Our Dividend and Income Plus portfolio’s total return has recently lagged the return of the overall market, as our growth has been hampered by our primary focus on yield. As of 4/1/2013 the portfolio yield is at 6.53% (net of fees) and the YTD beta is 0.61.

At this point I am very satisfied with our risk/yield parameters. I believe this combination of risk and yield continues to make our Dividend and Income Plus model an ideal portfolio for investors who are seeking a relatively high income stream from their investments.

I also think that going forward, we offer a suitable portfolio for all investors that want to participate in the current market’s run, but are hesitant due to the overall high level of the market.

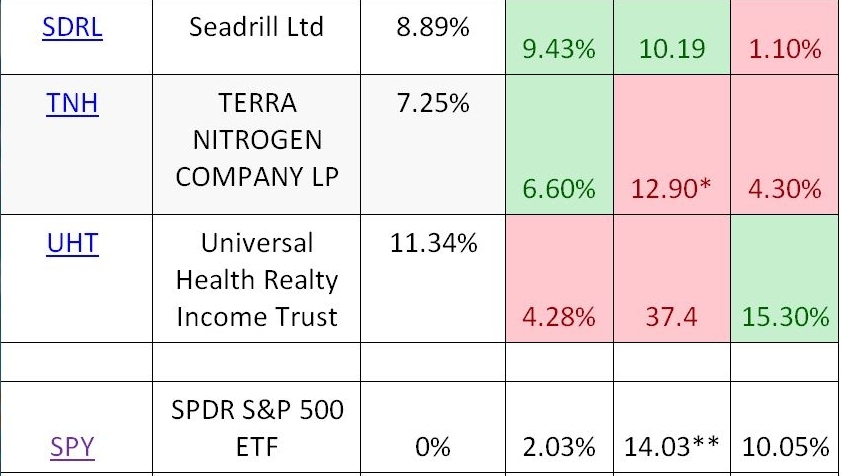

Below is a chart of our holdings, year to date price performance, and P/E ratio. I believe that a modest P/E ratio combined with high yield has the potential to offer both a defensive position in a market correction and capital appreciation as investors rotate from overbought, high P/E equities should the current rally continue.

Values above the S&P 500 are in red and those below in green for Yield and YTD Return. Opposite for P/E ratio.

SPY P/E based on S&P 500 projected operating earnings for 2013. Yield and YTD price from Kwanti.com. Forward P/E estimates from Finviz.com.

From the table above you can see that only Annaly Capital Management (NLY) has had a yield above the portfolio average, and a YTD performance above the S&P 500.

McDonalds (MCD) is at the high end of our valuation range. While I think MCD belongs in a dividend growth model, it no longer meets our high yield criteria. I’ll be monitoring its price for an appropriate exit strategy.

Universal Health Realty Income (UHT) has provided a very nice gain so far this year. However, 4.28% is not a high enough yield for a REIT so we plan to sell soon.

I continue to believe Seadrill (SDRL) will be a big gainer by the end of 2013. Now that we can expect a resumption of their normal dividend payments– they pre-paid their 1st Qtr 2013 dividend at the end of 2012–I will gladly wait to see if revenues, dividends and stock price see a nice gain as new rigs come on-line in 2013-2015.

Prospect Capital Corp. (PSEC) and BlackRock Kelso Capital (BKCC) are both in the business development category. As the economy continues to improve I believe we should also see a better environment for their stocks. While rising interest rates will add to costs, I believe their portfolio of business holdings should see appreciation.

I replaced SPDR Barclays High Yield (JNK) with PowerShares Senior Loan (BKLN) in an attempt to defend against rising interest rates. High yield bonds also trade at historically low yields. While I don’t see the overall stock market as being in bubble territory, I do think high yield bonds are.

Unfortunately BKLN is not helping out on price appreciation, and its yield is modest. But in a stock market decline, BKLN will be replaced first with cash, then a possible short ETF position to hedge the entire portfolios price. At this point I’m not happy with alternatives, so will likely just hope to make up for BKLN’s shortcomings with our other holdings.

Current candidates to replace MCD and UHT with are General Electric (GE), Newmont Mining (NEM), and Omega Healthcare Investors (OHI). There is no guarantee that any of these trades will be made or that new candidates will emerge for potential sales or purchases.

The investments discussed are held in client accounts as of March 31, 2013. These investments may or may not be currently held in client accounts. The reader should not assume that any investments identified were or will be profitable or that any investment recommendations or investment decisions we make in the future will be profitable.