The S&P 500 Index (SPX) returned 10.51% in Q4-2013 similar to the +10.61% returned in Q1-2013. The index ended the year with a total return of 32.39%, the best annual performance since 1997.

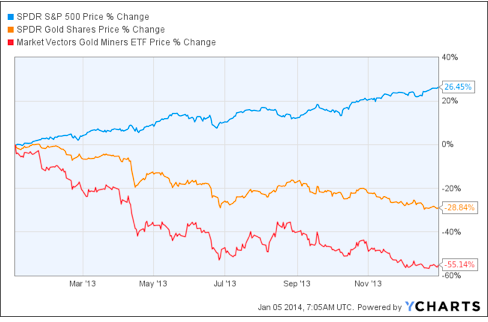

The improving U.S. economy combined with low inflation, modest tapering by the Fed, and reduced systemic risk created the perfect tailwind for the S&P 500 EFT (SPY) and the perfect storm for gold and gold stocks.

According to the Bureau of Economic Analysis, gross domestic product rose at a revised 4.1% annualized rate, the fastest pace in two years. Due to the improving economy and labor market, the Federal Open Market Committee decided to taper by $10 billion per month (reduce asset purchases from $85 billion per month to $75 billion per month) starting in January 2014.

Based on a reduced, but neverthelesss robust accommodative monetary policy, it behooves investors to put or at least keep capital working. However, with the monster move in stocks over the past year, it is also in the best interest of investors to determine whether stocks have gone up too far, too fast.

In the words of Benjamin Graham, have stocks reached so rich a valuation that would preclude them from providing a safety in principal and an adequate return?

On a historical basis, averaging last ten years of S&P 500 companies’ earnings and applying the Schiller P/E methodology, the S&P 500 is currently trading at 26.19 P/E as of Jan. 10, or about 60% higher than the historical mean of 16.5. Using this metric, the market seems overpriced.

However, in my opinion, given the backdrop of a low interest and low inflation rate environment for the foreseeable future, the market does not appear as overvalued as this one metric suggests.

In the fourth quarter, I continued to add mortgaged-backed related assets to the portfolio on price weakness. In December, I added Annaly Capital Management, Inc. (NLY). NLY is the largest public REIT financier of U.S. residential mortgages.

NLY owns, manage, and finance a portfolio of real estate related investments, including mortgage pass-through certificates, collateralized mortgage obligations (CMOs), agency callable debentures, and other securities representing interests in or obligations backed by pools of mortgage loans.

Under the company’s investment policy, at least 75% of its total assets consisted of mortgage-backed securities and short-term investments. The remainder of its assets, consisting not more than 25% of its total assets, may consist of other qualified REIT real estate assets.

As we enter 2014, I remain cautiously optimistic and will endeavor to find investments that I believe provide a margin of safety and an adequate (or more than adequate) return. We currently hold large cash reserves and short-term fixed income investments in the Prudent Value portfolio and I look forward to redeploying them into wonderful businesses, but I will be patient. Markets move on their own schedules and my goal is to be opportunistic on your behalf. To learn more about Prudent Value, please click here.

DISCLAIMER: The investments discussed are held in client accounts as of December 31, 2013. These investments may or may not be currently held in client accounts. The reader should not assume that any investments identified were or will be profitable or that any investment recommendations or investment decisions we make in the future will be profitable. Past performance is no guarantee of future results.