materials.

Technology stocks also appear reasonably valued.

Earnings

The other factor that mid caps have in their favor in the current environment is that due to their favorable earnings and growth characteristics. I believe that small-cap and large-cap managers want to own them.

Active managers are looking for great companies to own and/or buyout candidates in order to generate alpha relative to the benchmark. And many mid-cap stocks fit that bill.

Mid caps continue to offer many attractive opportunities for investors in the current market environment. It is no wonder the mid-cap indices are leading the pack so far this year.

The strength of the overall market is finally trickling down to lesser known companies with good growth prospects – it is finally becoming a stock-pickers market.

In my opinion, the mid-cap equity arena is one investors should consider having exposure to in the coming year in order to help boost their returns.

Photo Credit: colink via Flickr Creative Commons