The third quarter of 2014 had its shares of ups and downs. Much of the market volatility was geopolitically driven this quarter with Russia, Scotland, and ISIS taking turns spooking the capital markets.

Here in the U.S., there were mixed economic signals leading investors to wonder when Janet Yellen’s Federal Reserve will sound the “all clear” signal for the domestic economy and start to increase interest rates. The jobs picture looks vastly improved with the unemployment rate dipping to 5.9%.

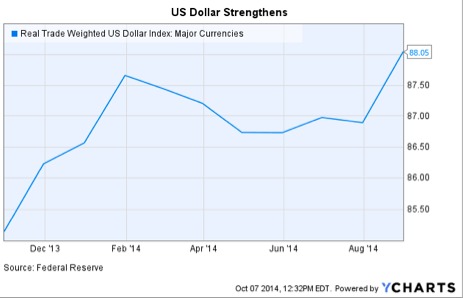

Strong dollar

But wage growth is still not impressive, contributing to weakness in areas like housing and discretionary spending. As a result, the Fed intends to wait a “considerable time” before it raises interest rates.

The S&P 500 Index climbed 0.6% in the quarter, setting new highs along the way. However, the quarter did not exactly end on a positive note, with the S&P 500 declining 1.6% in September, and off 4.6% from the record high it set on September 19th.

One reason for the market decline was the strengthening U.S. dollar relative to other global currencies. Investors are concerned that U.S. companies and their corporate earnings growth will be negatively impacted by a stronger dollar overseas.

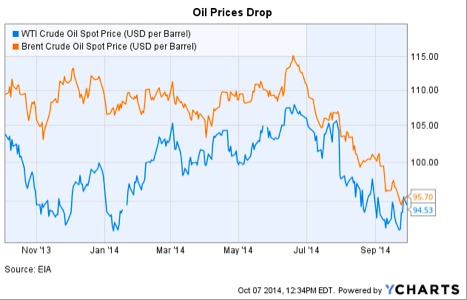

However, one residual effect of a stronger dollar is the driving down of dollar-denominated oil prices. This is a positive for industries and sectors where oil is a major input in the cost of production.

And to the extent that lower oil prices translate into lower prices at the gas pump, this is ultimately a good thing for the consumer in my opinion.

Just right?

So the question going into the end of the year is this: Will economic strength at home offset weakness abroad? And as we approach earnings season in this Goldilocks economy, are current earnings expectations too hot, too cold, or just right?

Mid-cap stocks remained at the middle of the pack in the third quarter, holding up better than small caps which are now near correction territory off almost 10% their July 3rd highs.

But mid caps did not keep pace with large caps, as investors remain more cautious, favoring size, quality, and liquidity. Mid Cap Value outperformed Mid Cap Growth.

One of the top-performing names for the EQM Capital MidCap Quant portfolio in Q3 was specialty pharma company Salix Pharmaceuticals (SLXP). Salix Pharmaceuticals has a desirable GI drug franchise and has been a rumored takeover candidate.

Another top contributor was athletic apparel maker Under Armour (UA). The company continues to execute well and posted strong earnings results.

Buying opportunity

Retail names like apparel and handbag company Kate Spade (KATE) and Zebra Technologies (ZBRA), which makes barcode scanners, detracted from relative performance during the quarter.

Kate Spade was sold toward the end of September in favor of biopharmaceutical stock Medivation (MDVN), which has a promising new drug (Xtandi) to treat prostate cancer.

Our stock selection process continues to identify growth stocks in the mid-cap segment trading at reasonable multiples. And with all the uncertainty out there going into the end of the year, the middle ground seems like a good place to fish for good opportunities.

—

DISCLAIMER: The investments discussed are held in client accounts as of September 31, 2014. These investments may or may not be currently held in client accounts. The reader should not assume that any investments identified were or will be profitable or that any investment recommendations or investment decisions we make in the future will be profitable. Past performance is no guarantee of future results.